A sophisticated financial loop has emerged where OpenAI pays Oracle for cloud services, Oracle buys NVIDIA chips with that money, and NVIDIA invests back into OpenAI—creating a self-reinforcing cycle that generates trillions in market cap gains while ultimately being funded by external investors betting on AI's future success.

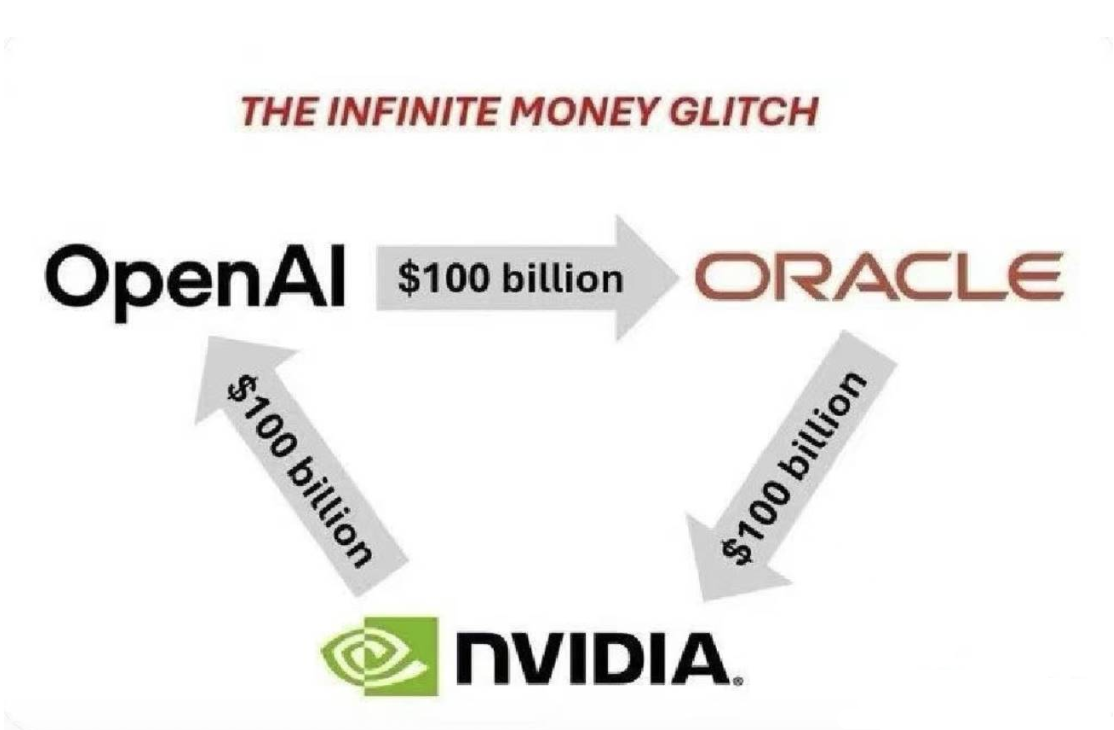

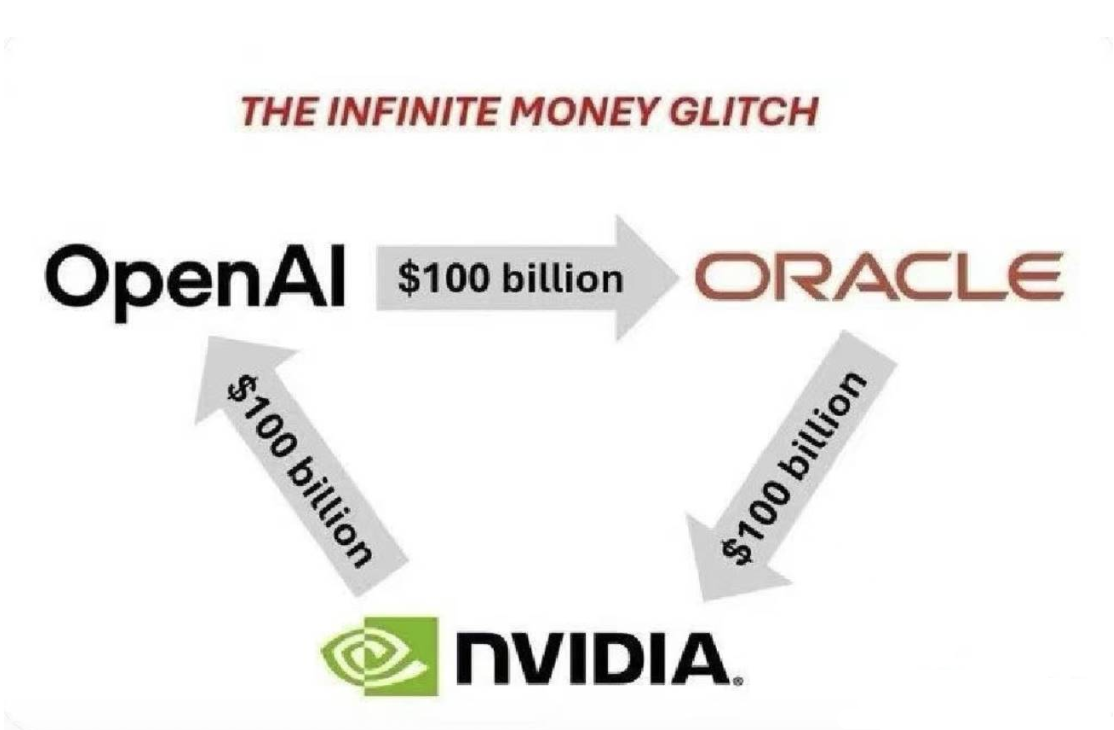

A joke has been making the rounds in US stock circles lately:

"OpenAI invests $100 billion in Oracle for cloud computing services; Oracle invests $100 billion in NVIDIA for graphics cards; NVIDIA then invests $100 billion back into OpenAI for AI systems. Question: Who actually put up the $100 billion?"

Of course, this is just a joke—the amounts and facts are greatly exaggerated, and it's not three companies passing the same money around in circles. But it does reflect a new kind of closed-loop capital narrative that's emerging in the market.

Here's what makes this fascinating: In this loop, each link represents real contracts or investments, and every move gets amplified by capital markets, driving trillions in market cap gains. It's essentially a sophisticated form of financial alchemy—transforming relatively modest capital commitments into massive paper wealth through the power of market psychology and narrative construction.

The numbers speak for themselves. On September 11th, Oracle's stock skyrocketed 36%, marking its biggest single-day gain since 1992. Overnight, the company's market cap soared to $933 billion, and founder Larry Ellison briefly surpassed Elon Musk to become the world's richest person.

Then on September 22nd, NVIDIA and OpenAI announced a strategic partnership, with NVIDIA planning to invest up to $100 billion in OpenAI. NVIDIA closed up nearly 4%, pushing its market cap past $4.46 trillion and igniting a tech stock rally that sent all three major US indices to new highs.

The leverage effect is breathtaking: $100 billion in announced investments generates over a trillion dollars in market cap gains—a 10x multiplier that would make any hedge fund manager envious. US stocks are playing a new kind of AI roulette game.

The Triangle Loop: How Does the Money Spin?

In this real-world investment maze, three names form a perfect capital circuit: OpenAI, Oracle, and NVIDIA. Think of it as a sophisticated perpetual motion machine for capital markets—each component feeds the others while generating exponential returns for shareholders.

First Loop: OpenAI's Computing Hunger

The story begins with OpenAI's insatiable appetite for computing power. As the creator of ChatGPT, the company processes requests from 700 million users daily—a scale of AI computation that requires truly massive infrastructure.

This year, OpenAI made headlines by signing what may be the largest tech contract in history: a 5-year, $300 billion cloud computing agreement with Oracle. The numbers reveal a fascinating disconnect between current reality and future promises—OpenAI will pay Oracle approximately $60 billion annually, equivalent to six times Oracle's current annual revenue.

What does this astronomical sum actually buy? The answer is 4.5 gigawatts of data center capacity—enough to power 4 million American households. Oracle will build sprawling data center campuses for OpenAI across five states: Wyoming, Pennsylvania, Texas, and others.

It's a masterclass in risk transfer: OpenAI secures guaranteed infrastructure capacity while Oracle assumes the massive capital expenditure burden, betting their entire company's future on AI demand sustainability.

Second Loop: Oracle Needs Chips

With OpenAI's massive order in hand, Oracle faces its own challenge: How do you actually build these data centers? The answer reveals the beautiful simplicity of this capital chain—Oracle becomes a conduit, transforming OpenAI's future payment promises into immediate chip purchases.

Oracle CEO Safra Catz was refreshingly direct about their strategy: "The vast majority of our capital expenditure investments go toward purchasing revenue-generating equipment that will go into data centers." Translation: they're buying chips, and lots of them.

The company plans to invest tens of billions in the Stargate project, primarily to purchase NVIDIA GPUs. Industry estimates suggest that 4.5 gigawatts of computing power requires over 2 million high-end GPUs—a shopping list that includes NVIDIA's H100, H200, and latest Blackwell chips.

This massive procurement need has transformed Oracle into one of NVIDIA's largest customers virtually overnight—a perfect example of how contract announcements can instantly reshape entire market dynamics.

Third Loop: NVIDIA Gives Back

Just as Oracle was ramping up its chip-buying spree, NVIDIA dropped a bombshell: the company announced plans to invest $100 billion to support OpenAI in building 10 gigawatts of AI data centers.

The investment structure reveals NVIDIA's strategic brilliance—they're essentially financing their own customer's expansion, creating guaranteed future demand while appearing generous and forward-thinking.

The investment will be phased, with NVIDIA contributing funds each time OpenAI deploys 1 gigawatt of computing power. The first phase is scheduled to launch in the second half of 2026, using NVIDIA's cutting-edge Vera Rubin platform.

NVIDIA CEO Jensen Huang put the scale in perspective: "10 gigawatts of data center capacity equals about 4 to 5 million GPUs—roughly our entire annual shipment for this year."

And there you have it—a perfect capital perpetual motion machine: OpenAI pays Oracle for computing power, Oracle uses that money to buy chips from NVIDIA, and NVIDIA reinvests its earnings back into OpenAI. It's financial engineering disguised as organic business development.

The Wealth Amplifier Between Reality and Perception

The market's response to these announcements reveals the true power of this circular investment model. A $300 billion long-term contract drove Oracle's market cap up by over $250 billion in a single day. A $100 billion investment commitment boosted NVIDIA by $170 billion overnight.

What we're witnessing is the financialization of technological optimism—where future promises generate immediate wealth that exceeds the underlying economic activity by orders of magnitude.

The three companies have mastered the art of synchronized market manipulation through legitimate business announcements. Each validates the others' business models, creating powerful stock price resonance that amplifies every press release.

But there's genuine logic behind these seemingly irrational stock surges. For capital markets, the scarcest commodity isn't money—it's future certainty. Oracle's contract with OpenAI essentially monetizes uncertainty, converting speculative AI demand into contractual revenue streams that investors can value and trade.

NVIDIA has also mastered the art of narrative innovation. Instead of talking about "buying X number of GPUs," they're now using "GW (gigawatts)" as their unit of measurement. This linguistic shift is pure marketing genius—gigawatts sound like energy infrastructure, suggesting permanence and scale that transcends typical tech product cycles.

The endorsement cycle works like a sophisticated reputation laundering system: NVIDIA's investment in OpenAI essentially declares, "I recognize this as a future super-customer." OpenAI's contract with Oracle signals, "Oracle can support my future cloud computing needs," which helps OpenAI secure additional funding. Oracle's massive procurement of NVIDIA GPUs broadcasts, "NVIDIA chips are in such high demand that we're buying billions of dollars worth."

Together, these moves paint a picture of a stable and prosperous AI supply chain. But the stability is largely performative—each company's success depends entirely on the others maintaining their commitments and the broader AI market continuing to grow exponentially.

Yet beneath this seemingly flawless loop lies an intriguing paradox. OpenAI currently generates about $10 billion in annual revenue but has committed to paying Oracle $60 billion yearly—a 6x revenue multiple that would be considered financially reckless in any traditional industry.

The answer reveals the venture capital subsidy at the heart of this entire system. OpenAI completed a $40 billion funding round in April and is expected to continue raising capital regularly. In essence, OpenAI uses investor money to pay Oracle, Oracle uses this money to purchase NVIDIA chips, and NVIDIA reinvests part of its revenue back into OpenAI. It's a circulation system powered entirely by external capital—a financial ecosystem that exists primarily to generate paper returns for public market investors.

There's another crucial detail: these astronomical contracts are mostly based on "commitments" rather than immediate cash transfers. They can be delayed, renegotiated, or even canceled under certain conditions. Markets see the headline numbers, not the actual cash flow—and that's exactly where the magic happens.

This represents modern financial markets at their most sophisticated: expectations and commitments create multiplied wealth effects that dwarf the underlying economic activity, turning corporate press releases into trillion-dollar market events.

Who Foots the Bill?

So let's return to our opening joke: "Who actually put up the $100 billion?"

The honest answer reveals a complex pyramid of capital sources, with retail investors and pension funds ultimately bearing the risk while venture capitalists and corporate insiders capture most of the upside.

Investment institutions like SoftBank, Microsoft, and Thrive Capital are the primary financiers, having poured hundreds of billions into OpenAI to keep the entire capital circulation spinning. But these "smart money" investors typically negotiate preferential terms, downside protection, and early exit opportunities that aren't available to public market participants.

The funding web extends far beyond venture capital into the broader financial system. Banks and bond investors provide crucial funding support for Oracle's massive expansion plans. Corporate pension funds, university endowments, and sovereign wealth funds all participate through various investment vehicles.

At the end of the chain are ordinary investors—people holding tech stocks, AI-focused ETFs, and mutual funds—who serve as the ultimate "bag holders" if this AI investment cycle turns sour. They provide the patient capital that makes the entire system possible while bearing the greatest downside risk.

This AI capital rotation game represents financial engineering specifically designed to extract maximum value from public market enthusiasm for artificial intelligence. It leverages widespread market optimism about AI's future to build a self-reinforcing investment cycle that benefits insiders and early investors disproportionately.

In this carefully orchestrated cycle, everyone appears to win: OpenAI secures the computing power it needs to scale, Oracle locks in guaranteed revenue streams, and NVIDIA enjoys both massive sales and strategic investment opportunities. Meanwhile, shareholders across all three companies watch their paper wealth multiply.

But this collective euphoria rests on one critical assumption: that AI's future commercialization will generate enough real economic value to justify these astronomical investments. The entire system works beautifully as long as everyone believes in the AI revolution's inevitable success.

The systemic risk is enormous—if AI commercialization disappoints, or if any major participant fails to meet their commitments, the entire circular investment structure could collapse rapidly. What looks like a diversified investment ecosystem is actually a highly concentrated bet on a single technological trend.

For now, though, the game continues. The ultimate payers are every investor who believes in AI's transformative potential—people using today's money to subsidize tomorrow's AI infrastructure while enriching today's AI entrepreneurs.

Let's hope the music doesn't stop playing anytime soon.

Connect with us:

Fast News: t.me/blockflownews

Insights & Trends: x.com/BlockFlow_News

PEPE0.00 -10.92%

PEPE0.00 -10.92%

TON1.29 -2.84%

TON1.29 -2.84%

BNB622.89 -1.30%

BNB622.89 -1.30%

SOL86.08 -3.52%

SOL86.08 -3.52%

XRP1.40 -3.74%

XRP1.40 -3.74%

DOGE0.10 -6.17%

DOGE0.10 -6.17%

TRX0.29 -0.23%

TRX0.29 -0.23%

ETH2026.17 -1.95%

ETH2026.17 -1.95%

BTC67579.14 -1.91%

BTC67579.14 -1.91%

SUI0.93 -6.00%

SUI0.93 -6.00%