Hyperliquid's Hypurr NFT collection generated $270M+ market cap by rewarding 4,600 top traders with NFTs worth $62K-$100K each, creating one of crypto's highest-value airdrops through genuine utility.

The decentralized finance space witnessed one of its most remarkable wealth distribution events on September 29th, when Hyperliquid's Hypurr NFT collection generated over $270 million in market capitalization within hours of launch. This wasn't your typical NFT pump-and-dump scheme or celebrity-endorsed cash grab. Instead, it represented a masterclass in community-driven value creation that fundamentally challenged conventional wisdom about digital asset valuation and platform tokenomics.

For institutional observers and serious DeFi participants, the Hypurr phenomenon offers critical insights into how genuine utility platforms can create extraordinary value for early stakeholders through strategic community rewards. The numbers alone tell a compelling story: 4,600 NFTs achieving a sustained floor price of $62,000-$100,000, representing one of the highest-value airdrops in cryptocurrency history on a per-recipient basis.

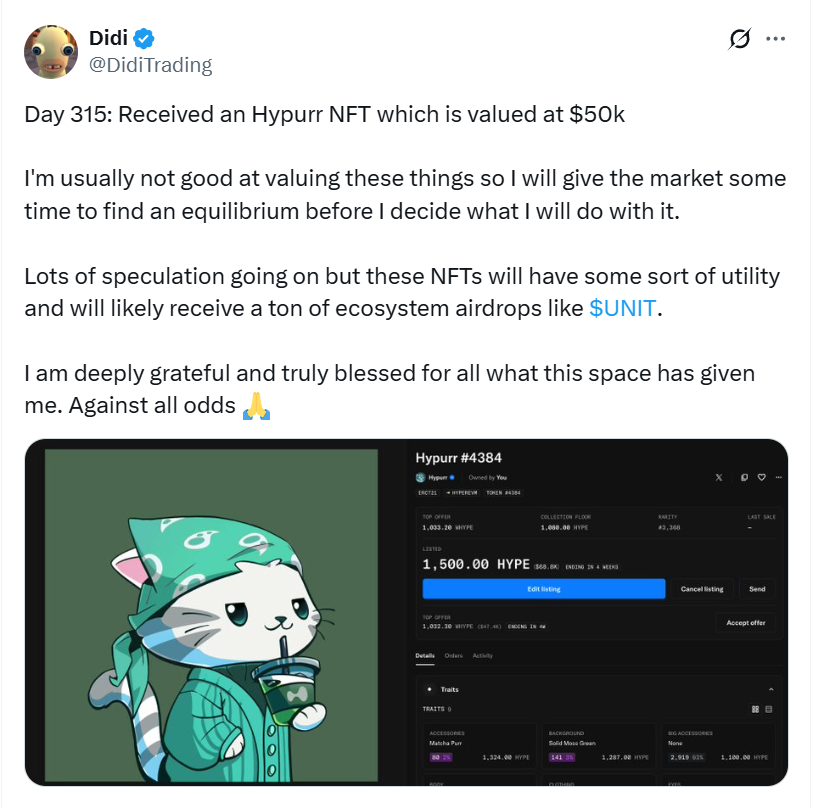

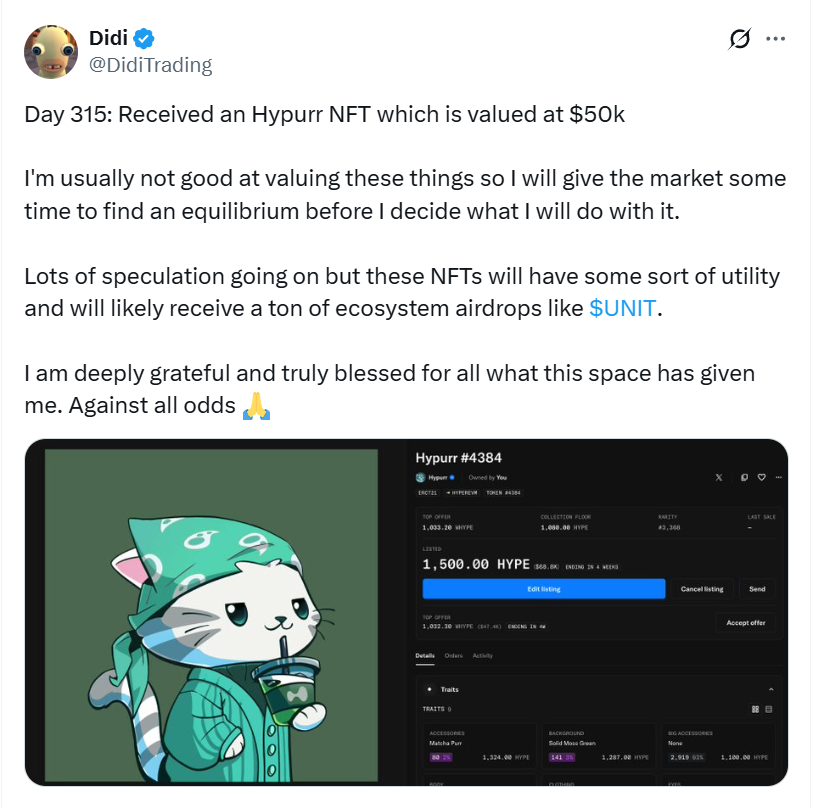

The claim procedure was remarkably straightforward - eligible users simply accessed the Hyperliquid platform and selected their preferred reward option during the Genesis Event. Many sophisticated traders who had been grinding through the S1 season literally woke up to discover $50,000+ sitting in their wallets, as captured by trader @DidiTrading's viral post about users receiving instant five-figure windfalls overnight.

The foundation of this value creation lies in Hyperliquid's technical architecture and market positioning. Unlike the vast majority of DeFi protocols that struggle with liquidity fragmentation and execution quality, Hyperliquid built a vertically integrated trading infrastructure combining HyperBFT consensus with HyperEVM compatibility. This allowed them to offer institutional-grade perpetuals trading with sub-millisecond latency while maintaining full decentralization - a technical achievement that attracted sophisticated traders willing to commit significant capital and time to the platform.

The Genesis Event distribution mechanism reveals sophisticated understanding of behavioral economics and community psychology. Rather than implementing a simple airdrop, Hyperliquid required active participation through their S1 season, where only the top 5,000 most active accounts achieved Platinum tier eligibility. This created a natural filter ensuring NFT recipients were genuine platform contributors rather than airdrop farmers or passive speculators.

The opt-in mechanism during the Genesis Event proved particularly brilliant from a game theory perspective. By presenting users with a binary choice between "tokens only" or "tokens plus NFT," Hyperliquid created an implicit value signal. Those who chose the NFT option demonstrated additional commitment to the platform's ecosystem beyond pure financial returns. This self-selection mechanism concentrated the NFTs among users most likely to hold and value them as community status symbols rather than immediately liquidate them.

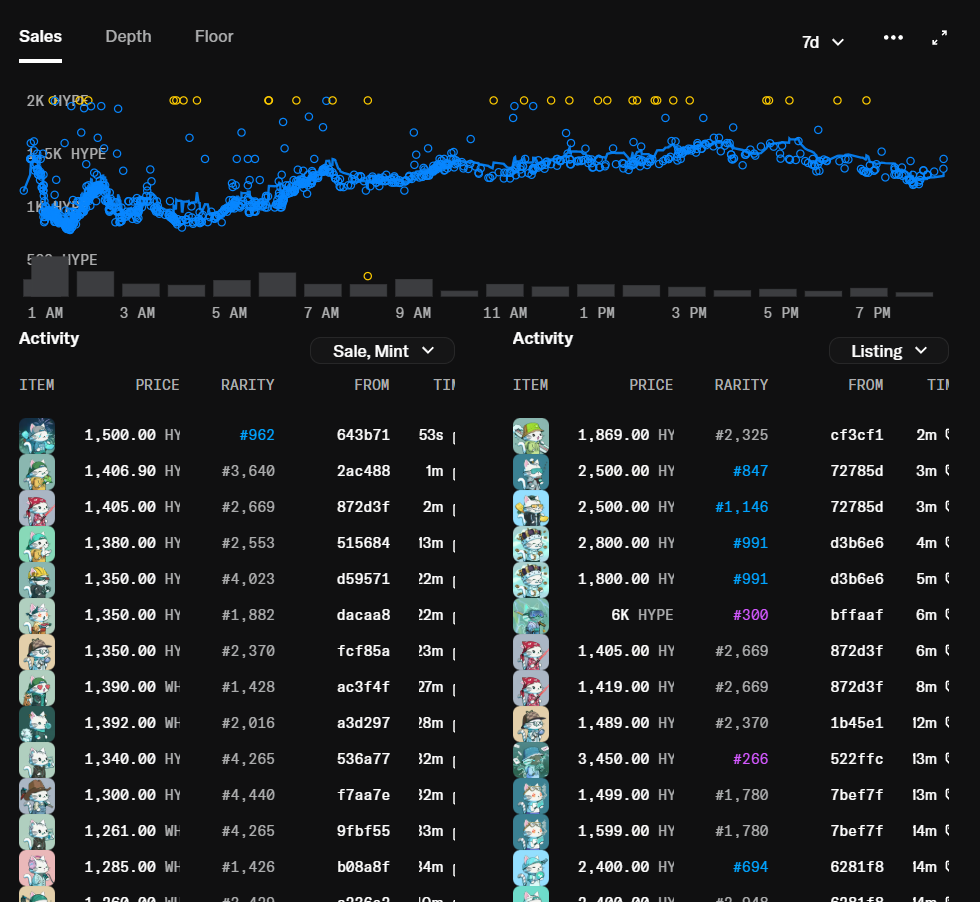

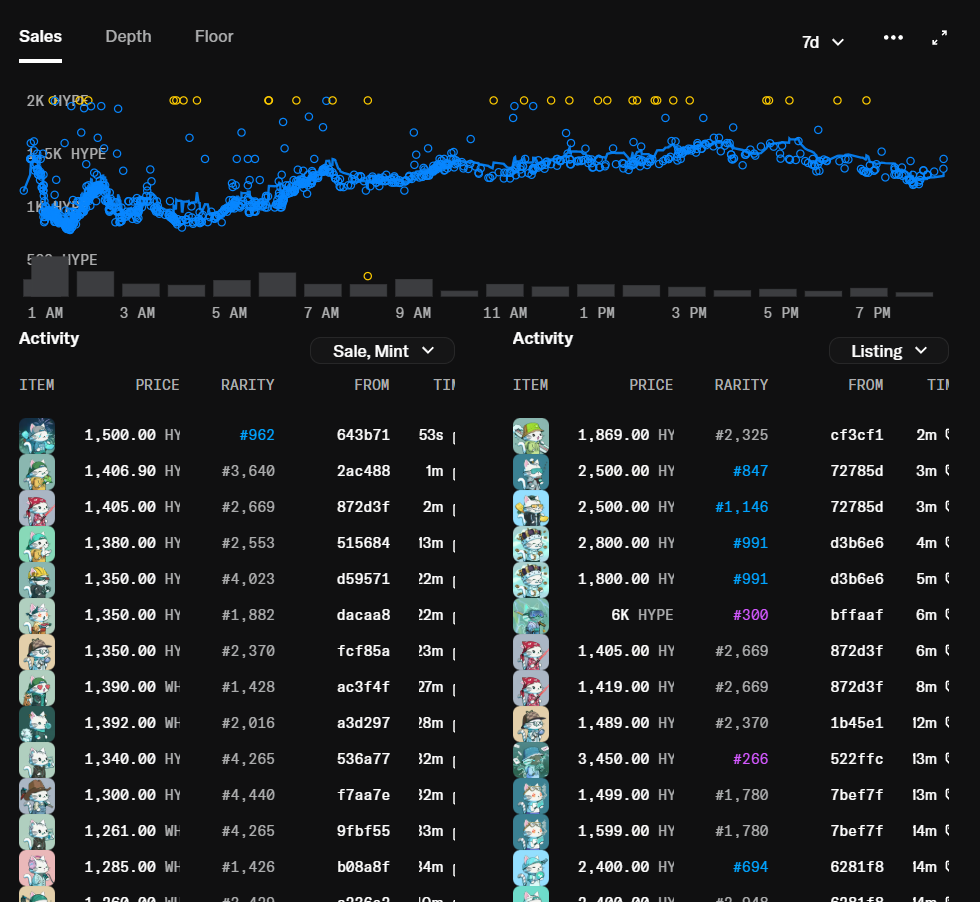

Market dynamics following the launch defied typical NFT trading patterns and revealed sophisticated price discovery mechanisms. The immediate $70,000 floor price wasn't driven by speculative FOMO but by rational market participants recognizing the scarcity value and community signaling power of ownership. With only 4,313 NFTs distributed to qualified participants and no future minting planned, the supply constraint created genuine scarcity economics.

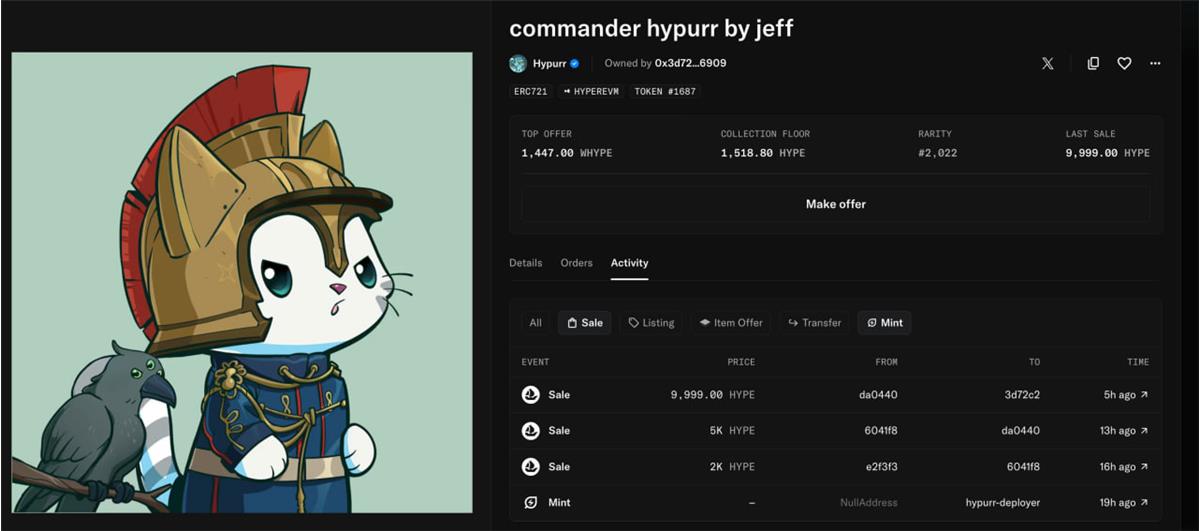

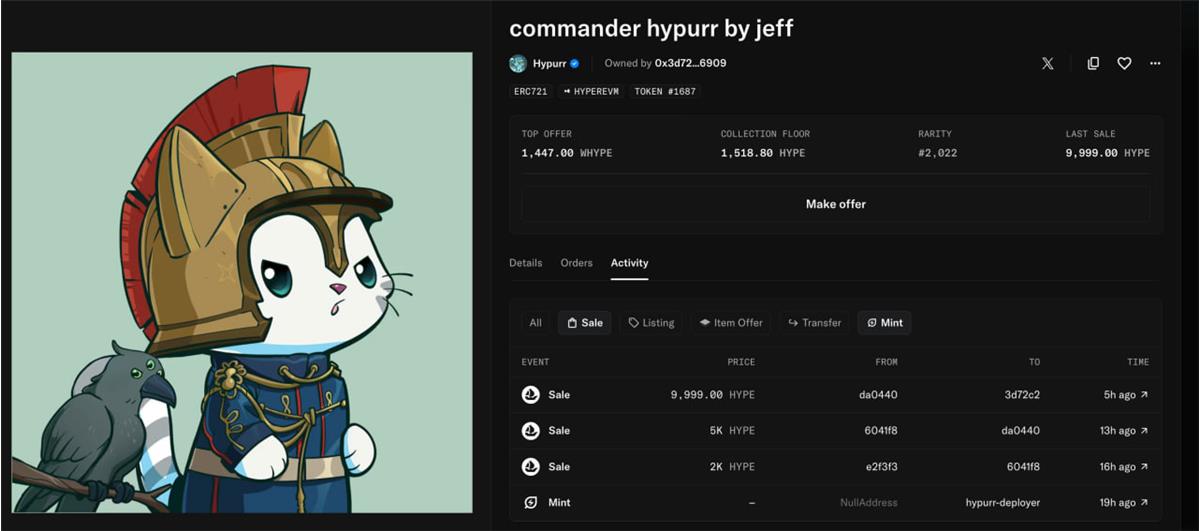

The sustained trading volume of over $45 million in the first 24 hours, with individual sales reaching $467,000, demonstrated institutional-level participation rather than retail speculation. These weren't profile picture purchases but strategic acquisitions of verifiable proof of early platform adoption - essentially tradeable certificates of DeFi alpha generation capability.

Hypurr NFT #21 sold for 9,999 HYPE ($466,000)

https://opensea.io/item/hyperevm/0x9125e2d6827a00b0f8330d6ef7bef07730bac685/1687

From a portfolio construction perspective, Hypurr NFTs represent a unique asset class combining elements of collectibles, community tokens, and platform equity. The correlation between Hyperliquid's platform success and NFT valuations creates an interesting hedge for sophisticated DeFi participants. Holders benefit from both the platform's growth through their HYPE token exposure and the increasing exclusivity value of early adopter status as the platform scales.

Current market metrics reveal remarkable holder behavior patterns. With 4,031 unique holders maintaining an 87.6% distribution rate, the collection shows minimal whale concentration - unusual for high-value NFT projects. This suggests holders view their NFTs as long-term community membership tokens rather than short-term trading vehicles. The sustained floor price around 1,315 HYPE tokens ($62,000) with peaks at $100,000 indicates strong conviction among holders despite significant unrealized gains.

Risk considerations remain significant. The concentration of value in non-productive assets creates potential volatility as market conditions change. The correlation between platform success and NFT values means holders face concentrated exposure to Hyperliquid's business risk. Additionally, the lack of intrinsic utility beyond community signaling makes valuations susceptible to sentiment shifts.

However, for qualified institutional participants and sophisticated DeFi allocators, Hypurr NFTs represent a fascinating case study in community value creation and platform loyalty mechanisms. The collection's success validates the thesis that genuine utility platforms can generate extraordinary returns for early supporters through innovative reward structures that go beyond traditional token distributions.

Connect with us:

Fast News: t.me/blockflownews

Insights & Trends: x.com/BlockFlow_News

PEPE0.00 -12.22%

PEPE0.00 -12.22%

TON1.28 -4.34%

TON1.28 -4.34%

BNB616.69 -1.89%

BNB616.69 -1.89%

SOL85.05 -4.04%

SOL85.05 -4.04%

XRP1.39 -5.35%

XRP1.39 -5.35%

DOGE0.10 -6.86%

DOGE0.10 -6.86%

TRX0.29 0.01%

TRX0.29 0.01%

ETH1987.06 -4.12%

ETH1987.06 -4.12%

BTC66762.11 -2.80%

BTC66762.11 -2.80%

SUI0.91 -6.50%

SUI0.91 -6.50%