With the next FOMC decision just days away, this analysis zooms in on fiat-backed USD coins (USDT, USDC), takes a global view, and explores how Fed rate cycles—and other lurking risks—could reshape the industry.

Written by:0xYYcn (Bitfox Research)

The stablecoin market has surged in both scale and importance, powered by crypto-market enthusiasm and growing mainstream use. By mid-2025, its total capitalization topped $250 billion, up more than 22 percent so far this year. Morgan Stanley reports these dollar-pegged tokens now handle over $100 billion in daily transactions and drove $27.6 trillion in on-chain volume in 2024, surpassing Visa and Mastercard combined, per Nasdaq. Yet beneath this boom lies a web of hidden vulnerabilities, chief among them the tight coupling of issuers’ business models, and the coins’ very stability, to U.S. interest-rate moves. With the next FOMC decision just days away, this analysis zooms in on fiat-backed USD coins (USDT, USDC), takes a global view, and explores how Fed rate cycles—and other lurking risks—could reshape the industry.

Stablecoins 101: Growth Amid Hype and Regulation

What they are:Stablecoins are crypto assets engineered to hold a steady value, most commonly 1:1 with the U.S. dollar, by backing each token with reserves or algorithms. Fiat-backed coins like Tether’s USDT and Circle’s USDC maintain cash and short-term securities to fully collateralize every token. This safeguard keeps prices stable and has made USD stablecoins dominant, about 99 percent of the market is dollar-denominated, according to the Atlantic Council.

Why it matters:In 2025, stablecoins are breaking out of the crypto niche. Visa launched a platform for bank-issued coins, Stripe added stablecoin payments, and rumors swirl about Amazon and Walmart launching their own. U.S. lawmakers have also stepped in: in June 2025, the Senate passed the GENIUS Act, the first federal bill to regulate stablecoin issuance, mandating 1:1 backing in high-quality liquid assets (cash or <3-month T-bills) and clear obligations to holders. Across the Atlantic, the EU’s MiCA framework imposes strict rules, up to restricting non-euro coins if they threaten monetary stability. Their ascent has been meteoric: more than $255 billion in circulation as of June 2025, with Citi forecasting a sevenfold jump to $1.6 trillion by 2030. The message is clear: stablecoins are going mainstream, but rapid growth brings fresh risks and frictions.

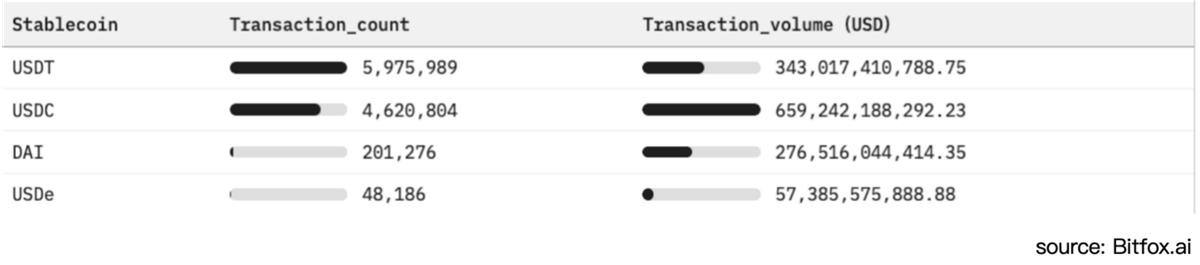

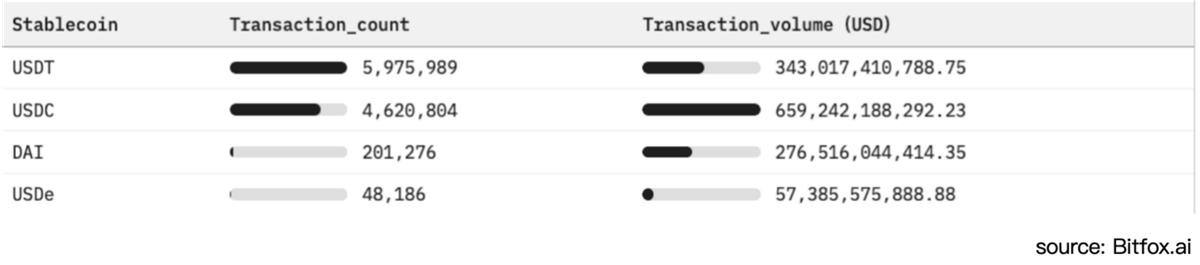

Ethereum Stablecoin Adoption Comparsion & Market Activity Analysis for the Past 30 Days

Fiat-Backed Stablecoins and an Interest-Rate Sensitive Model

Unlike traditional bank deposits, where customers earn interest, stablecoin holders typically receive zero yield. Under the GENIUS Act, USD coin balances would explicitly pay 0 percent to users, so issuers keep all the income from investing reserves. In today’s high-rate environment, that has turned firms like Tether and Circle into profit machines, but it also leaves them extremely vulnerable to rate cuts.

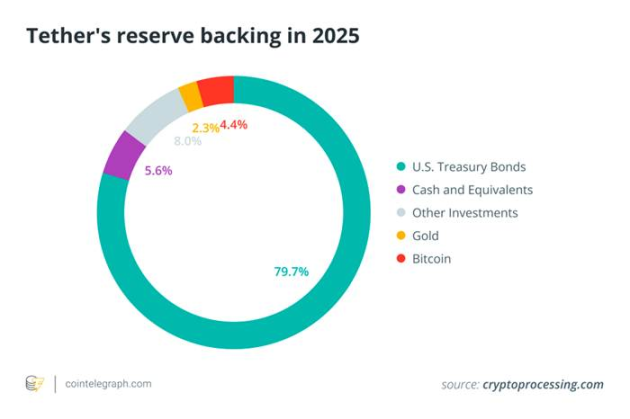

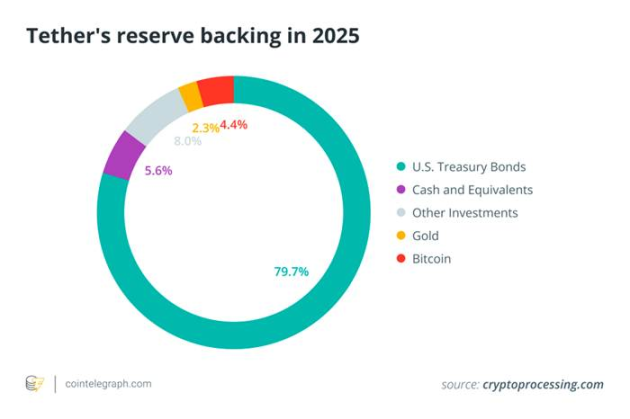

Reserve investments:Leading issuers park the bulk of their reserves in U.S. Treasury bills and other short-term instruments to ensure liquidity and preserve the peg. As of early 2025, Tether held $113–120 billion in U.S. government debt, about 80 percent of its reserves, and ranks among the top 20 global Treasury holders. The chart below breaks down Tether’s reserve allocation, showing its heavy tilt toward Treasuries, with smaller allocations to cash, other securities, gold, and Bitcoin.

Fig1. Tether’s reserve backing in 2025 (majority in U.S. Treasury bonds), reflecting the heavy dependence of fiat-backed stablecoins on interest-bearing government assets

By design, these high-quality reserves protect the peg and inspire user confidence. But they also generate substantial interest income – effectively the lifeblood of the stablecoin business model today. As the Federal Reserve raised rates aggressively from 2022 to 2023, yields on T-bills and bank deposits soared to multi-year highs, directly boosting stablecoin reserve returns. From Circle’s disclosed financial reports, in 2024, it earned $1.67 billion of its $1.68B total revenue from interest on its reserves, an astonishing 99% of revenue. On another hand, according to Techxplore, in 2024, Tether’s profit reportedly hit $13 billion, rivaling or exceeding Wall Street’s biggest banks like Goldman Sachs. These eye-popping profits, earned with only ~100 employees in Tether’s case,underscore how elevated interest rates have supercharged stablecoin issuers’ income. Essentially, stablecoin providers run a lucrative “carry trade”, investing customer dollars into Treasuries yielding 5%+ and keeping the spread since customers accept zero interest.

Vulnerability to Rate Swings: Stablecoin issuers’ revenue models are acutely sensitive to Fed rate moves. A 0.50 % cut, for instance, would slash Tether’s annual interest income by an estimated $600 million. As analysts at Nasdaq warn, “reliance on interest makes Circle vulnerable to rate cuts.”

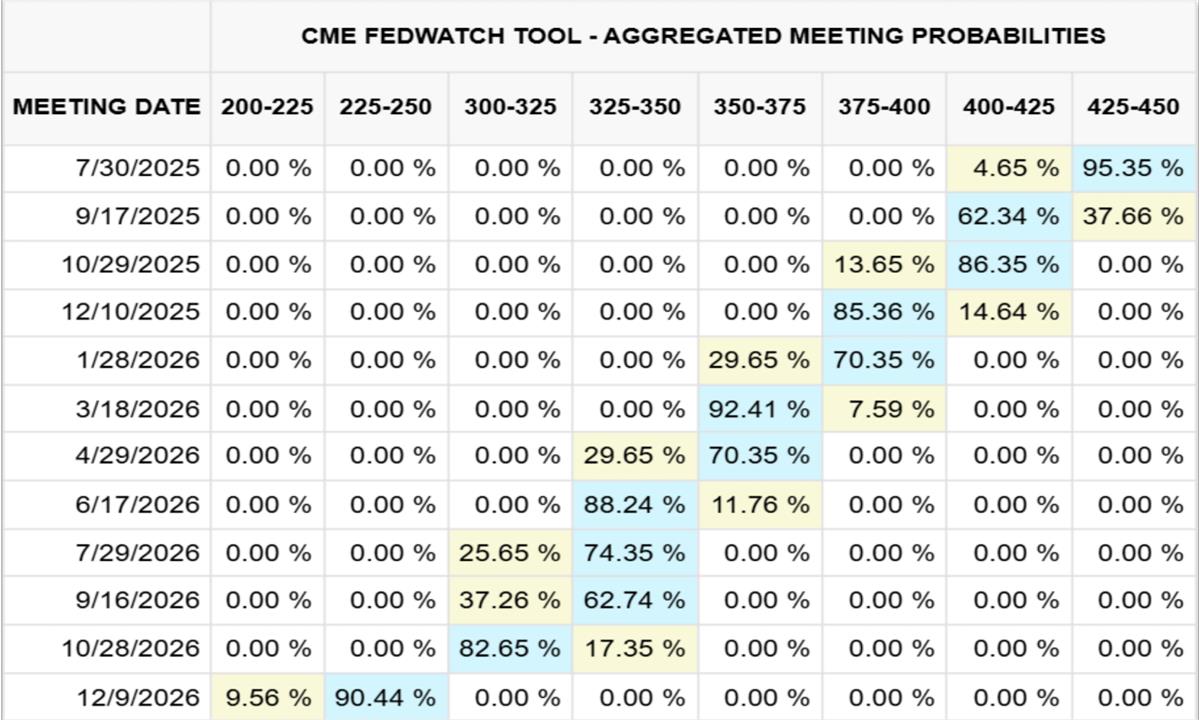

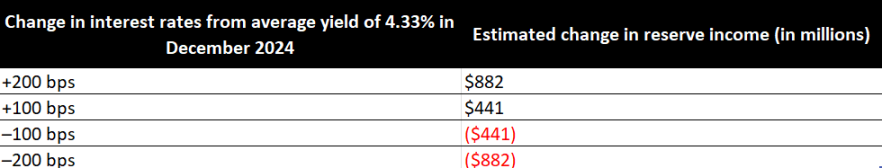

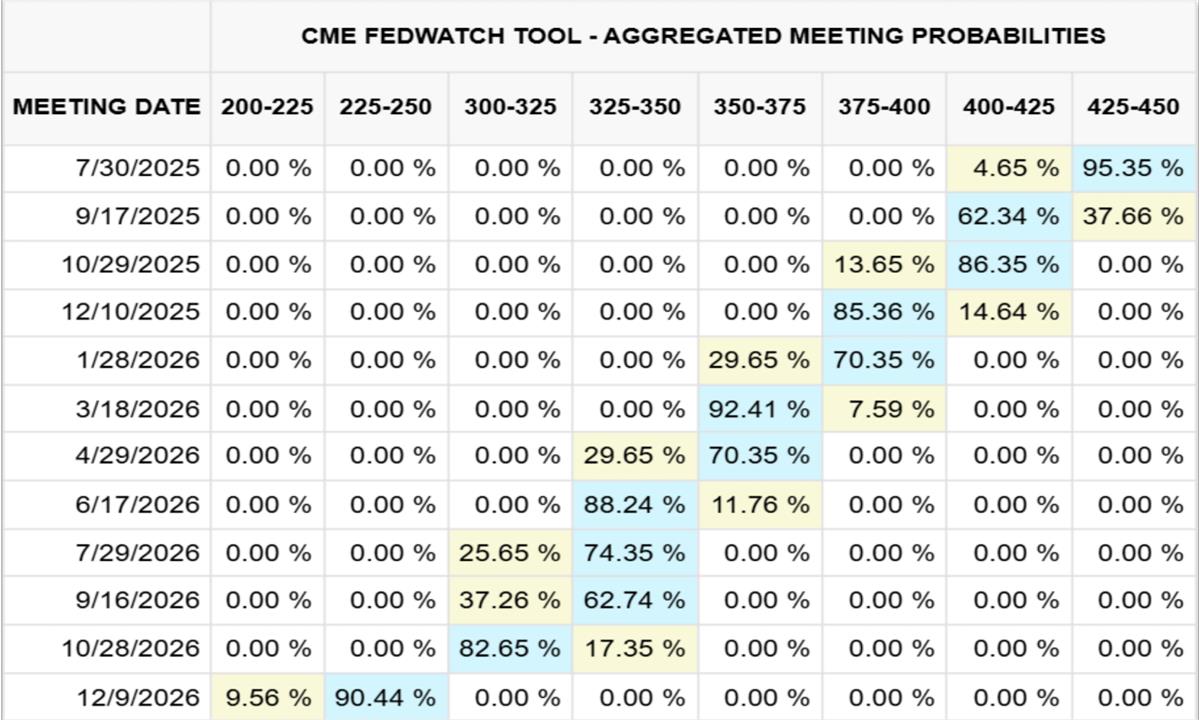

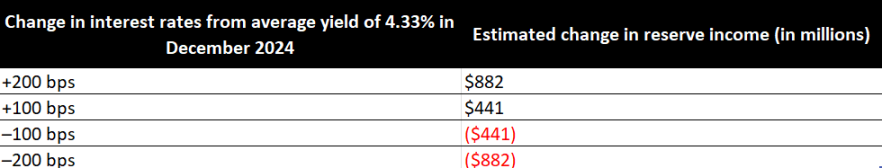

Below, Figure 2 shows the CME’s Fed Funds rate forecast through end-2026 (as of July 23, 2025), and Figure 3 illustrates how changes in interest rates impact Circle’s reserve income in $ millions.

Fig2. Fed Funds Rate Outlook to Dec 2026 (CME, 7/23/2025)

Fig3. Circle Reserve Income Sensitivity to Rate Moves disclosed by Circle

There is Math. In 2024, Circle earned $1.67 billion, 99 % of its revenue, from reserve interest alone. If rates settle at 2.25–2.50 % by December 2026 (a ~90 % probability by CME), Circle would forfeit roughly $882 million in interest income, over half its 2024 haul. To offset that shortfall, Circle would need to double its USDC supply by end-2026.

Beyond Interest Rates: Other Key Risks in the Stablecoin Ecosystem

Even as interest rate dynamics play a pivotal role, several other risks and challengessurround stablecoins. It’s critical to highlight these issues to provide a sober perspective amid the optimism:

● Regulatory & Legal Flux.Stablecoins operate under patchwork rules from the U.S. GENIUS Act to Europe’s MiCA that can legitimize issuers but also saddle them with hefty compliance costs and abrupt market restrictions. Enforcement actions over reserve disclosures, sanctions evasion (e.g., billions of dollars via Tether in sanctioned regions), or consumer‐protection concerns could swiftly halt redemptions or drive tokens out of key jurisdictions.

● Banking & Liquidity Concentration.Fiat‐backed coins depend on a handful of banks for reserve custody and on‐ramp/off‐ramp services. A partner failure (SVB’s shutdown stranded $3.3 billion in USDC reserves) or a sudden redemption rush can drain those deposits, trigger de‐pegging, and even stress broader banking liquidity if wholesale withdrawals overwhelm cash buffers.

● Peg Integrity & De-Peg Risk.Though fully collateralized, stablecoins can and have broken their $1 peg when market confidence falters. USDC’s drop to $0.88 in March 2023 exemplifies how doubts about reserve access can prompt rapid outflows. Algorithmic models face an even steeper vulnerability curve, as TerraUSD’s 2022 collapse starkly illustrated.

● Transparency & Counterparty Exposure.Users rely on issuers’ attestations (often quarterly) to trust that reserves exist and are liquid. Without full public audits, credibility gaps persist, and reserve assets, whether held at banks, money‐market funds, or in repo, carry counterparty and credit risk that can impair redemption guarantees in stress scenarios.

● Operational & Tech Hazards.Centralized stablecoins can freeze or confiscate tokens, mitigating some hacks but introducing a single-point governance risk, while DeFi variants remain exposed to smart-contract bugs, bridge exploits, and custody hacks. Meanwhile, user errors, phishing, and irreversible blockchain transactions pose everyday threats to holders.

● Systemic Stability Concerns.With hundreds of billions parked in short-dated Treasuries, stablecoin redemptions can influence T-bill demand and yield volatility. Large outflows risk Treasury fire-sales, and mass dollarization via stablecoins may weaken the Fed’s monetary-policy transmission, prompting calls for a U.S. CBDC or tighter regulatory guardrails.

Conclusion

As the next FOMC meeting approaches, and a rate hold seems likely, we shall be watching the Fed’s guidance for clues about what comes next. The remarkable growth of fiat‐backed tokens like USDT and USDC masks a business model deeply entwined with U.S. interest‐rate dynamics. Looking ahead, even a modest rate cut could erode hundreds of millions in interest income, forcing issuers to rethink growth strategies or share more yield with holders to maintain adoption.

Beyond rate sensitivity, stablecoins must navigate an evolving regulatory landscape, banking and liquidity concentrations, peg‐integrity challenges, and operational vulnerabilities—from smart‐contract exploits to reserve transparency gaps. Moreover, as these tokens become systemic holders of short‐dated U.S. Treasuries, their redemption behavior could reverberate through global bond markets and the very transmission of monetary policy.

PEPE0.00 -3.35%

PEPE0.00 -3.35%

TON1.29 -0.41%

TON1.29 -0.41%

BNB624.85 1.70%

BNB624.85 1.70%

SOL87.38 3.41%

SOL87.38 3.41%

XRP1.43 1.10%

XRP1.43 1.10%

DOGE0.10 0.01%

DOGE0.10 0.01%

TRX0.29 0.22%

TRX0.29 0.22%

ETH2049.21 3.75%

ETH2049.21 3.75%

BTC67514.61 1.63%

BTC67514.61 1.63%

SUI0.94 2.24%

SUI0.94 2.24%