"It means early, and frankly, it means like there will come a time where you're not going to be able to exchange dollars for Bitcoin."

Compiled by: antoniayly, BlockFlow

Guest: Brandon Green, Chief of Staff at BTC Inc

Host: Bonnie

Original Title: 市場下跌!即將推升比特幣的大事件!川普家族與BTC!Brandon Green 【邦妮區塊鏈】

Date: August 18, 2025

Highlights

-

"Bitcoin treasury companies are probably the most interesting thing happening in the space right now... I think that Bitcoin treasury companies are the meta of this cycle - this 2024-2025, probably into the 2026 cycle."

-

"What you're going to see is all of the best companies in the world adopting a Bitcoin strategy to pour their profits into Bitcoin, and you're going to see the market reward that massively. And that's going to create this flywheel effect for the Bitcoin price that will propel us to, I mean, orders of magnitude higher from where we are right now."

-

"People don't appreciate that the original Bitcoin community was in Asia...Like in 2017, when I first joined, all the action was happening in Shanghai, all the action was happening in Japan, in Hong Kong. "

-

"There will come a time where you're not going to be able to exchange dollars for Bitcoin. That is not going to be a trade that anyone is actively going to allow or take... There will be history books trying to recount and understand how this thing happened, how Bitcoin succeeded, because it is so monumental for the history of humanity."

Bonnie: Today I'm super, super excited to be joined by Brandon Green. He is one of the most important people behind the scenes in Bitcoin. So he's helped grow Bitcoin Conference into the best global event, now put in places like Amsterdam, Abu Dhabi, Hong Kong, and of course the US. He is also the Chief of Staff to the CEO of BTC Inc, working directly with the top team to shape the future of Bitcoin. And he's smart, he's strategic - he is one of the reasons why Bitcoin events are so cool right now. Really happy to have you here, Brandon.

Brandon: Yeah, honored to be here and thank you for that glowing review of who I am. I don't know, I'll try to live up to all of it.

Bonnie: Let's start with something really interesting. Okay, so I was in Vegas for the Bitcoin conference in May - yeah, it was in May - and I've heard this really interesting observation. So this year, the female toilets actually had a line, and people who attended previous events said it was always the male toilets being packed and no females on site. So is that a sign for bull or bear market?

Brandon: I think it's probably a sign for neither. I think this is a sign for progress, you know. Bitcoin was really born out of this cypherpunk sort of highly online subculture, and we're starting to see it really - you know, it's almost cliche to say break into the mainstream at this point - it IS mainstream. And so, you know, where there's the greatest gains to be seen in sort of the composition of the Bitcoiner user base is with women, because there were so few early on. Now we're getting to a little closer to parity, and I think that's awesome. And it's an important step in the adoption cycle for Bitcoin.

Bonnie: You've been in Bitcoin for a long time, right? Since 2017. Has the definition of being a Bitcoin maxi changed for you? Or, you know, how a normal person getting into crypto - first they learn about Bitcoin, and then there is this shinier object, which is one of the alts or a main coin that pumped, I don't know, like 10x, 100x in a week, and you're like "oh that sounds cooler, let me just try and buy some of those." Have you been an altcoiner or shitcoiner, they say?

Brandon: Yeah, you know, it's funny. So when I joined in 2017, Vitalik Buterin actually used to write for Bitcoin Magazine, and I interfaced with him a few times in my early time at Bitcoin Magazine. I was writing articles, and he's the one who coined the term "Bitcoin maximalist," and he used it in a derogatory sense where someone was kind of - I don't remember the full conversation - but it was someone who wasn't that excited about Ethereum. This was early days of Ethereum, and they were basically saying we should just devote all of our focus to Bitcoin, and he kind of derided the person for being a Bitcoin maximalist.

And so in the early - like the very beginnings of at least my tenure in the space - being a Bitcoin maximalist was seen as a negative thing. You know, it hadn't quite really played out yet to say like, "oh Bitcoin for sure is going to be the king cryptocurrency in our space." And that was something that really started to, I think, form and articulate in that 2018 bear market, where you had all these ICOs, all these shitcoins, all these things launching through Ethereum, and they were all just hemorrhaging value.

And the question was, you know, where do you invest not in a bull market but in a bear market? What actually protects you the most? And I think that's where Bitcoin, you know, especially in 2018, really shined. I mean, even though it was down 75-80% compared to 99% for many of the projects, it really was the safe haven of the space.

And I think growing out of that, the narratives really started to form around why it's so important to have Bitcoin, quote unquote, "maximalism." And really what that means is just a recognition that there's a lot of different cryptocurrencies, altcoins, shitcoins competing for other things other than what Bitcoin is competing for. And what Bitcoin is competing for is the decentralized monetary system of the world. And so in that way, like, it needs to be set aside. And then if you want to talk about other things happening in the cryptocurrency space, that, you know, to me that's okay. It's not as interesting. It's okay to talk about it, it's just, you know, it's not the same as talking about Bitcoin. So that's how I've kind of viewed it.

Bonnie: Okay, so here comes the next question. You know how after MicroStrategy - they're like "oh my God, this is the perfect cheat sheet" - the stock went crazy after Michael Saylor adopted the Bitcoin strategy, right? And then you see Metaplanet and a lot of other smaller Bitcoin companies, so-called. But a lot of them, they are not really Bitcoiners. They just see that adding Bitcoin on their balance sheet could pump the stock price. What is your view on those companies?

Brandon: Yeah, I mean, I think that these Bitcoin treasury companies are probably the most interesting thing happening in the space right now, and there's a couple reasons why. First of all, I think this is the narrative of the cycle, you know. I actually have a theory that I've developed over the past four years, which is you tend to see the meta or the narrative of the cycle that we're in happen once, like in a small way, in the cycle before.

And so if you go all the way back to, you know, like the Mastercoin ICO and the Ethereum ICO that happened back in 2014-ish, and then ICOs became the major theme of 2017. But also in 2017, there was this little thing called CryptoKitties on Ethereum, which was the first ever NFT project, or at least the first big NFT project. And of course, NFTs became the meta, I would say, of the 2021 cycle, right?

But in 2020, you saw this Michael Saylor guy launch a Bitcoin treasury company, and I think that Bitcoin treasury companies are the meta of this cycle - this 2024-2025, probably into the 2026 cycle. And, you know, my bold prediction would be that you've seen the US announce the Strategic Bitcoin Reserve, I think nation-state adoption is going to be the major meta of the future cycle from now.

So all that being said, you know, like that's how I'm framing Bitcoin treasuries for this cycle. But if we're looking at like what's really going on, what you're seeing is the market - the stock market - is rewarding companies for saving their money and valuing their profits in Bitcoin. And it's not that absurd or crazy of an idea, but the thing is, is the market is so starved for that activity that you're seeing wild premiums on it.

And so you're seeing these companies that are able to have a 2x - some of them are 10x - MNAV, you know, 10x the valuation of the Bitcoin they're holding without an operating company to go alongside them that really imbues them any sort of value. And so I think we're in a moment in time right now where this trade exists, and you can basically just arbitrage the value of your stock versus the underlying Bitcoin you have.

I don't think that's gonna last forever. You know, maybe we've got six more months of that, maybe less, maybe more, but it's not gonna last forever. And what's gonna take its place is publicly traded companies that have massive profits that are dumping their profits into Bitcoin, and the market is going to reward that behavior with a premium on the stock. And that will be the thing that creates the fastest horse, let's say.

And so what I think we're going to see happen is not this proliferation of holding company treasury companies that don't do anything except buy Bitcoin. You know, I think that that's mostly run its course already. You know, you'll see it in some other markets, right, internationally, but in terms of like the major markets, all those plays are already out there.

Instead, what you're going to see is all of the best companies in the world adopting a Bitcoin strategy to pour their profits into Bitcoin, and you're going to see the market reward that massively. And that's going to create this flywheel effect for the Bitcoin price that will propel us to, I mean, orders of magnitude higher from where we are right now.

Bonnie: Do you predict it's going to happen this cycle or next cycle?

Brandon: It's a good question. I mean, it's a matter of time in my mind. I don't think - if you had asked me three years ago, I would say, "okay, we have major blockers, right?" Number one: institutions still don't believe in Bitcoin. Well, now we have the Bitcoin ETFs, BlackRock's all in, you know, Bridgewater's all in, like that's no longer an issue.

Then I would say, you know, we had these FASB accounting rules, especially in the US, where, you know, on a public markets balance sheet, it didn't treat Bitcoin as - it treated it as like an intangible asset, so you couldn't mark to market, which means that - actually this happened today with MicroStrategy - this was the first time MicroStrategy was actually allowed to realize the appreciation on all their Bitcoin they've been holding for the past five years, right?

And so that was something that was punishing public companies and preventing them from adopting. And then the third thing I would say is you didn't have a regulatory environment that felt supportive of, you know, dipping your toe into Bitcoin like this.

Well now, you've got regulatory regimes around the world that are all fighting tooth and nail - the game theory is flipped right now. All of a sudden, they all want to be the place where the Bitcoin and crypto companies can go. And so I think that if you just combine those three things, there are no barriers for this meme to play out in the market now. So it's really just a matter of it continuing to propagate.

Bonnie: Would you expand more on the accounting rule change? Because Michael Saylor was talking about this last year, but we want to know more details. How does that benefit more companies buying Bitcoin?

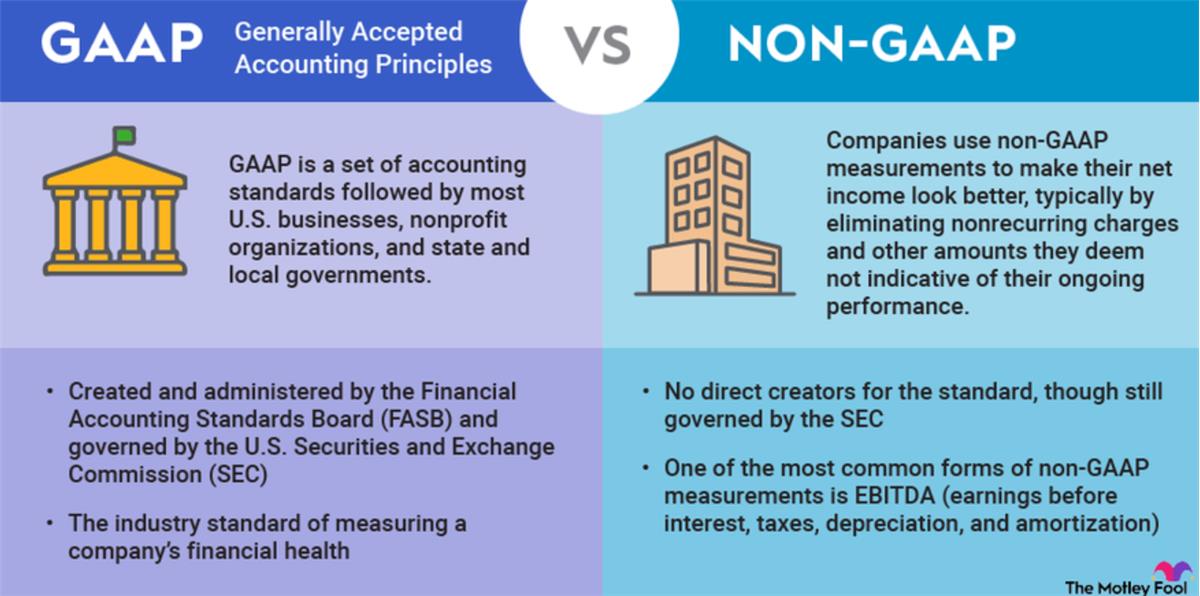

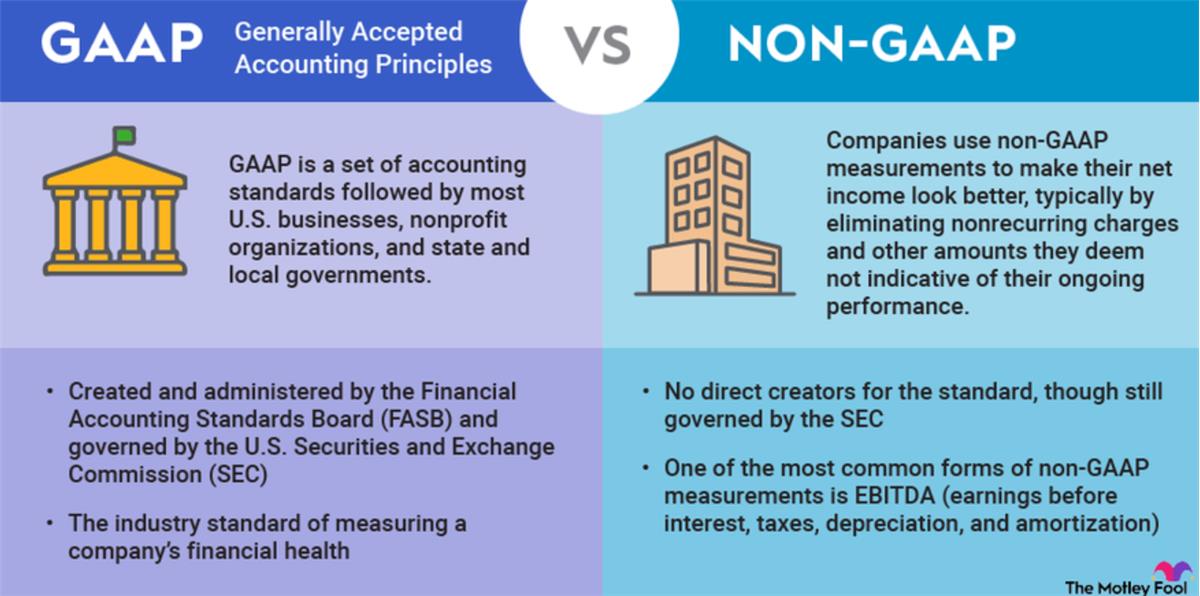

Brandon: Yeah, it's a good question. And to be clear, I'm not a CFO or an accountant, so, you know, some of this stuff I may butcher a little bit. But the way that public companies have to run their books, and therefore like the way that they can record profit, record loss, report their finances to the market, is something called GAAP accounting. And it's the FASB, which is an accounting regulatory apparatus that basically puts these standards out there.

So a while back, they said Bitcoin is an intangible asset, and so it should be valued on your balance sheet basically at the value that you purchased it, with the exception that if it goes down, you have to mark to market those losses. So, you know, if Saylor were to buy it at $10 and it goes down to $5, he has to recognize that on his balance sheet. But if it goes from $10 to $10 million, he can't recognize that on his balance sheet, which means things like access to leverage, access to financing, all sorts of just having the market recognize the valuation of your company - like the book value of your company - it's not allowed.

It's kind of like this strange handcuff that existed for years. And so that got lifted back in January, and it's gonna cause a lot of companies that were sitting on the sidelines to change their mind.

And I'll tell you the one place where it's like very clear that this change will have an impact, which is the S&P 500 and some of these indexes where, you know, you have to be a profitable company in order to join. They have not let MicroStrategy in up until this point because of those accounting rules, because MicroStrategy did not look like a profitable company.

Now that those accounting rules have changed, MicroStrategy is a massively profitable company, and it's about to get inducted into the S&P. And that's going to create massive amounts of passive flows into MicroStrategy that have never come in before. You know, think of all those index funds - your Charles Schwabs, your Vanguards, your BlackRocks - anyone who just buys the S&P, you know, buys this sort of passive market participation as their 401k.

They have been excluded from buying MicroStrategy up until now. Once MicroStrategy gets put in, now you actually have a vehicle by which people's passive investments into the market will directly go into Bitcoin via Michael Saylor converting it onto Bitcoin on his balance sheet via MicroStrategy. So it's a cool flywheel that has not existed yet. It's very exciting. It's going to create ripples in the Bitcoin price.

Bonnie: So for the everyday person that's watching, they should just look for when MSTR gets added into S&P 500. That's going to be a massive thing to watch.

Brandon: It should happen soon. I don't know the exact timing of it, but when that happens, you will see billions of dollars flow into MicroStrategy and therefore Bitcoin due to no other reason than like all of these passive funds have to allocate to it now because it's part of the S&P.

Bonnie: I talked to Michael Turpin in Vegas, and he was telling me about his theory - the Four Season Theory of Bitcoin - where he thinks it is better to buy Bitcoin in the Bitcoin winter, which is the bear market, and then sell it in summer, so then you can accumulate more Bitcoin. That is his theory. There are people who say never sell your Bitcoin because you'll never be able to buy it back. What is your thought on these two different approaches?

Brandon: Yeah, you know, what I'll say is I live and breathe this industry. I have for the past eight years. I do not feel like I know enough to time the market. And I run, you know, the largest media outlet, the largest conference. You know, like, if anyone would be in the know to buy or sell, it would be me, and I'm telling you it's so hard to time the market like that.

But at the end of the day, like, Bitcoin is the best performing asset in the history of mankind. And so it's picking up pennies in front of a bulldozer to try and time the market and buy in the winter and sell in the summer.

Bonnie: I was looking at Google Trends earlier before we talk, and Bitcoin is at very close to all-time high, but the interest on Bitcoin is only at 25. Well, in December 2017, it was 100, and February 2022, it was 69, and right now it's only what, 25. Why aren't people as excited?

Brandon: Yeah, so there's a couple of things about like the intricacies of Google Trends, right, that you'd have to keep in mind. Number one is that, especially with like things like ChatGPT, right, people actually just aren't Googling as much as they were before, right? So that's number one. That's a small thing, right? I wouldn't put that as a major thing.

But the bigger thing is that I'm guessing the term you're looking for is just "Bitcoin," right? People Googling "Bitcoin." And I would say, or "what is Bitcoin," right? I would say that the average person no longer needs to Google like, "oh, I've never heard of Bitcoin at all," like "Bitcoin," right?

Right now, the questions are a little more specific. They're like "how do I buy Bitcoin," they are "what's a Bitcoin ETF," "who's Michael Saylor," "what's MicroStrategy," you know, "why does President Trump like Bitcoin," you know, all of these kinds of things, "Strategic Bitcoin Reserve."

And so what you're seeing, in my opinion, is the market is actually starting to learn and understand Bitcoin better, and that's what's eating into the Bitcoin search volume more than anything.

But I will also, at the same time, say that we are not in a mania phase. We are not in a crazy hype cycle mania phase like we were in December of 2017. If you remember December 2017, you couldn't NOT talk about Bitcoin. I mean, everyone was there. Your Uber driver wouldn't shut up about it, right? You know, and so like we're not at that phase right now. That could come. I think it will come at some point, but, you know, we're still very early in this summer, as Michael Turpin would call it.

Bonnie: I love that answer. Let's talk about the Bitcoin theories. So you've met a lot of people in Bitcoin, you've probably heard a lot of theories on Bitcoin. Which one is your favorite? And is there any Bitcoin-related realization that you've heard recently that you're like "wow"? I mean, you've been in the industry for a long time. I can share mine first. So back to Michael Turpin, he said like the last 40 years of Bitcoin being mined, there will only be a total of 2.5 Bitcoin being mined. And I was like, "oh my god," like 40 years, 2.5 Bitcoins. And because it's so far into the future, you're like, you're not even thinking about it. So that was my wow moment recently.

Brandon: Yeah, I'm looking at the total supply right now, you know. Already we're at 19.9 million Bitcoin mined. So I mean, you know, you're looking at 2140 is the year the last Bitcoin's going to be mined. That's in - math is hard - 116 years from now, right? Yeah. And so in the next 116 years, we're gonna have to mine the incremental, you know, 1.1 million Bitcoin.

So just right there, that should tell you all you need to know. Like, there are not a lot of Bitcoin left to be mined.

Bonnie: If people want to have these type of really OG and refreshing conversations, they can just attend Bitcoin Conference in Asia Hong Kong. It is coming up soon. What can we expect?

Brandon: So first of all, I'm very excited just to be back in what we call "the East," right? There's such a - people don't appreciate that the original Bitcoin community was in Asia. You know, it was not the US. Like in 2017, when I first joined, all the action was happening in Shanghai, all the action was happening in Japan, in Hong Kong. All, you know, the coolest startups - BitMEX, FTX - like all of these major, you know, Three Arrows - like they were all in Singapore, they were all in Hong Kong.

And so it was only through kind of the 2021 cycle that that shifted back over to the West. But it doesn't have to be that way. And in fact, some of the most OG, smartest whales, you know, Bitcoin whales, are still out in, you know, Hong Kong and Shenzhen and Shanghai and, you know, Tokyo and Seoul, and so on and so on.

And so what I'm really excited to do is like this is a good chance to bring the OG Bitcoin community back together - all of the miners up in, you know, the Sichuan region of China, everyone - to just come back and have that one time a year where you get to talk about Bitcoin. You don't have to worry about talking about all the altcoins, all the shitcoins. You know, no one's going to come show you their product. You know, like you just get to come talk about Bitcoin.

https://www.aljazeera.com/gallery/2018/1/17/inside-the-world-of-chinese-bitcoin-mining

And Bitcoin is the single most interesting, most exciting thing happening in the world today. And it's really an honor to be able to create a platform to just talk about it, to learn about it, to understand what's going on today from a technical standpoint, all of the stuff happening now with the treasury companies.

You know, there's massive stuff happening now in, you know, Hong Kong - there's Mogo Inc., there's like six different companies getting launched in Seoul right now. Obviously there's Metaplanet in Japan, there's a few getting launched in Thailand. It's an amazing moment in time, and we're in the middle of a bull market. I mean, we're at $118K Bitcoin prices.

And so there's gonna be a lot of new faces too. There's gonna be a lot of people that this will be their first Bitcoin conference. And so yeah, it's going to be a really fun time. And we've got some amazing speakers. We've got some we haven't announced yet that are, I think, going to raise some eyebrows as well.

Bonnie: Yeah, you can't miss it. And there are really cool speakers - Eric Trump is coming. What was the conversation like? How do you convince him to fly all the way to Hong Kong?

Brandon: Yeah, well, so Eric is someone that we've gotten to know really well through our, you know, work with President Trump. You know, President Trump spoke in Nashville in 2024. We worked really closely with him on, you know, his Bitcoin policies that have now become the policy of the government, right? And, you know, through that process we got to meet Eric, we got to meet Don Jr., we got to meet all sorts of folks kind of in his orbit.

And what was really cool, especially with Eric, is he's super knowledgeable about Bitcoin. Like he's been in Bitcoin way longer than anyone knows. And my first conversation, I kid you not, my first conversation with Eric was about whether he should be, you know, utilizing multisig for his, you know, company treasury, or whether he should just be sticking with a custodian. And like, what did I think about the risk tradeoff of, you know, self-custodying it and using multisig? And like, what are the best practices there?

And I was like, "Dude, I figured, you know, we're gonna talk about like what's the difference between Bitcoin and Helium," and here he is like 10 steps ahead. And so, you know, this guy's - he's truly into Bitcoin. He's thought very deeply about it. You know, he got announced he's on the advisory board for Metaplanet. You know, he's got a lot of knowledge, and he also has the ear of his father in terms of making sure that like what he's doing, what President Trump is doing, is impacting the industry in a good way.

So he's a very influential person in the world right now, and we're very excited to have him there. He had a great time in Vegas, and, you know, we told him we've got this road show happening, we're going to Hong Kong next. You know, would you want to come? And he was like, "Well, I mean, you know, is there a Bitcoin community out there?" And we were like, "Oh yeah, I mean, the Bitcoin community there is massive."

And he was like, "Well, I want to meet Bitcoiners from all around the world." And, you know, he was especially excited due to the Metaplanet deal, and he wanted to show up in a big way. And so, you know, this was the best venue for him to really kind of make an appearance in Hong Kong.

Yeah, he's really excited about it. I think there's gonna be, you know, some very cool, like, we'll say path-crossing that I think will happen at the event of different people from, you know, the Hong Kong sphere getting to meet Eric and vice versa. And, you know, there are also some other speakers, like I said, that we haven't announced yet that I think will also capture some imagination in terms of how those conversations might go on site.

So everybody should really join us. I'm gonna go as well. You're gonna go. Super excited.

Bonnie: We want to end with this. An average person in their 20s, 30s, and 40s - how many Bitcoins should they try to obtain right now to be, let's say, a millionaire equivalent when they reach retirement age?

Brandon: Yeah, so I actually have a really funny video that I did with Altcoin Daily a few years ago, maybe a couple years ago, where they asked how much Bitcoin would you need to own to be a millionaire in the year 2032? And my answer was - and I did the math like on air with them, and I'm not going to go rehash all of that - but my answer at the time was I think 0.01 Bitcoin. And that my idea was that by 2032, it's possible that, you know - and this would be like the blow-off top, and, you know, I was also hedging by saying like I think that it would come alongside an inflationary moment where "millionaire" is not what it used to mean, right?

But of course that in 2032, you know, 0.01 Bitcoin could get you there potentially. And so, you know, is that crazy bull math? Probably. But what I'll say is as time goes on, Bitcoin's value is only going to appreciate against the dollar.

I think probably most people who are getting into the space right now won't ever own one Bitcoin. That's okay. Like, you know, it's just a unit. You know, like it doesn't mean anything. One Bitcoin is 100 million satoshis. You can still own a million satoshis, and that's going to be a ton of value in the future.

And so it's really just about creating healthy financial habits about being able to save every day a little bit into Bitcoin and just squirrel it away for later. And if you can have that sort of habit, that is good financial hygiene, and Bitcoin is the best savings tool ever created. And so if that's your habit - "Hey, I'm taking a little bit of my paycheck and I'm putting it into Bitcoin and I'm not touching it" - then by the time you are ready to retire, you are going to be shocked with the amount of value you were able to hold on to in that process.

So that's my advice. And, you know, I just count myself and ourselves so lucky to be in this moment in time where such an invention is on its path, because there will never be another time like this. It's a unique moment to be able to actually buy Bitcoin and hold on to it. So don't miss that opportunity.

Bonnie: When you say unique, does that mean early?

Brandon: It means early, and frankly, it means like there will come a time where you're not going to be able to exchange dollars for Bitcoin. That is not going to be a trade that anyone is actively going to allow or take. What we're watching is we're watching this thing come to fruition step by step every day. And like, what a cool thing. There will be history books - history books trying to recount and understand how this thing happened, how Bitcoin succeeded, because it is so monumental for the history of humanity. And we just happen to be the ones living inside of it. And it's so cool.

Bonnie: I love that ending. And also, people, if people want to talk to people as cool as Brandon, they should go grab a ticket for Bitcoin Conference Asia. There is no reason why you should not just check it out, honestly.

Brandon: Absolutely. Thank you so much for your time. This has been so much fun.

Bonnie: Yeah, it's been a blast. Thank you so much for having me, Bonnie.

PEPE0.00 -11.29%

PEPE0.00 -11.29%

TON1.30 -2.37%

TON1.30 -2.37%

BNB625.47 -1.08%

BNB625.47 -1.08%

SOL86.74 -3.06%

SOL86.74 -3.06%

XRP1.41 -3.81%

XRP1.41 -3.81%

DOGE0.10 -6.47%

DOGE0.10 -6.47%

TRX0.29 -0.11%

TRX0.29 -0.11%

ETH2037.97 -1.53%

ETH2037.97 -1.53%

BTC67782.22 -1.69%

BTC67782.22 -1.69%

SUI0.94 -6.73%

SUI0.94 -6.73%