Japan's bond market is experiencing extreme volatility with surging yields, triggering a massive unwinding of the yen carry trade. This is causing significant liquidity drainage from global markets, including crypto assets, which have fallen sharply as investors unwind leveraged positions.

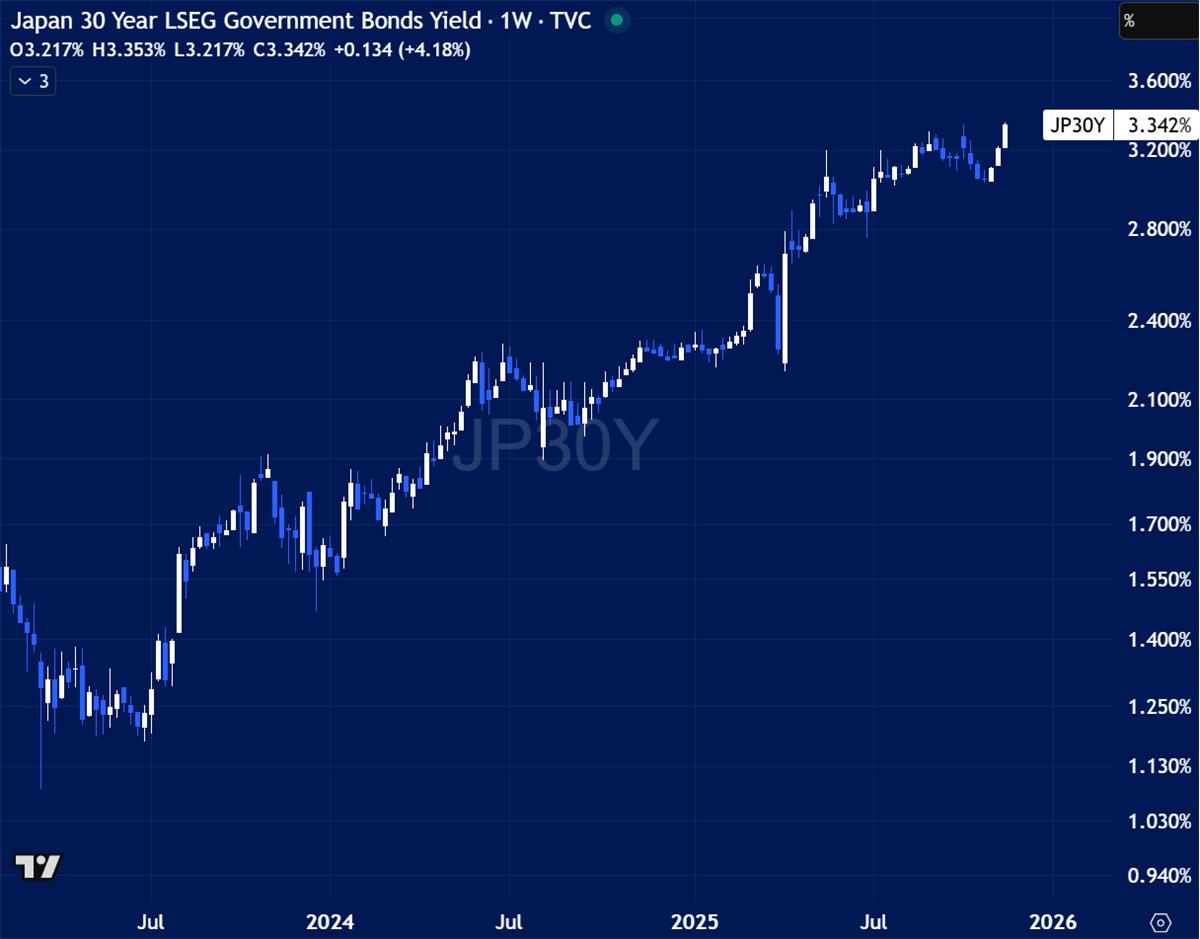

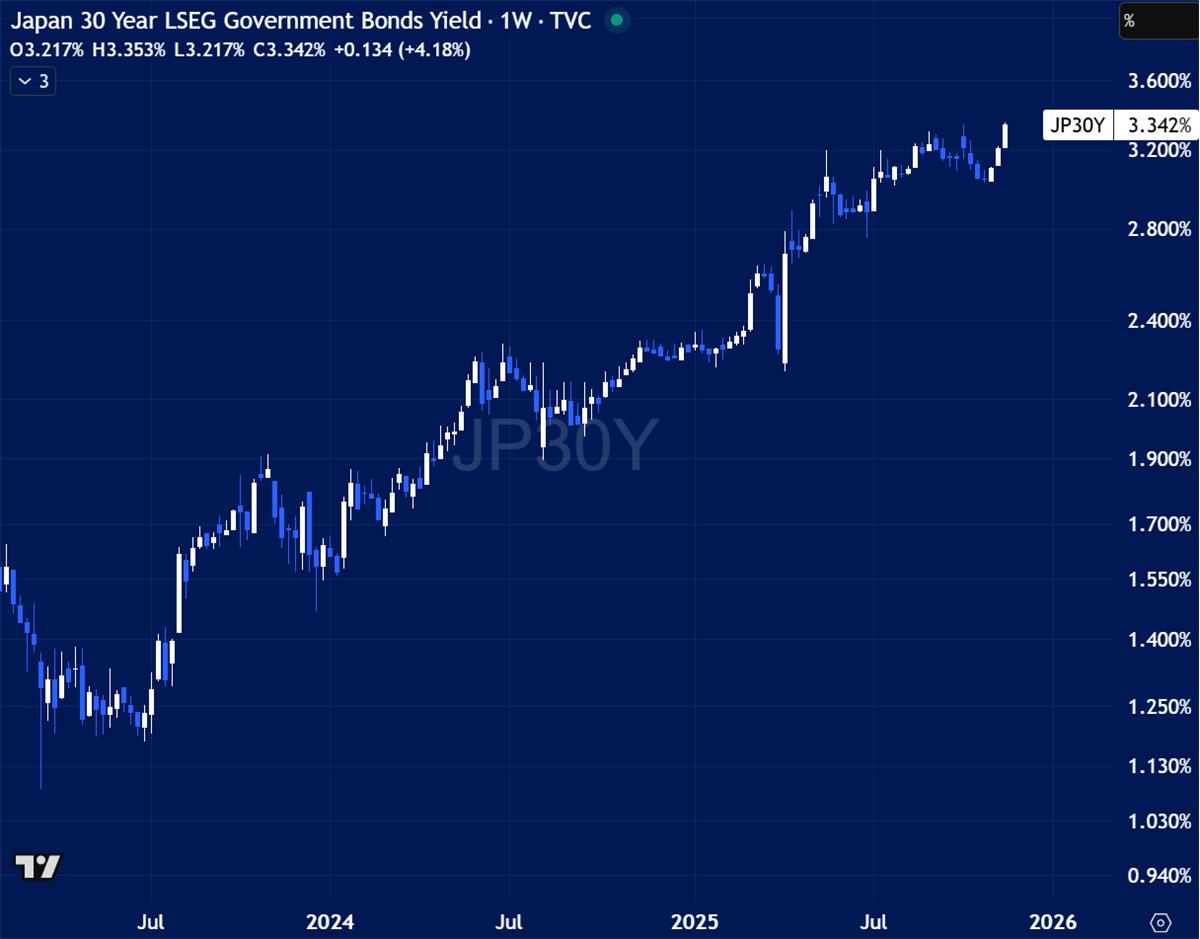

In November 2025, Japan's government bond market slipped into one of its most volatile phases in decades. Long-term yields surged to levels not seen since the 2008 financial crisis, with the 30-year Japanese Government Bond (JGB) yield jumping 100 basis points in just 45 days to reach 3.20%. The 40-year bond witnessed an even more dramatic collapse, shedding over 20% of its value and erasing more than $500 billion in market capitalization.

This was not just another routine repricing. The speed and severity of the sell-off forced the Bank of Japan to intervene repeatedly with emergency bond purchases, a stark departure from its recent path toward policy normalization. What began as a measured exit from ultra-loose monetary policy has morphed into a broader crisis of confidence, raising uncomfortable questions about Japan's fiscal sustainability and the stability of a market long considered a bedrock of global finance.

For crypto investors, the immediate reaction might be to dismiss this as a distant problem confined to traditional finance. That would be a mistake. Japan's bond market turmoil is triggering a massive unwinding of the yen carry trade, one of the most consequential sources of global liquidity over the past two decades. This unwinding is already reshaping capital flows across asset classes, and crypto, as a high-beta risk asset deeply intertwined with global liquidity conditions, is feeling the impact.

Understanding what is happening in Japan, and why it matters for crypto, requires stepping back to examine the mechanics of the carry trade, the forces driving its collapse, and the second-order effects now rippling through digital asset markets.

The Yen Carry Trade: A Primer

The yen carry trade is one of the most enduring and profitable strategies in global finance. At its core, the trade is elegantly simple: borrow money in a currency with ultra-low interest rates (the Japanese yen), convert it into another currency, and invest in higher-yielding assets elsewhere. The profit comes from the interest rate differential, also known as the "carry."

https://www.alt21.com/hedge-glossary/japanese-yen-carry-trade/

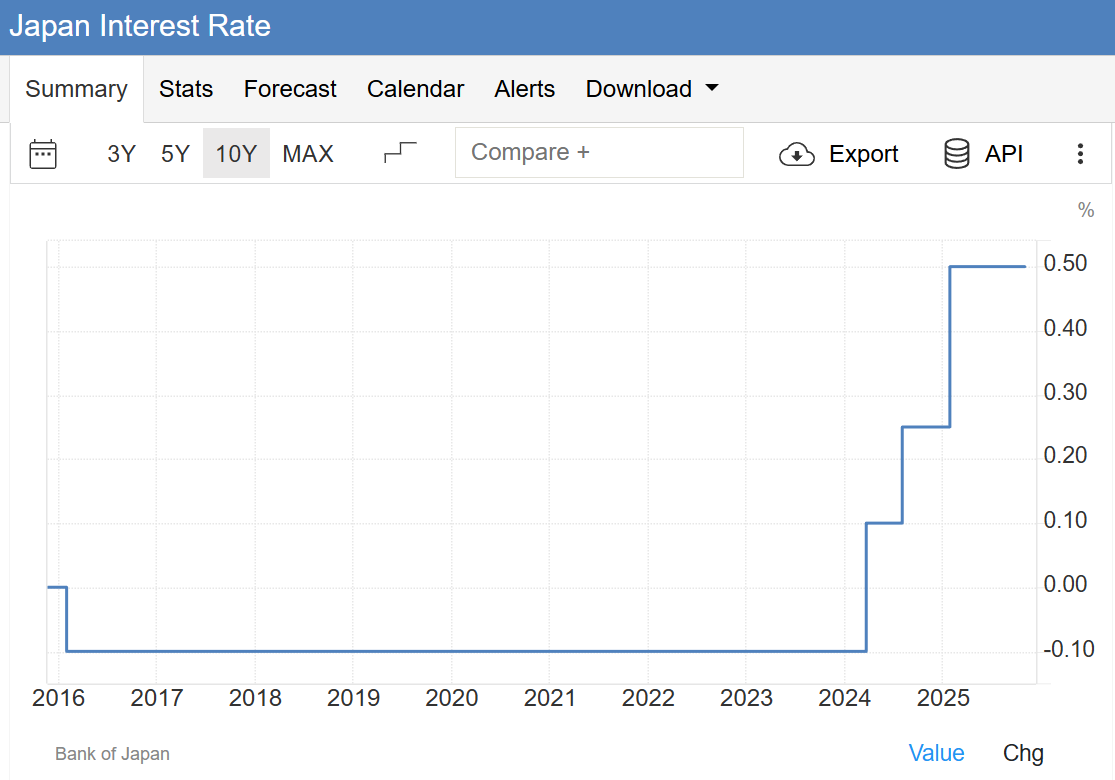

Japan has been the ideal funding currency for this trade since the late 1990s, when the Bank of Japan first pushed interest rates to zero in response to a deflationary spiral following the collapse of the asset bubble. For more than two decades, Japanese interest rates remained at or near zero, and at times even negative. This made the yen the cheapest currency in the world to borrow. Investors, from hedge funds to retail traders, could borrow yen at virtually no cost and deploy that capital into U.S. Treasuries yielding 4%, emerging market bonds yielding 8%, or even riskier bets like U.S. tech stocks and crypto assets promising double-digit returns.

The scale of the yen carry trade is difficult to measure precisely because much of it occurs off-balance-sheet or through derivatives, but estimates suggest trillions of dollars have been deployed through this mechanism. Japanese institutional investors, including insurance companies, pension funds, and banks, hold massive portfolios of foreign assets. As of mid-2025, Japanese investors held over $3 trillion in foreign bonds and equities. While not all of this represents carry trade activity, a significant portion is funded by borrowing in yen at low rates.

The trade works smoothly as long as two conditions hold: the yen remains weak or stable, and interest rate differentials remain wide. If the yen weakens further, investors earn additional gains on the currency leg of the trade. If rates in Japan stay near zero while yields rise elsewhere, the carry becomes even more attractive.

Crypto became a natural destination for carry trade capital in recent years. Bitcoin and Ethereum offered the potential for outsized returns, and the 24/7 liquidity of crypto markets made it easy to enter and exit positions. During the 2020-2021 bull run, anecdotal evidence and exchange data suggested significant inflows from Japanese retail and institutional investors, many of whom were likely using low-cost yen funding to amplify their exposure.

But carry trades are inherently fragile. They rely on leverage, they depend on stable currency markets, and they are vulnerable to sudden reversals. When the conditions that made the trade profitable begin to shift, the unwind can be swift and brutal.

https://tradingeconomics.com/japan/interest-rate

The Unwind: Why Now?

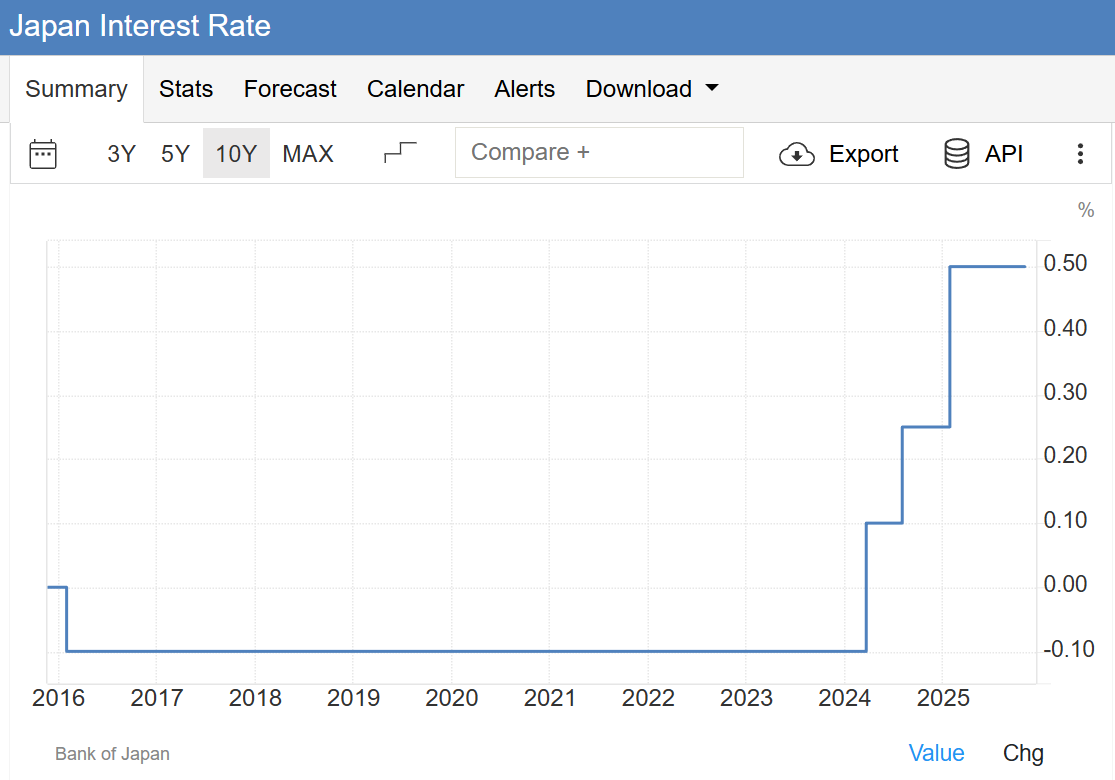

The current unwinding of the yen carry trade is driven by a confluence of factors, but the primary catalyst is the Bank of Japan's gradual exit from its ultra-loose monetary policy. For years, the BOJ maintained a policy known as Yield Curve Control (YCC), which capped the yield on 10-year JGBs at around 0%. This policy, combined with negative short-term rates and massive bond purchases, effectively anchored Japanese interest rates at historic lows.

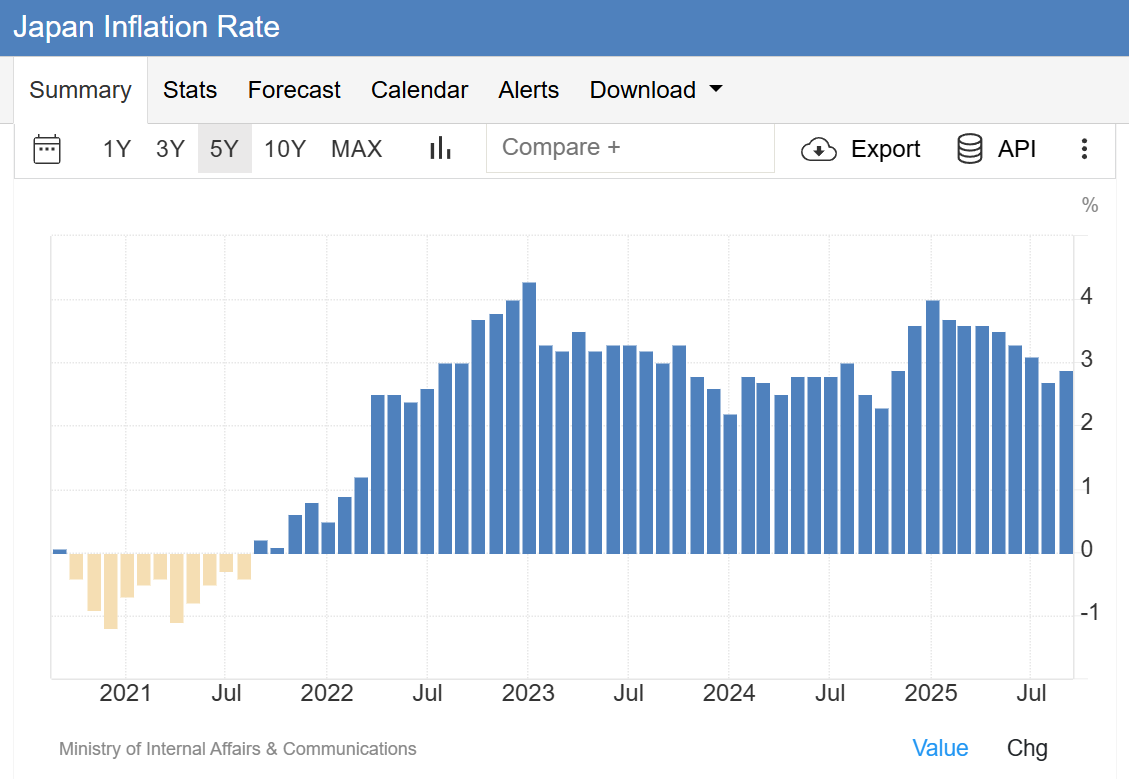

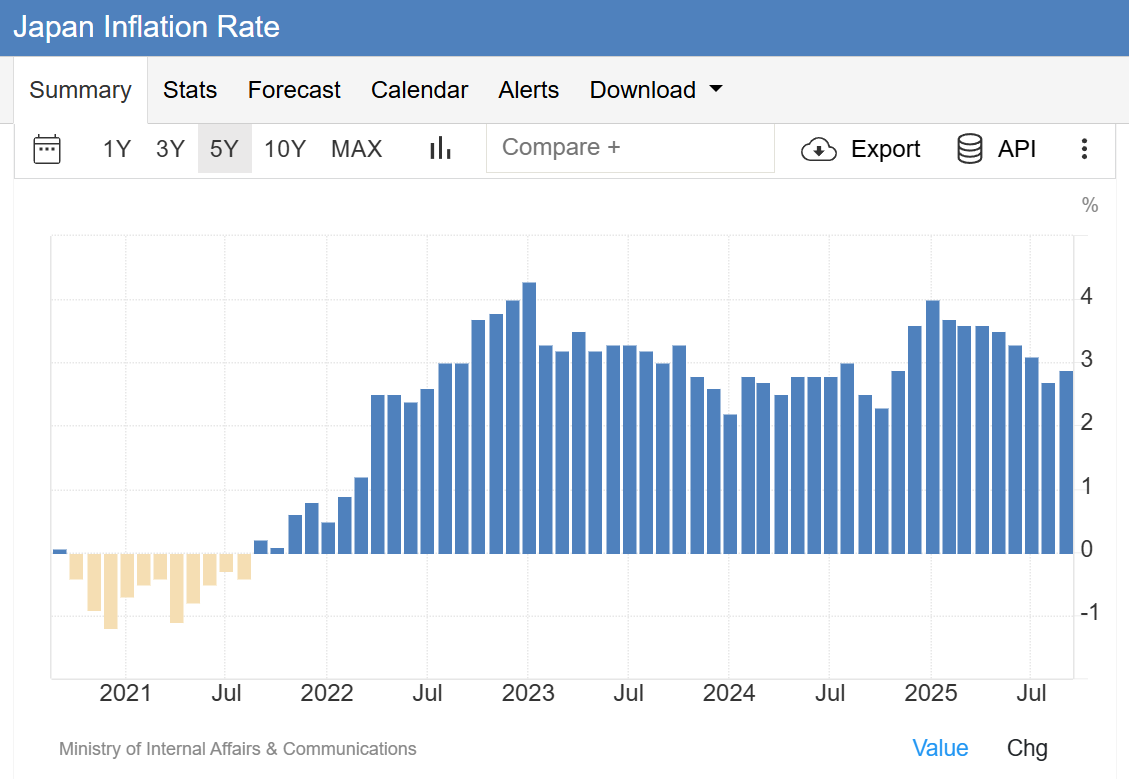

That era is now ending. Inflation, dormant in Japan for decades, has returned. Consumer prices have risen steadily, driven by global supply chain disruptions, energy price shocks, and a weakening yen that has made imports more expensive. By 2024, inflation had breached the BOJ's 2% target and showed little sign of cooling. This forced the BOJ to begin normalizing policy.

https://tradingeconomics.com/japan/inflation-cpi

In early 2025, the BOJ took its first concrete steps, raising its policy rate and adjusting the YCC framework to allow 10-year yields more flexibility. The market interpreted these moves as the beginning of a sustained tightening cycle. By mid-2025, long-term JGB yields were rising steadily, and by November, the 30-year yield had spiked to 3.20%, levels not seen since 2008.

Rising JGB yields have profound implications for the carry trade. First, they increase the cost of borrowing in yen. What was once a near-zero cost funding source is now becoming more expensive. Second, they make Japanese domestic bonds more attractive to Japanese investors, reducing the relative appeal of foreign assets. Third, and most critically, they strengthen the yen. As yields rise and the BOJ signals a more hawkish stance, the yen appreciates against other currencies. This creates a currency headwind for carry traders, who must eventually convert their foreign assets back into yen to repay their loans. A stronger yen means they receive fewer yen per dollar, euro, or bitcoin, eroding or even eliminating their gains.

The mechanics of the unwind are self-reinforcing. As some investors begin to close their carry trade positions by selling foreign assets and buying yen, this pushes the yen higher. The stronger yen then forces more carry traders to unwind, creating a negative feedback loop. Markets that were once buoyed by steady inflows of yen-funded capital now face sustained selling pressure.

There is also a fiscal dimension to the crisis. Japan's government debt stands at 260% of GDP, more than double that of the United States. Rising interest rates make this debt burden more expensive to service. The Japanese government must now issue new bonds at higher yields, and investors are beginning to demand a risk premium for holding long-dated JGBs. This adds to the upward pressure on yields and amplifies concerns about fiscal sustainability.

The result is a toxic mix: tightening monetary policy, rising yields, a strengthening yen, and growing fiscal stress. All of these factors are accelerating the unwinding of the carry trade and pulling liquidity out of global markets.

Comparing today's situation to these historical episodes reveals both similarities and differences:

Similarities to 2006-2007: Like then, the BOJ is normalizing policy after a long period of ultra-low rates. The 10-year JGB yield reached 1.77% in November 2025, approaching the 2007 highs. The 30-year yield has gone further, hitting 3.29%, well above anything seen in the 2000s. The scale of the carry trade today is likely larger than in 2007, given two additional decades of near-zero rates.

Similarities to 2008: Risk-off sentiment is evident, with crypto behaving like a high-beta risk asset rather than a safe haven. The correlation between yen strength and crypto weakness mirrors the 2008 pattern with equities and commodities.

Differences from 2013: Unlike Abenomics, today's policy shift is driven by inflation and fiscal stress, not a deliberate attempt to weaken the yen. The ¥17 trillion stimulus package is a counterforce, but it is unclear whether fiscal policy can offset monetary tightening. Additionally, crypto did not exist as a mature asset class in 2013, so this cycle offers a new test of how digital assets respond to carry trade dynamics.

New variable: Crypto: In 2006-2007 and 2008, the primary victims of carry trade unwinding were equities, high-yielding currencies, and commodities. Today, crypto has emerged as one of the most liquid and leveraged expressions of the carry trade. Bitcoin's 30% drawdown from its October 2025 highs suggests it is absorbing a significant share of the deleveraging pressure, much as emerging market equities did in 2006 and 2007.

History does not repeat, but it rhymes. The current unwind shares the same fundamental dynamics as prior episodes: rising yields, yen strength, forced deleveraging, and selling pressure on risk assets. What remains uncertain is whether this cycle will resolve like 2006-2007 (a temporary scare followed by resumed easing) or escalate into something more severe, akin to 2008. For crypto investors, the historical lesson is clear: carry trade unwinds are toxic for high-beta assets, and the path forward depends on whether the BOJ can sustain its tightening or is forced to pivot.

Liquidity Drainage: The Second-Order Effects on Crypto

Crypto markets are not immune to macro forces, and the yen carry trade unwind is a textbook example of how traditional finance dynamics can ripple into digital assets. The most immediate and visible impact has been on price.

Bitcoin, which peaked above $126,000 in October 2025, entered a technical bear market by mid-November, falling nearly 30% from its highs. Ethereum and other major cryptocurrencies followed a similar trajectory. While crypto volatility is nothing new, the timing and character of this drawdown suggest macro forces at work. The decline coincided precisely with the acceleration of JGB yield spikes and yen strength, pointing to deleveraging and capital repatriation as key drivers.

The carry trade unwind hits crypto through multiple channels. First, there is direct selling pressure from investors who used yen funding to buy crypto. As borrowing costs rise and the yen strengthens, these positions become unprofitable, and traders are forced to sell their crypto holdings to repay yen-denominated loans. Second, there is indirect pressure from broader risk-off sentiment. As Japanese investors repatriate capital from global risk assets, liquidity tightens across the board, and high-beta assets like crypto are the first to feel the pain.

Data from Japanese crypto exchanges supports this narrative. On bitFlyer, one of Japan's largest exchanges, the BTC/JPY trading pair saw a brief spike in volume in early November as prices in yen terms hit record highs near ¥19.78 million. But this was followed by sustained net outflows, with Japanese retail investors reducing their crypto exposure. Similar patterns were observed on Coincheck and other domestic platforms.

The derivatives market tells a similar story. Bitcoin funding rates, which measure the cost of holding leveraged long positions in perpetual futures, turned negative in mid-November for the first time in months. This indicates that short positions were paying long positions to maintain their trades, a sign of market stress and forced liquidation. Options markets also showed heightened demand for downside protection, with implied volatility spiking and put options trading at a premium to calls.

Beyond price, the carry trade unwind is affecting the structure of crypto markets. Stablecoin flows, a key indicator of capital movement, have shown a shift. USDT and USDC, the two dominant dollar-pegged stablecoins, saw reduced inflows into Asian exchanges in November, suggesting that capital is being pulled back rather than deployed. On-chain data from Glassnode and other analytics firms showed declining active addresses and transaction volumes, consistent with reduced speculative activity.

Leverage across the crypto ecosystem has also been unwinding. DeFi protocols that offer leveraged trading or lending saw a spike in liquidations as collateral values fell and borrowing costs rose. Centralized exchanges reported increased redemptions and withdrawals, as traders moved to close positions and reduce risk.

The broader context is important here. Crypto is deeply tied to global liquidity conditions. When central banks print money and interest rates are low, capital flows into risk assets, including crypto. When liquidity tightens, crypto suffers. The yen carry trade has been a significant source of global liquidity for two decades. Its unwinding represents a structural shift in how capital is allocated, and crypto, as one of the most liquid and accessible high-risk assets, is absorbing a disproportionate share of the adjustment.

It is also worth noting that crypto's correlation with traditional risk assets has increased during this episode. Historically, Bitcoin advocates have argued that it behaves as "digital gold," a non-correlated safe haven. But in November 2025, Bitcoin moved in lockstep with the Nasdaq and other risk-on assets, falling as they fell. This suggests that in periods of acute liquidity stress, crypto is treated as just another risk asset, not a hedge.

The Counter-Narrative: Fiscal Stimulus as Liquidity Backstop

While the carry trade unwind is real and its effects on crypto are tangible, it would be premature to conclude that this is a one-way street toward lower prices and tighter liquidity. There is a counter-narrative, rooted in fiscal policy and the limits of monetary tightening in a highly indebted world.

In mid-November 2025, the Japanese government announced a ¥17 trillion fiscal stimulus package aimed at cushioning the economy from the effects of tighter monetary policy and rising borrowing costs. The package includes direct payments to households, subsidies for energy costs, and infrastructure spending. The goal is to offset the deflationary impact of higher interest rates and prevent a sharp economic slowdown.

https://www.bloomberg.com/news/articles/2023-11-01/japan-s-kishida-set-to-unveil-stimulus-package-as-support-sags

This creates a fascinating contradiction. On one hand, the Bank of Japan is tightening monetary policy and allowing yields to rise. On the other hand, the government is loosening fiscal policy and injecting liquidity into the economy. The net effect on liquidity is ambiguous and depends on which force dominates.

If fiscal stimulus is large enough and sustained, it could counteract the liquidity drain from the carry trade unwind. Government spending puts money into the hands of consumers and businesses, some of which will find its way back into financial markets. A weaker yen, which is a byproduct of fiscal expansion, also makes Japanese exports more competitive and can support risk asset prices globally.

There is also the question of whether the BOJ can sustain its tightening path. Japan's debt-to-GDP ratio is 260%, and rising interest rates make that debt more expensive to service. At some point, the government may face a choice: continue tightening and risk a fiscal crisis, or reverse course and return to monetary accommodation. History suggests that when faced with this trade-off, central banks often choose accommodation. This is the logic behind the theory of "fiscal dominance," where fiscal pressures force central banks to keep rates low and print money to finance deficits.

If the BOJ does eventually pivot back to easier policy, either because of fiscal stress or because the economy weakens, the liquidity picture could shift quickly. A resumption of bond purchases or a reversal of rate hikes would weaken the yen, reduce carry trade unwinding pressure, and potentially reignite risk appetite.

For crypto, this scenario would be bullish. Easy money and fiscal stimulus have historically been rocket fuel for digital asset prices. The 2020-2021 bull run was driven largely by unprecedented monetary and fiscal expansion in response to the pandemic. If Japan's current tightening proves short-lived and gives way to renewed stimulus, crypto could benefit.

However, this counter-narrative comes with caveats. Fiscal stimulus takes time to work its way through the economy, and in the meantime, the carry trade unwind continues. Moreover, if stimulus leads to higher inflation, it could force the BOJ to tighten even more aggressively, exacerbating the unwind. The interplay between monetary and fiscal policy is complex, and outcomes are highly uncertain.

What is clear is that the macro environment is in flux, and simplistic narratives about crypto's direction are likely to be wrong. Investors need to navigate a landscape where multiple forces are pulling in different directions, and flexibility is more valuable than conviction.

Investment Implications for Crypto VCs

For venture investors focused on crypto, the yen carry trade unwind is not just a macro curiosity. It has direct implications for portfolio construction, risk management, and capital deployment. The key lesson is that macro matters, and ignoring global liquidity dynamics is a recipe for underperformance.

The first implication is the need for active risk management. In a regime where liquidity is tightening and volatility is rising, static allocations are dangerous. Investors should monitor a set of key indicators that provide early warning of stress: USD/JPY exchange rates, JGB yields, Bitcoin funding rates, and options skew. Sharp moves in any of these can signal that the unwind is accelerating or that a policy shift is imminent.

Hedging strategies also become more important in this environment. Traditional crypto portfolios are long-only and unhedged, leaving them fully exposed to drawdowns. In periods of macro uncertainty, adding hedges through put options, inverse positions, or allocations to uncorrelated assets can reduce portfolio volatility and preserve capital for better opportunities.

Rather than making binary predictions about where prices are headed, a more useful approach is scenario planning. There are three plausible scenarios for how the carry trade unwind could play out, each with different implications for crypto.

- Scenario A is a disorderly unwind. In this case, the yen strengthens rapidly, yields spike further, and forced liquidations cascade across global markets. Crypto faces sustained selling pressure, with prices potentially falling another 20-30% from current levels. The signal that this scenario is unfolding would be extreme readings in funding rates, a sharp inversion of options skew toward puts, and headline risk of institutional failures or systemic stress. In this scenario, the right move is to preserve capital, hold cash or stablecoins, and wait for capitulation signals before deploying.

- Scenario B is a managed transition. Here, the BOJ and Japanese government successfully thread the needle, allowing yields to rise gradually while using fiscal policy to cushion the economy. The carry trade unwinds over months rather than weeks, and markets experience heightened volatility but no systemic crisis. Crypto prices chop within a range, with sharp moves in both directions but no clear trend. In this scenario, a disciplined dollar-cost averaging strategy into high-quality assets like Bitcoin, Ethereum, and liquid infrastructure tokens makes sense. Avoid illiquid altcoins and high-leverage DeFi protocols, which are vulnerable to sudden liquidity shocks.

- Scenario C is a policy pivot. In this case, the BOJ is forced to reverse course, either because fiscal stress becomes untenable or because the economy weakens sharply. The central bank resumes bond purchases, cuts rates, or signals a return to accommodation. The yen weakens, carry trades are re-established, and global liquidity expands. Crypto, as a high-beta beneficiary of loose money, rallies sharply. The signal for this scenario would be explicit BOJ dovish guidance, a weakening yen, and a decline in JGB yields. In this case, the right move is to increase exposure aggressively, particularly to regulated crypto products like ETFs and stablecoin infrastructure, which benefit from both liquidity expansion and institutional adoption.

Within crypto, some sectors are better positioned than others to weather this environment. Stablecoin infrastructure is a relative winner. As cross-border capital flows become more volatile and traditional payment rails face stress, demand for fast, cheap, and reliable settlement increases. Companies building regulated stablecoin issuance, custody, and payment rails are insulated from crypto price volatility and can even benefit from increased transaction volumes during periods of market stress.

Regulated exchanges and custody providers are also relatively defensive. Institutional investors, who are more sensitive to compliance and security, are likely to consolidate activity on platforms with strong regulatory standing. Japanese crypto firms, in particular, may see increased domestic demand as local investors seek compliant on-ramps and off-ramps for digital assets.

On the other hand, high-leverage DeFi protocols and illiquid altcoins are vulnerable. Protocols that depend on borrowed liquidity or offer extreme leverage face the risk of cascading liquidations and collateral shortfalls. Illiquid tokens, which have wide bid-ask spreads and shallow order books, can suffer dramatic drawdowns in periods of stress.

Geography also matters. Japanese crypto projects and infrastructure may benefit from policy support and domestic capital flows, even as global liquidity tightens. The Japanese government has been supportive of crypto innovation, and the Financial Services Agency has been working on frameworks for yen-backed stablecoins and tokenized securities. Investors with exposure to Japan-focused crypto companies may find that local dynamics offset some of the global headwinds.

Conversely, crypto markets in the U.S. and Europe may face a liquidity gap as Japanese capital is repatriated. This is particularly true for markets that have relied on Asian demand, such as certain altcoins and DeFi tokens popular with Japanese retail traders.

The broader point is that positioning matters more than prediction. No one knows with certainty how the carry trade unwind will play out, or whether fiscal stimulus will offset the liquidity drain, or when the BOJ might pivot. What investors can control is how they allocate capital across scenarios, how they manage risk, and how they adapt as new information arrives.

Liquidity is King, and Kings Can Fall

The yen carry trade unwind is a reminder that crypto does not exist in a vacuum. Digital assets are woven into the fabric of global finance, and when major shifts occur in traditional markets, crypto feels the effects. The narrative of Bitcoin as "digital gold," immune to macro forces and uncorrelated with risk assets, has been tested and found wanting in November 2025. When liquidity tightens and carry trades unwind, crypto behaves like what it is: a high-beta risk asset.

This does not invalidate the long-term case for crypto. Bitcoin remains a non-sovereign, scarce digital asset with no counterparty risk. DeFi offers transparent, permissionless financial infrastructure that operates independently of central banks and governments. Stablecoins provide fast, cheap cross-border payments that are increasingly integrated into the global financial system. These attributes are valuable, and they will remain valuable regardless of short-term price movements.

But short-term price movements matter, especially for investors deploying capital and managing portfolios. The lesson from the current episode is that macro awareness is not optional. Understanding how global liquidity flows work, how central bank policy affects funding costs, and how carry trades can amplify or drain capital from risk assets is essential for navigating crypto markets successfully.

The yen carry trade has been one of the most important sources of global liquidity for two decades. Its unwinding is a structural shift, not a temporary blip. The effects will be felt across asset classes, and crypto, as one of the most liquid and accessible high-risk plays, will continue to be affected.

At the same time, the counter-forces of fiscal stimulus and the limits of monetary tightening in a debt-saturated world are real. If history is any guide, governments and central banks will eventually choose liquidity expansion over austerity. When that happens, crypto will be well-positioned to benefit.

For now, the path forward is uncertain. Investors who can stay flexible, manage risk actively, and position across scenarios will be best prepared to navigate the volatility ahead. Liquidity is king in crypto markets, and when kings are in transition, the only certainty is change.

PEPE0.00 -11.61%

PEPE0.00 -11.61%

TON1.30 -2.56%

TON1.30 -2.56%

BNB624.65 -1.23%

BNB624.65 -1.23%

SOL86.51 -3.35%

SOL86.51 -3.35%

XRP1.41 -3.97%

XRP1.41 -3.97%

DOGE0.10 -6.47%

DOGE0.10 -6.47%

TRX0.29 -0.23%

TRX0.29 -0.23%

ETH2032.23 -1.95%

ETH2032.23 -1.95%

BTC67702.01 -1.99%

BTC67702.01 -1.99%

SUI0.93 -6.70%

SUI0.93 -6.70%