World Liberty Financial's WLFI token, backed by the Trump family, begins trading with extreme volatility and heavy speculation, raising questions about its long-term viability.

World Liberty Financial (WLFI), a decentralized finance platform supported by the Trump family, officially launched its governance token WLFI on September 1, 2025. The token aims to bridge traditional finance with blockchain technology, accompanied by its USD1 stablecoin. Despite its ambitious goals, the token's debut has been marked by significant volatility and speculation.

Built on Ethereum, the token operates under the smart contract address

- 0xdA5e1988097297dCdc1f90D4dFE7909e847CBeF6

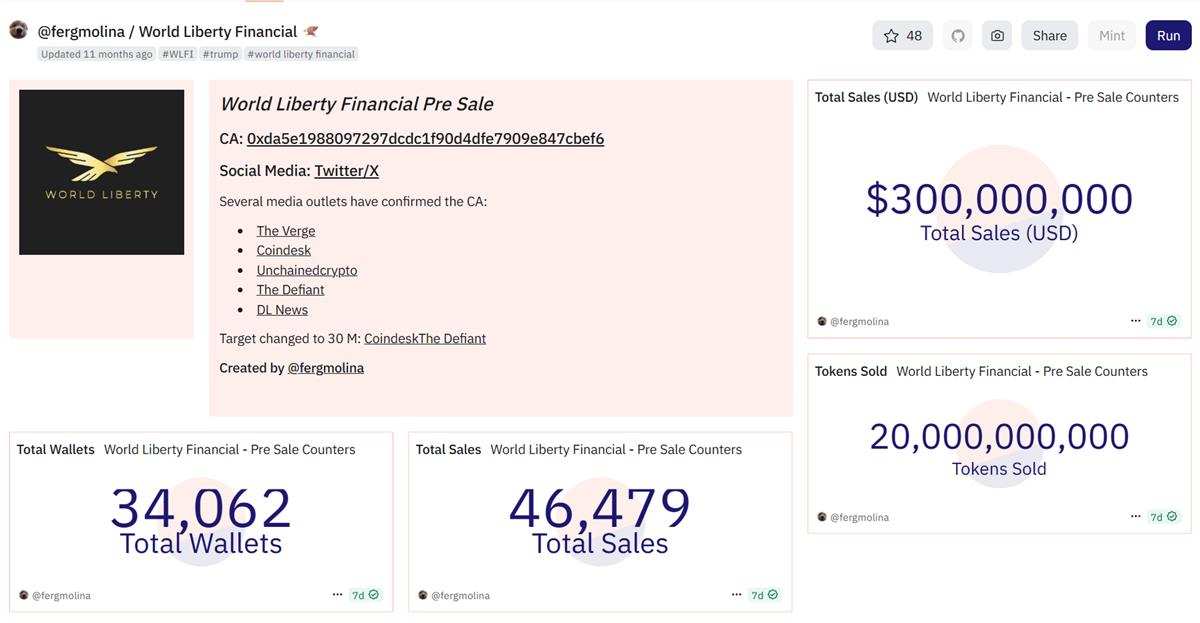

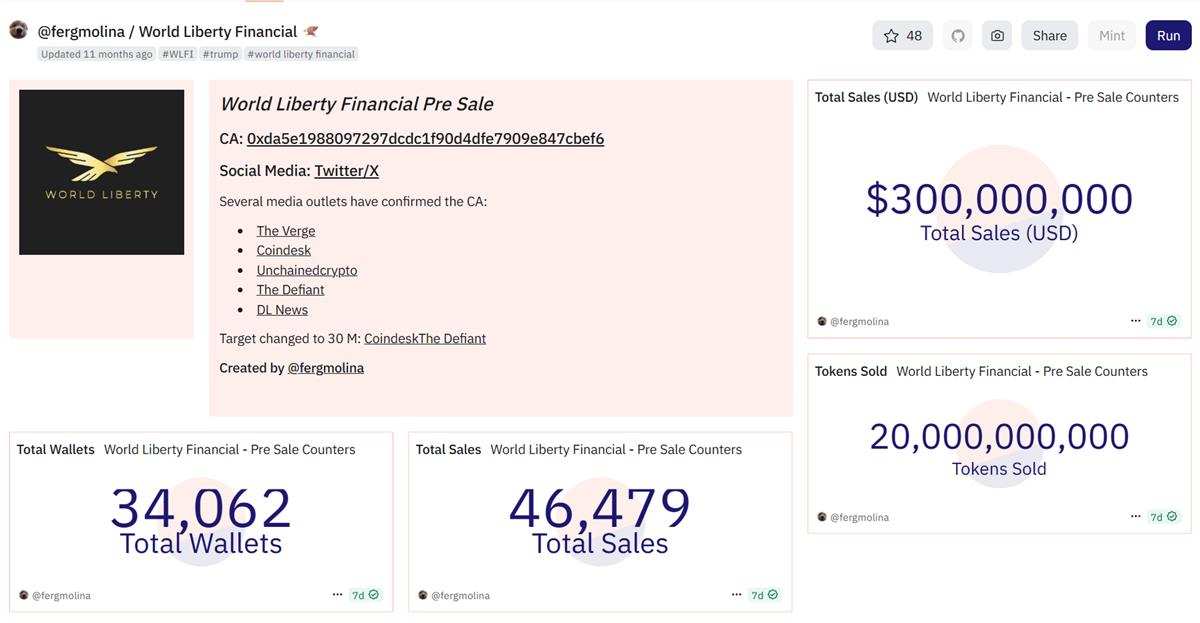

Within hours of its debut, WLFI recorded 85,116 unique holders and a 24-hour trading volume of $184.25 million on decentralized exchanges (DEXs). Liquidity pools for WLFI currently hold $31.15 million, providing moderate depth but leaving the token vulnerable to price manipulation. Despite its high trading activity, WLFI has yet to establish centralized exchange (CEX) liquidity channels, with trading concentrated on DEXs like Uniswap.

Price volatility has defined WLFI's launch, with its opening price of $0.3999 plunging to $0.2436—a single-day drop of 36%. The token briefly surged to $0.460 before facing immediate rejection, driven by panic-selling volumes exceeding 1.4 billion tokens. On-chain activity shows a buy/sell ratio of 1.37:1, suggesting positive sentiment among smaller traders, while larger holders exert stronger selling pressure.

According to official announcement, the initial circulating supply of WLFI at launch is approximately 24,669,070,265 tokens, allocated as follows:

- 10,000,000,000 tokens: Unlocked ecosystem portion for World Liberty Financial, Inc.

- 7,783,585,650 tokens: Allocated for Alt5 Sigma Corporation, holding ~8% of the total WLFI supply as part of its Treasury Strategy.

- 2,880,884,615 tokens: Designated for liquidity and marketing purposes to support the initial exchange offering.

- 4,004,600,000 tokens: Allocated to public sale participants, representing their initial 20% unlock at launch.

Alt5 Sigma Corporation, a blockchain and fintech company closely tied to the Trump family, plays a significant role in WLFI's ecosystem. Alt5 Sigma holds approximately 8% of the total WLFI supply as part of its Treasury Strategy, underscoring the project's connection to Trump-backed ventures. The company has previously positioned itself as a key player in the crypto space, focusing on digital asset custody, trading platforms, and compliance.

The non-circulating supply is distributed as follows:

- Treasury: 19,955,030,000 tokens (vesting schedule TBD).

- Team: 33,506,999,999 tokens (vesting schedule TBD).

- Public Sale (locked portion): 16,018,400,000 tokens.

- Strategic Partners: 5,850,499,736 tokens.

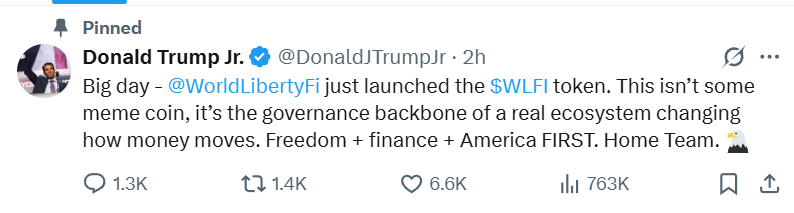

The project's association with the Trump family has generated significant media attention and social media hype. Eric Trump and Donald Trump Jr. are actively promoting the project, while notable figures like Justin Sun and Solana's founder have engaged with its official Twitter account. However, the overwhelming presence of "airdrop" and "giveaway" tweets has raised concerns about the project's reliance on speculative hype rather than technical innovation.

While WLFI has reportedly secured $1.5 billion in funding and deployed its ecosystem across Ethereum, Solana, and Binance Smart Chain, transparency issues have surfaced. The team deleted a post about token circulation data after community backlash, adding to skepticism around the project.

World Liberty Financial's broader crypto initiatives include the USD1 stablecoin, which has reached a $2 billion market cap, and previous ventures such as the meme coin $TRUMP. The Trump family's WLFI holdings are estimated to be worth $6 billion, with restrictions placed on early investors' ability to sell their tokens.

The launch highlights the growing trend of political tokens gaining traction in the crypto market, but WLFI's future remains uncertain, hinging on its ability to transition from hype-driven speculation to sustainable adoption.

PEPE0.00 -2.06%

PEPE0.00 -2.06%

TON1.29 -0.71%

TON1.29 -0.71%

BNB626.46 2.27%

BNB626.46 2.27%

SOL87.79 5.06%

SOL87.79 5.06%

XRP1.44 2.66%

XRP1.44 2.66%

DOGE0.10 3.50%

DOGE0.10 3.50%

TRX0.29 0.30%

TRX0.29 0.30%

ETH2067.25 5.67%

ETH2067.25 5.67%

BTC68135.85 3.07%

BTC68135.85 3.07%

SUI0.95 4.33%

SUI0.95 4.33%