Aave Labs launched a consumer-friendly mobile app offering 6-9% yields without crypto jargon. The app connects directly to banks, features $1M balance protection, and secured regulatory approval in Europe. This could be DeFi's "iPhone moment" by prioritizing user experience over technical complexity, potentially transforming protocols from infrastructure into consumer brands.

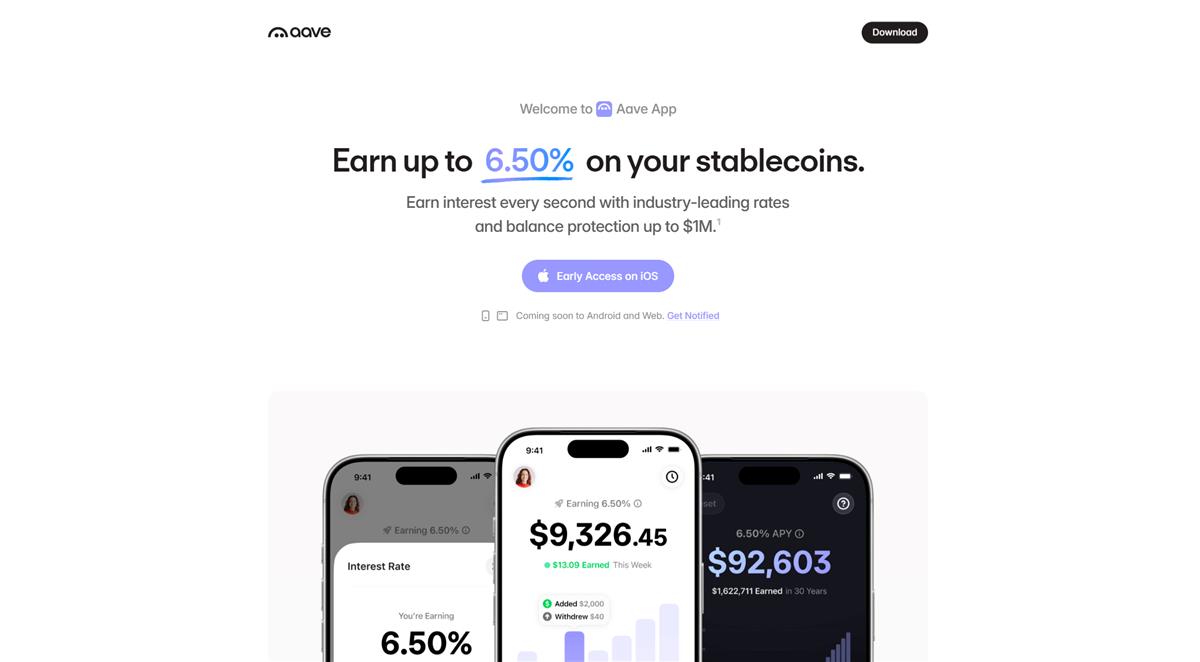

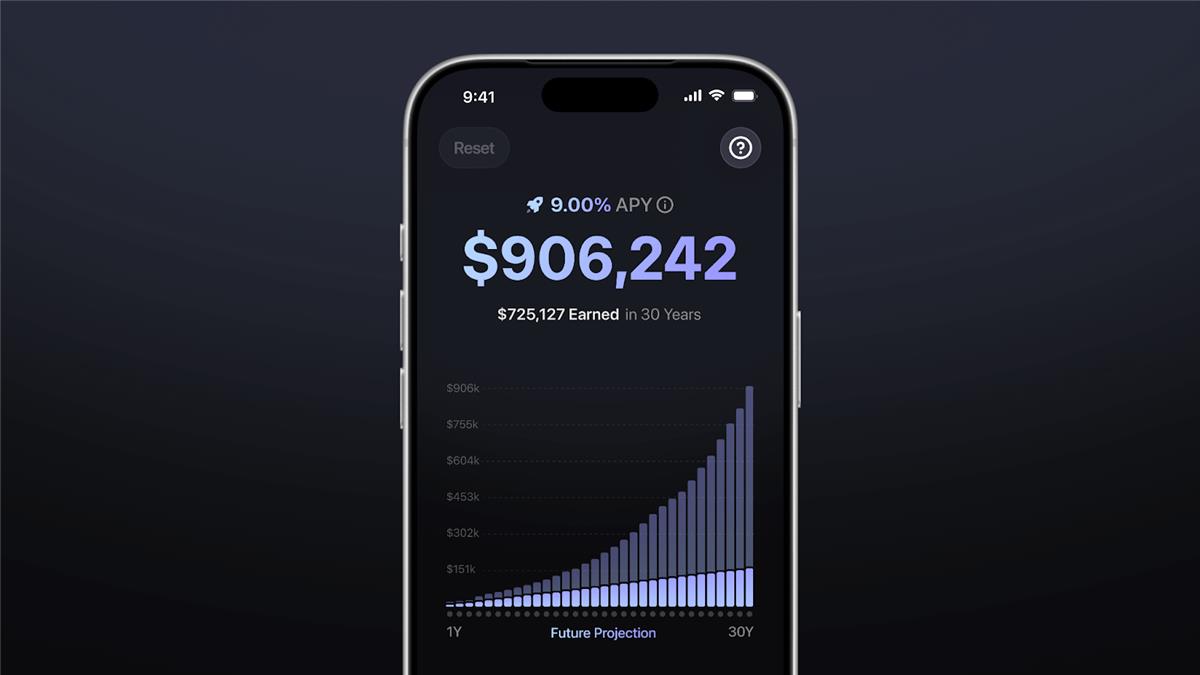

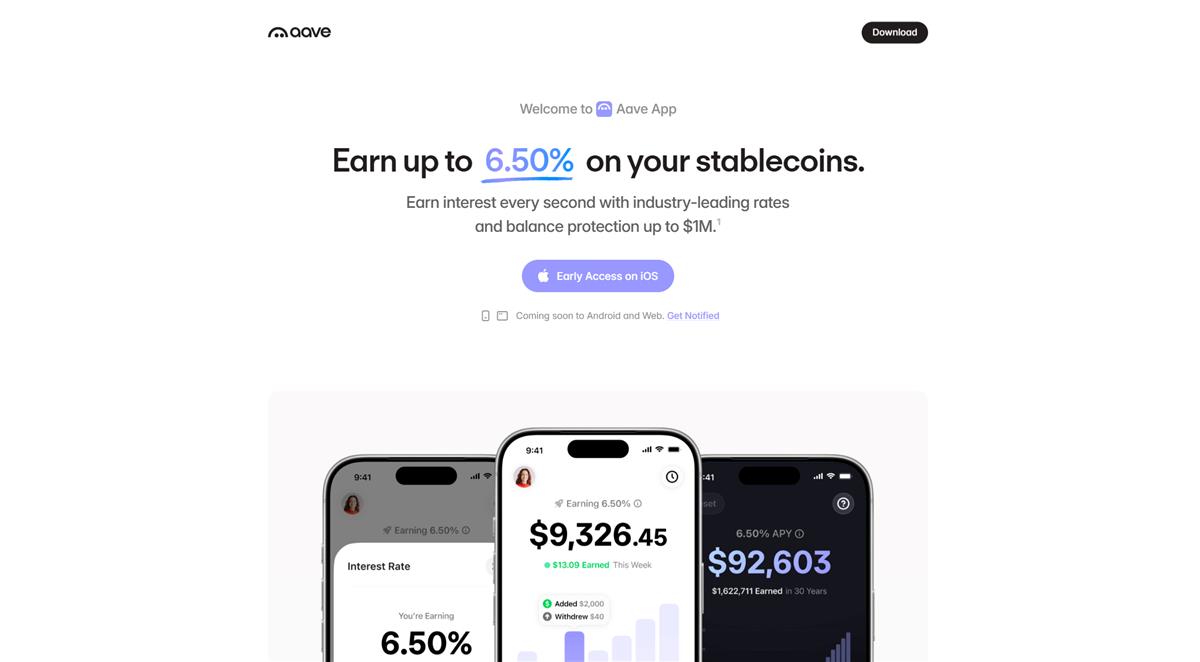

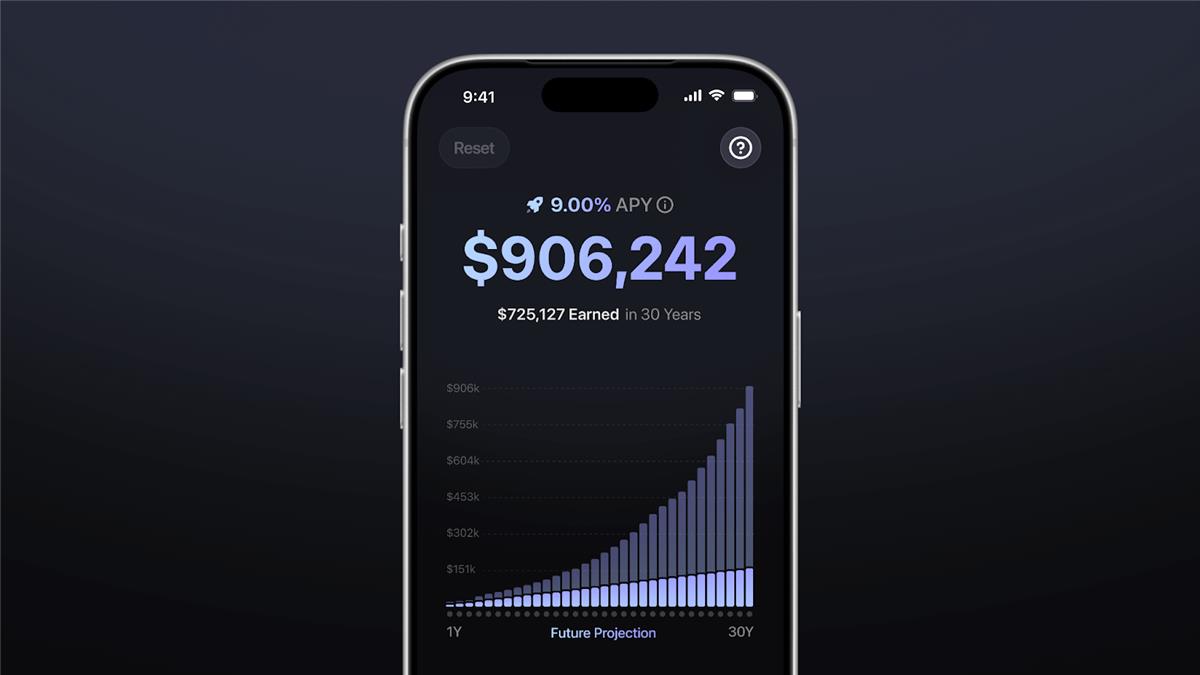

On November 17, Aave Labs announced something unusual for a decentralized finance protocol: a mobile app that looks nothing like crypto. The Aave App, now accepting waitlist signups on Apple's App Store, offers 6% to 9% annual yields on savings deposits. Users can fund accounts directly from their bank or debit card, watch interest compound in real time, and withdraw instantly. There are no obscure words like liquidity pools, collateralization ratios, or gas fees. The interface resembles a modern savings account, not a DeFi protocol.

The launch is significant because Aave is the world's largest DeFi lending platform, managing over $31 billion in total value locked across multiple blockchains.

Yet this is the first time the protocol has built a product designed explicitly for mainstream consumers rather than crypto-native users. The app includes balance protection up to $1 million, supports more than 12,000 banks and cards for deposits, and strips away virtually all blockchain terminology from the user experience.

This might be DeFi's "iPhone moment." Not because the underlying technology has fundamentally changed, but because someone has finally prioritized user experience over technical sophistication. If successful, the Aave App could redefine how decentralized finance protocols are valued and understood, transforming them from infrastructure plays into consumer brands.

The Product Itself: What Makes This App Different

At its core, the Aave App delivers three things traditional DeFi interfaces have struggled to provide: seamless onboarding, jargon-free experience, and credible security messaging.

The onboarding flow eliminates the multi-step friction that has kept DeFi niche. Users connect a bank account or debit card and deposit dollars directly. There is no need to first acquire ETH, bridge assets across chains, or manage gas fees. The app converts fiat to stablecoins like USDC behind the scenes, then routes deposits into Aave's lending markets. From the user's perspective, they are simply opening a high-yield savings account.

The interface strips away blockchain jargon entirely. Instead of "supplying liquidity" or monitoring a "health factor," users see a straightforward savings rate that updates in real time. Interest compounds every second, visible as a growing balance rather than an abstract APY figure. Withdrawals are instant, mirroring the experience of transferring money between traditional bank accounts.

The balance protection offering addresses one of the biggest psychological barriers to DeFi adoption. While details remain somewhat opaque, Aave advertises coverage up to $1 million per account, positioning the app as safer than leaving funds in an uninsured crypto wallet. Whether this protection covers smart contract exploits, custody failures, or both will matter greatly, but the messaging itself signals a shift toward consumer-grade risk management.

Underneath, the app runs on Aave V3, a battle-tested protocol that has operated for years without major security incidents. It also integrates GHO, Aave's native stablecoin, which contributes to the yield generation and strengthens the protocol's economic flywheel. The consumer app was built with help from the team at Stable Finance, a stablecoin startup Aave Labs acquired in October 2025.

Perhaps most importantly, Aave secured regulatory approval before launch. On November 14, Push by Aave Labs, a subsidiary, obtained a Crypto-Asset Service Provider (CASP) license from Ireland's Central Bank under the EU's Markets in Crypto-Assets (MiCA) framework. This authorization allows Aave to offer regulated fiat on- and off-ramps for stablecoins across the European Economic Area. While many DeFi protocols have avoided regulatory engagement, Aave has leaned into it, treating compliance as a product feature rather than a constraint.

The Simplification Graveyard: Why Past Attempts Failed

The Aave App is not the first attempt to make DeFi accessible. It enters a landscape littered with well-intentioned efforts that promised simplicity but delivered complexity in disguise.

Aave itself spent years building protocol-layer innovations that served developers and power users, not everyday consumers. Aave V1, launched in 2020 as a rebrand of ETHLend, introduced flash loans and pooled liquidity. V2 brought credit delegation and collateral swaps. V3, released in 2022, added cross-chain portals and isolation mode for riskier assets. Each upgrade improved capital efficiency and expanded what was technically possible. But all were designed for users who already understood liquidation thresholds, over-collateralization, and gas optimization. The better the protocol became at serving sophisticated users, the further it drifted from mainstream comprehension.

Wallet developers tried to close the gap. MetaMask became the de facto standard for interacting with decentralized applications, but it still required users to manage seed phrases, approve token transactions, and pay gas fees in ETH. In 2023, MetaMask launched Snaps, a plugin system meant to let developers build more user-friendly experiences on top of the wallet. The initiative improved some workflows, but the underlying complexity remained. Users still needed to understand that they were custodians of their own private keys, that transactions could fail if gas prices spiked, and that approving a malicious contract could drain their wallet.

Other wallets tried different angles. Rainbow emphasized beautiful design and social recovery. Argent removed gas fees by subsidizing transactions. WalletConnect simplified the process of linking wallets to apps. These were genuine improvements, but they shared a fatal assumption. They assumed users wanted a better crypto experience. They optimized for people who had already decided to use DeFi and just needed the friction reduced.

The truth is more fundamental. Most people do not want a crypto experience at all. They want better financial products. They want higher yields, faster transfers, and lower fees. The fact that these benefits might come from blockchain technology is irrelevant to them, and possibly a deterrent. Asking someone to download MetaMask, buy ETH on an exchange, transfer it to their wallet, connect to a DeFi app, approve a smart contract, and monitor their position is not simplification. It is a tutorial in a foreign system.

The analogy to early smartphones is instructive. Palm Pilots and BlackBerrys were optimized for people who wanted a better personal digital assistant or a better email device. They assumed users would learn stylus gestures or master a tiny keyboard.

The iPhone succeeded because it redefined the question. It was not a better PDA. It was the internet in your pocket, and it worked the way normal objects worked: you touched what you wanted, and it responded. The technology underneath was complex, but the mental model was simple.

DeFi's simplification attempts failed because they optimized the wrong variable. They made crypto easier to use without questioning whether users should have to think about crypto at all.

Why Aave App Might Break Through

The Aave App avoids past mistakes by doing something simple: it stops pretending to be a crypto product.

The app does not market itself as a "DeFi interface" or a "web3 portal." It positions as a savings account with better yields than traditional banks. The comparison set is Marcus by Goldman Sachs, Ally Bank, and Wealthfront. When a user opens the app, they see an interest rate, not a wallet address. They see dollars growing, not liquidity pool tokens. The mental model borrows from something people already understand and trust.

Traditional DeFi requires users to acquire crypto, transfer it to a wallet, connect to a decentralized app, approve smart contracts, and monitor collateral ratios. The Aave App collapses this into a single step: connect your bank and deposit. Everything else happens invisibly. The app converts dollars to stablecoins, supplies them to Aave's lending markets, and calculates yield. Users never touch a blockchain explorer. They never see a transaction hash. They interact with a financial product, not a cryptographic system.

The timing helps. For years, DeFi protocols operated in a legal gray area, unable to integrate with traditional banking infrastructure without risking enforcement. Most teams chose ideological purity over distribution. Aave chose the opposite. By securing a CASP license under MiCA, it gained the ability to legally facilitate euro-to-stablecoin conversions across the European Economic Area. The license allows Aave to be listed on the Apple App Store, to partner with banks for direct deposits, and to offer insurance-like protections. Competitors without similar regulatory approvals cannot replicate this distribution advantage quickly.

The timing matters for another reason. In 2021 and early 2022, during the DeFi summer hype cycle, users were willing to tolerate complexity in exchange for speculative upside. Trust came from code audits and decentralization rhetoric. After the collapse of FTX, Celsius, and Terra, that trust evaporated. Today's users want regulated entities, transparent insurance, and legal recourse. The CASP license signals that Aave is a regulated service, not an anonymous protocol. For mainstream users, that distinction may matter more than any technical feature.

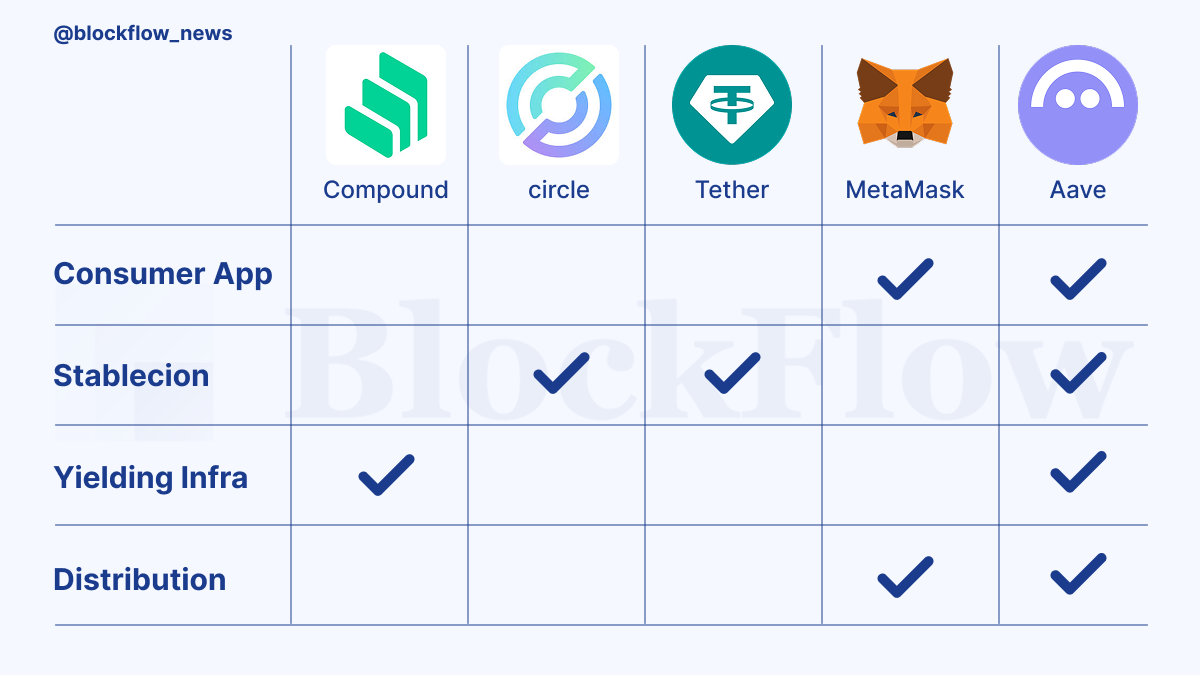

Aave also controls the entire value chain in a way no competitor does. It operates the underlying lending protocol, issues its own stablecoin (GHO), has built the consumer application, and secured the regulatory license. This vertical integration creates compounding advantages. At the protocol layer, Aave can optimize yield specifically for retail depositors. At the stablecoin layer, GHO creates a closed-loop economy where Aave captures both supply and demand. At the application layer, the team controls the user experience end-to-end. At the compliance layer, the CASP license is a durable moat that takes years to replicate.

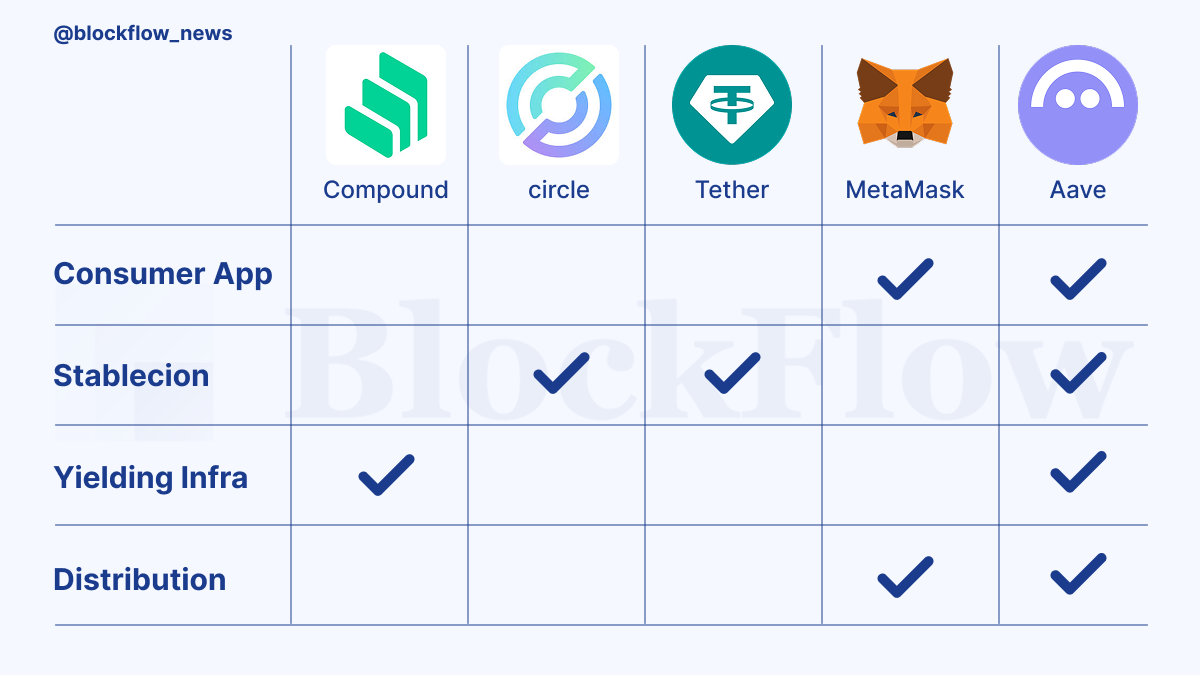

Compare this to competitors. Compound has a powerful protocol but no consumer app and no stablecoin. Circle and Tether issue stablecoins but do not control the yield-generating infrastructure. MetaMask has distribution but relies on third-party protocols for financial services. Aave is the first DeFi protocol to integrate all four layers. That structure is closer to how traditional banks operate: they issue deposits, manage lending, control the customer interface, and navigate regulation. If DeFi is going to compete with traditional finance, it may need to adopt a similar model.

The Road Ahead

If the Aave App succeeds, it will reshape how DeFi protocols are understood and valued. The implications extend across the industry, and the investment case depends on whether execution matches ambition.

For the broader crypto ecosystem, success would validate a new category: the protocol as consumer brand. For the past decade, DeFi protocols have been valued like infrastructure. Metrics focus on total value locked (TVL), transaction volume, and protocol revenue. These are appropriate for services that function like AWS or Stripe, providing backend tools for developers. But if Aave demonstrates that a protocol can also own the customer relationship, the valuation framework will need to change.

This shift would trigger capital reallocation. Venture funding has concentrated heavily on layer-1 blockchains, scaling infrastructure, and developer tooling. A successful consumer app from Aave would demonstrate that the next wave of value creation lies in applications, not infrastructure. Founders who have been building the "Ethereum killer" or the "next MetaMask" may redirect toward consumer financial products. Capital would follow.

Aave's regulatory strategy also sets a precedent. Most DeFi protocols have treated regulation as an external threat, something to resist or route around. Aave has inverted that assumption, treating a CASP license as a competitive weapon. If this approach proves successful, other protocols will race to secure similar authorizations in Europe, the US, and Asia. That would formalize a divide in the DeFi landscape: regulated protocols that can access mainstream users, and unregulated protocols confined to crypto-native markets. The valuation gap between the two groups could widen significantly over the next 12 to 24 months.

But the risks are substantial. The 6% to 9% yield Aave advertises depends on sustained borrowing demand within its lending markets. If crypto prices decline or leverage appetite weakens, yields will compress. At that point, the app becomes less attractive than risk-free Treasury bills, which currently offer north of 4%. Aave could subsidize yields temporarily to retain users, but that is not a sustainable long-term model.

The $1 million balance protection is another uncertainty. The specifics of this coverage remain vague. Does it protect against smart contract exploits? Custody failures? Regulatory seizures? If users deposit funds assuming FDIC-like insurance and then lose money in a scenario not covered by the policy, the backlash could damage Aave's reputation and set back consumer DeFi adoption broadly.

The centralization trade-offs are real—a regulated on-ramp means KYC requirements, geographic restrictions, and potential transaction monitoring, the opposite of DeFi's original censorship resistance. From an investment perspective, the case for Aave hinges on whether the app can onboard millions of retail users and force a re-rating of the AAVE token from infrastructure revenue to consumer brand value, similar to how Robinhood and SoFi trade at premiums justified by user growth. The next six to twelve months will reveal traction through assets under management growth, daily active users, and retention rates—if Aave surpasses $500 million in AUM within three months of launch, that would signal strong product-market fit. Longer term, even if the Aave App itself does not dominate, it validates a strategic direction: the combination of consumer focus, regulatory engagement, and vertical integration is likely the correct template for DeFi's next phase, and capital will flow toward teams that can execute on this vision.

The iPhone did not succeed because it had the fastest processor or the most features. It succeeded because it made the internet accessible to people who did not care about TCP/IP protocols. It redefined the product category, shifted the mental model, and made the complex feel simple.

The Aave App is attempting the same transformation for DeFi. It is not trying to build a better crypto wallet. It is building a better savings account that happens to use crypto infrastructure. Whether it succeeds will depend on execution, market timing, and whether enough users prioritize yield over ideology. But the approach is sound, and the timing may finally be right.

DeFi has spent a decade optimizing for developers and power users. The next decade will be defined by products built for everyone else. The Aave App may or may not be the one that breaks through. But it represents the direction the industry must move if it wants to graduate from niche to mainstream. The next 12 months will reveal whether Aave has cracked the code, or whether DeFi's true "iPhone moment" is still waiting to be built.

Connect with us:

- Fast News: t.me/blockflownews

- Trends: x.com/BlockFlow_News

PEPE0.00 -10.49%

PEPE0.00 -10.49%

TON1.29 -3.46%

TON1.29 -3.46%

BNB621.24 -0.37%

BNB621.24 -0.37%

SOL85.86 -1.68%

SOL85.86 -1.68%

XRP1.41 -2.29%

XRP1.41 -2.29%

DOGE0.10 -4.15%

DOGE0.10 -4.15%

TRX0.29 0.16%

TRX0.29 0.16%

ETH2013.84 -0.89%

ETH2013.84 -0.89%

BTC67009.59 -1.42%

BTC67009.59 -1.42%

SUI0.93 -2.86%

SUI0.93 -2.86%