Tokyo-listed Metaplanet raised $1.4 billion through an upsized international stock offering to purchase more Bitcoin for its treasury strategy.

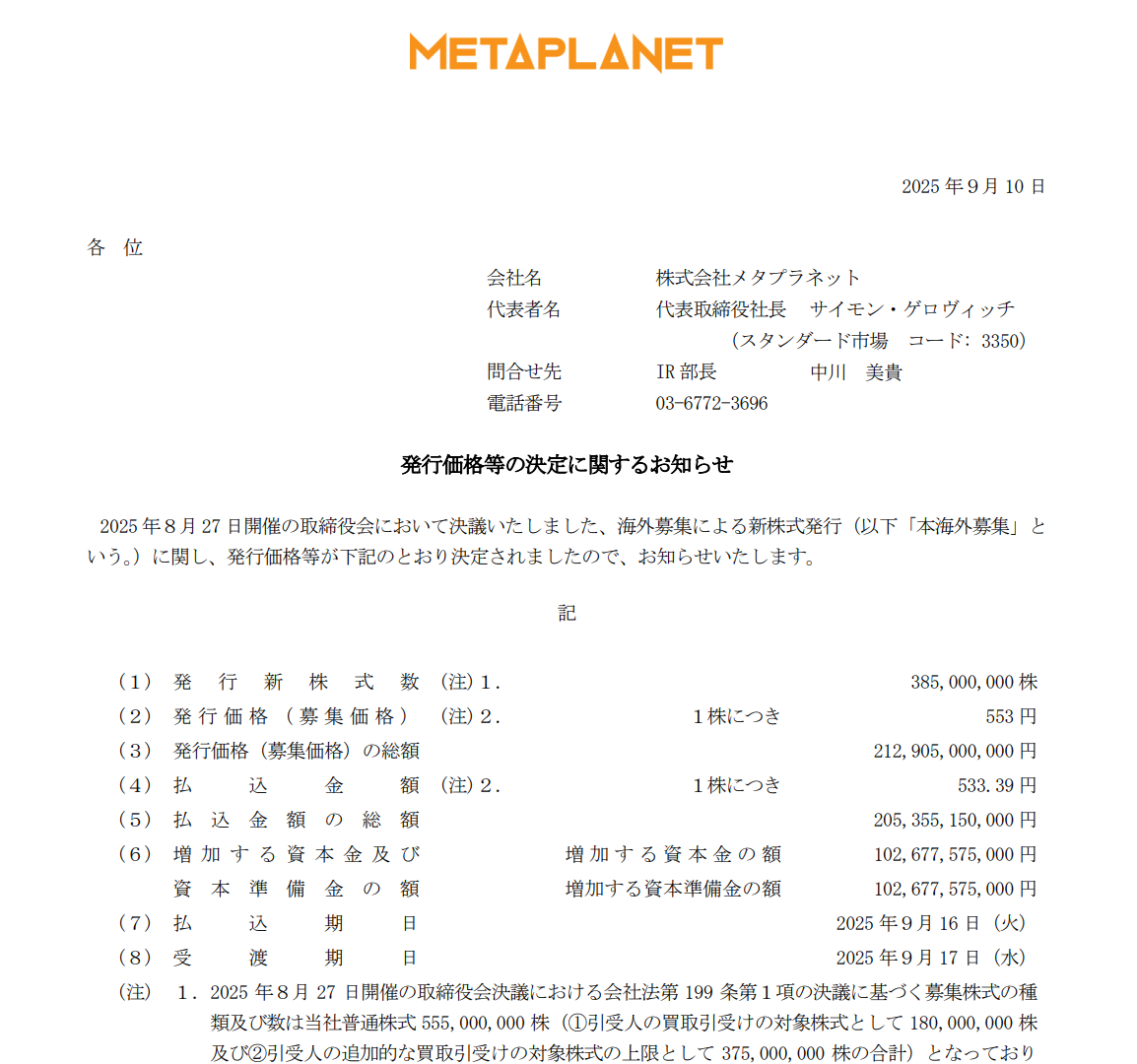

Tokyo-listed Metaplanet completed a 212.9 billion yen ($1.42 billion) international stock offering on September 9, 2025, issuing 385 million new shares at 553 yen per share. The Japanese company expanded the offering from an initially planned 180 million shares, indicating strong investor demand for the Bitcoin treasury strategy.

https://www.release.tdnet.info/inbs/140120250909554846.pdf

Metaplanet said it will allocate 90% of the net proceeds, approximately 183.7 billion yen ($1.22 billion), to purchase Bitcoin between September and October 2025. The remaining 10%, or 20.4 billion yen ($136 million), will fund its Bitcoin income business through options trading operations from September to December 2025. Payment for the new shares is scheduled for September 16, 2025.

The offering will increase Metaplanet's outstanding shares from 755.97 million to 1.14 billion shares, representing a dilution rate of approximately 51%. The company currently holds 20,000 Bitcoin valued at around 322 billion yen ($2.15 billion) at current market prices.

Metaplanet adopted Bitcoin as its primary reserve asset in May 2024, positioning itself as Japan's equivalent to MicroStrategy. The Tokyo-based firm cited Japan's challenging economic environment, including high debt levels, prolonged negative real interest rates, and ongoing yen weakness, as drivers for the strategy. The company aims to protect shareholder value by hedging against yen depreciation and inflation impacts.

The Bitcoin income business generated 1.9 billion yen ($12.7 million) in revenue during the second quarter of 2025 through options trading activities. This represents a new revenue stream for the company as it expands beyond simply holding Bitcoin as a treasury asset.

Metaplanet's aggressive Bitcoin accumulation strategy mirrors that of US-based MicroStrategy, which has raised billions of dollars through debt and equity offerings to purchase Bitcoin. The Japanese company's approach reflects growing corporate adoption of Bitcoin as a hedge against currency debasement and inflation, particularly relevant for Japanese companies facing persistent yen weakness.

The successful upsizing of the offering suggests institutional investor appetite for exposure to Bitcoin through publicly traded companies remains strong. Metaplanet's strategy of combining direct Bitcoin holdings with income-generating activities through derivatives trading provides investors with both asset appreciation potential and cash flow generation.

The company's treasury strategy comes as Bitcoin has gained broader acceptance among institutional investors and corporations seeking alternatives to traditional cash holdings. Japan's regulatory environment has been generally supportive of crypto assets, providing a favorable backdrop for Metaplanet's Bitcoin-focused business model.

Connect with us:

- Telegram: t.me/blockflownews

- Twitter: x.com/BlockFlow_News

PEPE0.00 -9.53%

PEPE0.00 -9.53%

TON1.30 -0.52%

TON1.30 -0.52%

BNB624.90 -1.23%

BNB624.90 -1.23%

SOL85.91 -3.56%

SOL85.91 -3.56%

XRP1.40 -3.73%

XRP1.40 -3.73%

DOGE0.10 -6.21%

DOGE0.10 -6.21%

TRX0.29 -0.12%

TRX0.29 -0.12%

ETH2025.71 -2.87%

ETH2025.71 -2.87%

BTC67424.49 -1.54%

BTC67424.49 -1.54%

SUI0.93 -5.71%

SUI0.93 -5.71%