Discover how Momentum became the Sui ecosystem's dominant DEX in just 4 months, achieving $180M TVL and pioneering RWA integration through innovative tokenomics.

Authorized reprint from CoinNess "A Look at the Sui Ecosystem's Largest DEX Momentum"

In this crypto market upward cycle, the Move language-based public chain Sui has performed exceptionally well. As the Sui ecosystem gradually expands, various applications within the ecosystem have also received widespread market attention. Among them, one of the fastest-growing and most discussed projects is the decentralized exchange (DEX) Momentum.

In just four months since its launch, Momentum has risen to become the platform with the highest trading volume and liquidity share in the Sui ecosystem, while also actively expanding into the RWA (Real World Assets) direction, demonstrating a more long-term strategic layout. This article will systematically review Momentum's functional mechanisms, data performance, and future plans, exploring its positioning and potential in the Sui ecosystem.

1. What is Momentum?

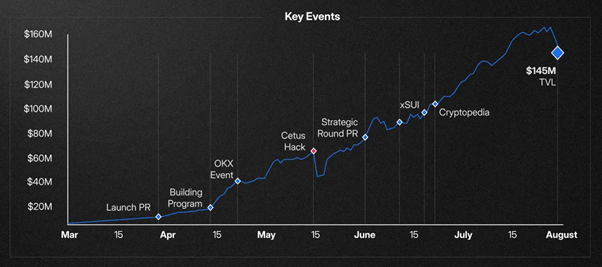

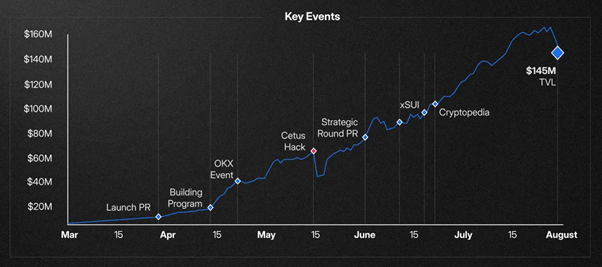

Momentum is the fastest-growing decentralized exchange in the Sui ecosystem. Since the beta version launched at the end of March last year, it has rapidly accumulated users through differentiated liquidity strategies and product mechanisms, gradually establishing a leading position in the Sui ecosystem.

Related data confirms its growth rate: peak TVL reached $180 million, cumulative trading volume exceeded $8.8 billion, and user count surpassed 1.83 million. For an emerging ecosystem, this performance demonstrates strong capital inflow and user recognition.

Momentum's role in the Sui ecosystem can be understood from two aspects:

First, as the ecosystem's liquidity center.

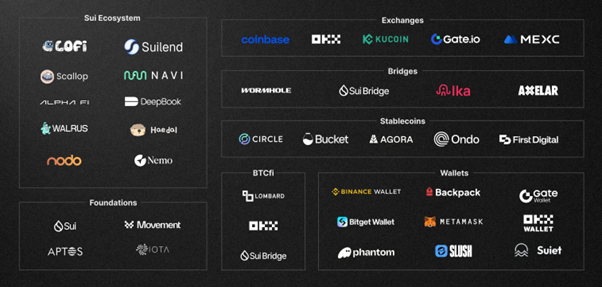

Momentum carries the vast majority of liquidity allocation within Sui, becoming the infrastructure for other projects to establish trading and liquidity. As RWA and cross-chain assets enter on a large scale in the future, its role as a "liquidity hub" may be further strengthened.

Second, it adopts an advanced ve(3,3) mechanism.

Unlike traditional DEXs that rely on short-term incentives to maintain liquidity, Momentum binds long-term stakers with ecosystem development through veMMT governance token design, creating a more stable liquidity environment. This mechanism not only improves participation but also contributes to the sustainable development of the ecosystem.

Overall, Momentum's position in the Sui ecosystem is similar to Curve on Ethereum or Velodrome on other public chains - it is not just a DEX, but the underlying liquidity infrastructure of the ecosystem.

2. Core Mechanisms and Functions

2.1 Basic DEX Functions

Momentum adopts a Concentrated Liquidity Market Maker (CLMM) model to improve capital efficiency and reduce slippage for large transactions. It currently supports trading of major assets in the Sui ecosystem, and liquidity providers (LPs) can obtain fee income while combining different strategies to enhance returns.

2.2 ve(3,3) Mechanism

Momentum's mechanism design borrows from and optimizes Andre Cronje's ve(3,3) model:

-

Locking mechanism: The longer MMT is locked, the more veMMT is obtained

-

Governance voting: veMMT holders can decide the direction of liquidity incentive allocation

-

Incentive and bribery system: Project parties can attract votes through additional rewards, thereby gaining more liquidity support

-

Fee dividends: Platform fees are only distributed to veMMT holders, encouraging long-term locking and governance participation

Through the above mechanisms, Momentum forms a positive cycle of "voting—liquidity—trading volume—token demand", balancing liquidity stability with token value growth.

2.3 Automatic Rebalancing Function

Momentum provides automated rebalancing tools for LPs, optimizing capital allocation according to set strategies, improving yield efficiency, and reducing manual operation costs.

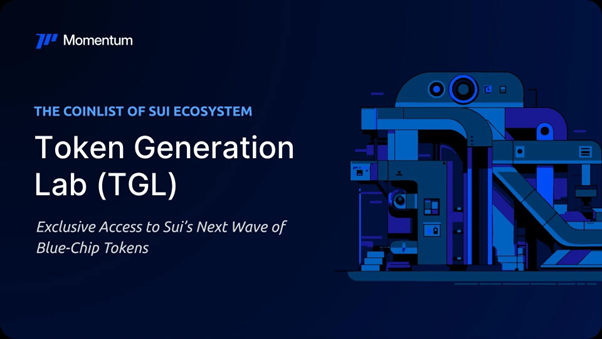

2.4 Launchpad Platform TGL

Momentum also plans to launch TGL (Token Generation Lab) to help high-quality Sui projects complete token issuance. TGL projects are all strictly screened, with some receiving exchange support, providing additional participation opportunities and incentives for veMMT holders.

3. Technology and Security

As a Sui-native DEX, Momentum has invested significantly in security design:

-

Multi-signature management: Important operations require multi-party co-signing, reducing single-point risks

-

Code auditing: Core contracts have been professionally audited with public reports, enhancing transparency

-

Security infrastructure: Based on the natural security characteristics of the Move language, combined with real-time monitoring mechanisms, effectively responding to potential attacks

When Cetus encountered security incidents previously, the Sui ecosystem demonstrated rapid coordinated response capabilities. Momentum, as a member of this ecosystem, also inherits this ecological advantage.

4. Team and Investment

Momentum's core team members have extensive experience in Sui development and DeFi protocols. CEO and co-founder ChefWEN was formerly an engineer on Facebook's Libra project and is a senior expert in the Move language field.

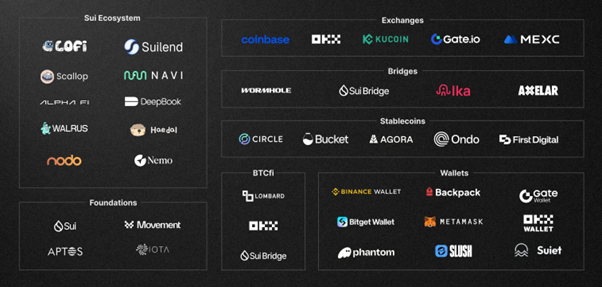

In terms of capital support, Momentum has received deep support from the Sui Foundation and Mysten Labs, as well as investments from internationally renowned institutions such as:

-

Coinbase Ventures

-

Circle Ventures

-

Jump Crypto

-

OKX Ventures

-

Amber Group

These resources not only provide funding but also assist in liquidity building, ecosystem cooperation, and token distribution.

5. Ecosystem Performance

Momentum has achieved in a short time:

-

Peak TVL of $180 million and cumulative trading volume of $8.8 billion, ranking first in the Sui ecosystem

-

User count exceeding 1.83 million, with governance participation and incentive mechanisms driving user growth

-

Compared to similar DEXs, it has significant advantages in liquidity depth, mechanism design, and ecosystem support

Its strategic goal is to become the "liquidity engine" of the Sui ecosystem and further expand boundaries through TGL and MomentumX.

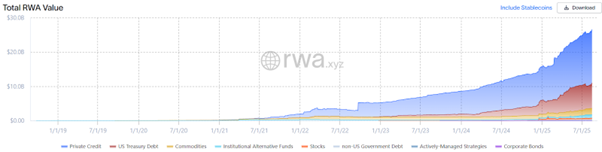

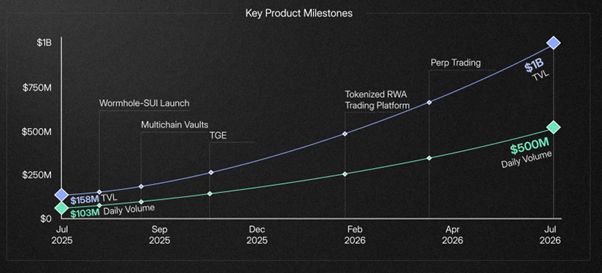

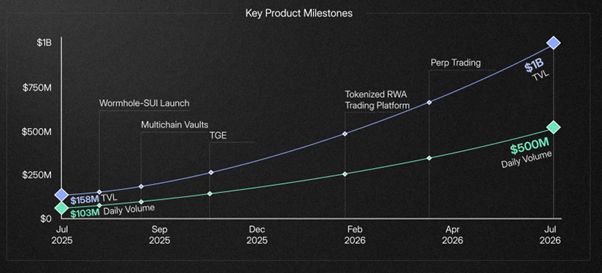

6. Future Plans: MomentumX and RWA

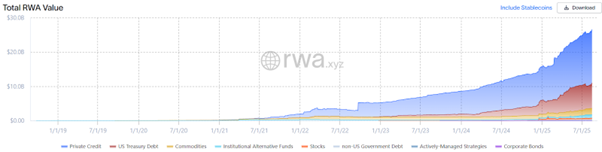

Momentum is not only positioned as a DEX but will also enter the RWA track through MomentumX.

RWA is one of the most watched trends in the current crypto market. MomentumX aims to solve three major problems in the existing RWA market: fragmented standards, insufficient liquidity, and off-chain compliance risks. Its solutions include:

-

Unified identity authentication (based on ZK technology and Walrus)

-

Cross-platform interoperability

-

Smart compliance embedding

Through MomentumX, institutional investors can more conveniently participate in tokenized asset trading, and ordinary users can also engage in collateral, liquidity provision, and other operations through RWA assets. The overall goal is to build a global RWA market infrastructure.

7. Conclusion

Momentum has formed a clear core position in the Sui ecosystem. Its DEX functions, ve(3,3) mechanism, automatic rebalancing, and TGL platform construct a complete product system. In the future, with the advancement of MomentumX, its business scope is expected to expand from DeFi to the RWA market, further enhancing its ecosystem influence.

For the Sui ecosystem, Momentum is not just a DEX, but a driving force for liquidity integration and ecosystem development. Its continuous expansion and mechanism innovation may bring long-term value to Sui and the broader blockchain ecosystem.

PEPE0.00 1.46%

PEPE0.00 1.46%

TON1.52 0.14%

TON1.52 0.14%

BNB879.92 0.80%

BNB879.92 0.80%

SOL124.07 1.25%

SOL124.07 1.25%

XRP1.89 -0.33%

XRP1.89 -0.33%

DOGE0.12 1.04%

DOGE0.12 1.04%

TRX0.29 -0.40%

TRX0.29 -0.40%

ETH2919.78 0.64%

ETH2919.78 0.64%

BTC87926.71 0.16%

BTC87926.71 0.16%

SUI1.44 0.18%

SUI1.44 0.18%