PEPE0.00 -0.53%

PEPE0.00 -0.53%

TON3.10 -0.03%

TON3.10 -0.03%

BNB878.90 0.04%

BNB878.90 0.04%

SOL216.35 1.22%

SOL216.35 1.22%

XRP2.94 -0.85%

XRP2.94 -0.85%

DOGE0.24 -1.27%

DOGE0.24 -1.27%

TRX0.34 1.19%

TRX0.34 1.19%

ETH4301.76 -0.03%

ETH4301.76 -0.03%

BTC111311.84 -0.50%

BTC111311.84 -0.50%

SUI3.46 -1.12%

SUI3.46 -1.12%

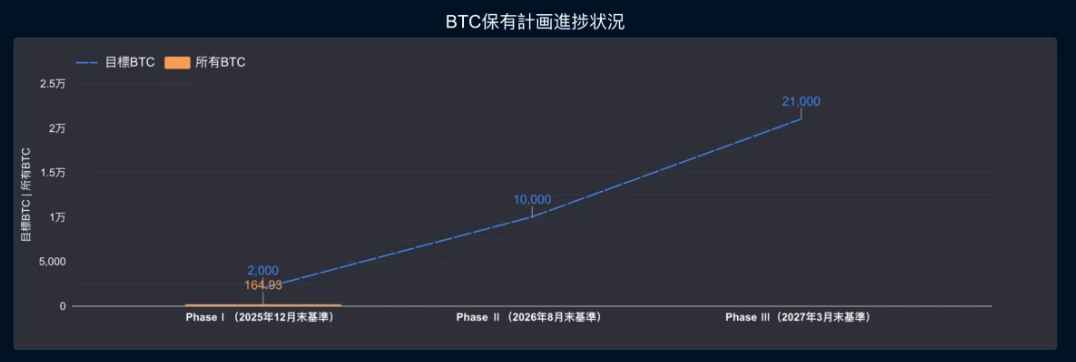

The company believes Bitcoin offers improved market liquidity and price discovery due to increased institutional investment, making it an opportune time for corporate adoption. Convano views the digital asset as both a store of value and strategic diversification tool while establishing a distinct presence in Japan's emerging corporate crypto sector.

The company believes Bitcoin offers improved market liquidity and price discovery due to increased institutional investment, making it an opportune time for corporate adoption. Convano views the digital asset as both a store of value and strategic diversification tool while establishing a distinct presence in Japan's emerging corporate crypto sector.