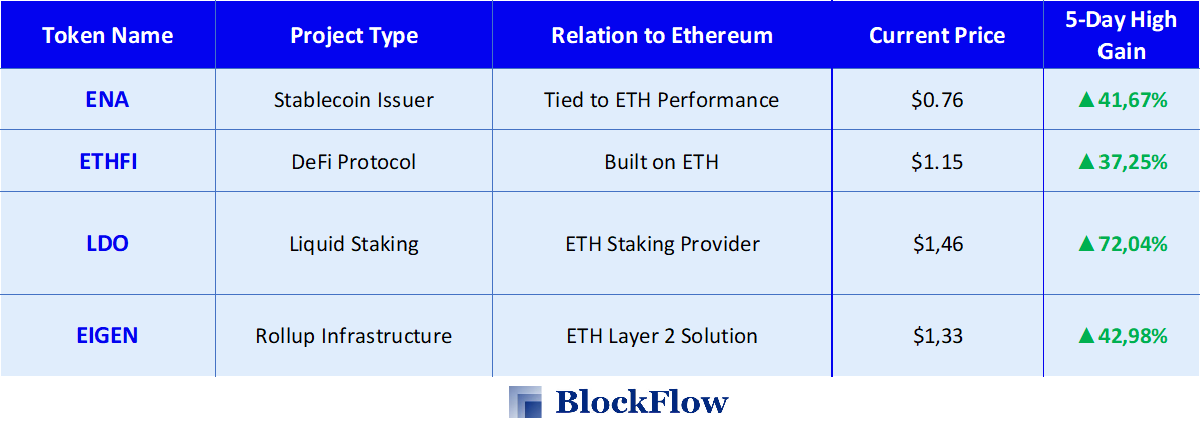

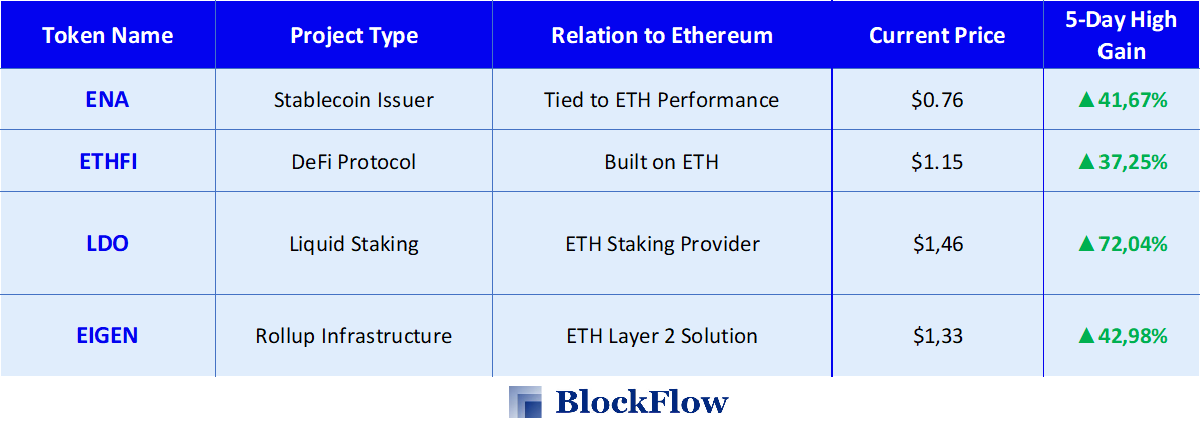

Last week, Ethereum ecosystem tokens posted an average 5-day high gain of nearly 50%; with the recent favorable CPI data, bullish momentum is expected to continue.

The cryptocurrency market has experienced a strong resurgence, led by Ethereum’s impressive rally. Ethereum surpassed the $4,400 mark, igniting optimism throughout the crypto ecosystem. This bullish momentum also propelled Ethereum-linked tokens such as ENA, ETHFI, LDO, and EIGEN to record notable gains over the weekend.

Notably, ENA surged from $0.62 to $0.84, marking an impressive increase of approximately 35.5%.

Meanwhile, LDO not only posted substantial gains but also sustained an upward trajectory, rallying from $0.62 last Friday to surpass $1.5, representing a remarkable 142% surge.

Market participants reacted swiftly to the release of the United States July CPI data, which came in at 2.7% year-on-year—slightly below expectations of 2.8% and unchanged from the previous month. The softer-than-expected reading eased inflation concerns, fueling a sharp rally in the crypto market.

Ethereum surged past $4,400 within minutes of the announcement, while Bitcoin also gained momentum, echoing a pattern noted by crypto analyst @ali_charts on X: “When Bitcoin $BTC dips ahead of CPI or PPI reports, it often rallies right after the data drops, and vice versa.”

Key Token Analysis: BTC, ETH, SOL, ENA, UNI

Overall, BTC remains in a consolidation phase while ETH continues to lead the market rally. Altcoins are showing signs of awakening and could experience significant bursts of activity in the near term, depending on broader market momentum and macro triggers.

Bitcoin

Bitcoin While Bitcoin seems to be hitting some resistance around the $120,000 mark, institutional investors continue to accumulate aggressively.

Notably, MicroStrategy added 155 BTC to its holdings, and Blue Origin has begun accepting Bitcoin payments, signaling long-term bullish sentiment. However, traders should remain cautious of short-term volatility risks driven by leveraged liquidations.

Additionally, Nakamoto CEO David Bailey’s planned billion-dollar scale purchase could eventually break through the $120,000 resistance barrier. Following the CPI release, Bitcoin’s price saw a modest uptick, with Kalshi prediction market data showing an 86% probability of a Federal Reserve rate cut in September, serving as a potential catalyst for a stronger move.

Ethereum

ETH has firmly established itself as the market leader in the current rally by breaking above $4,300. Institutional interest combined with solid fundamentals continue to underpin its bullish momentum.

Tom Lee, Chairman of Bitmine, is highly optimistic about Ethereum’s future, projecting that its value could surpass Bitcoin’s and forecasting a price range between $4,000 and $15,000.

Ethereum reacted sensitively to the recent CPI data, quickly surging past the $4,400 level, reigniting bullish sentiment across the crypto market, and moving closer toward Tom Lee’s upper target range. ETH’s next target is around $4,800, which may be reached soon.

Solana

SOL faces some short-term pressure as FTX/Alameda continues unlocking staked tokens and transferring them to exchanges, which may weigh on the price.

Despite this, the long-term outlook remains positive: influential players like Blue Origin are accepting SOL payments, and the ecosystem remains vibrant — exemplified by the $25 million investment into $BONK. These fundamentals underscore SOL’s strong growth potential. Despite trading in a relatively narrow range currently, Solana’s on-chain metrics are competitive with Ethereum’s, highlighting its robust network activity.

However, SOL’s market capitalization is only about 1/5 that of ETH, and its price stands roughly at half of its historical peak. This suggests that SOL’s independent price rally might hinge on whether Ethereum’s momentum wanes and capital flows back into SOL.

Investors are also eyeing October as a potentially pivotal month, with spot ETF approvals expected around October 10th, and several institutional investors, akin to “MicroStrategy” type players, preparing to complete funding rounds. These events could act as significant catalysts for SOL’s price breakout.

ENA

ENA’s team has been leveraging advanced strategies involving Aave and Pendle protocols to create a growth flywheel, driving continuous expansion and reinforcing its market position.

Looking ahead to Q4, ENA plans to go public via a NASDAQ SPAC listing, positioning itself to capitalize on the US government's robust support for stablecoins. ENA is currently the world’s third-largest stablecoin issuer, trailing only behind USDC and USDT.

Its flagship stablecoin USDE saw issuance rise sharply from under $6 billion last year to over $10 billion now, while its token price remains below previous highs — indicating substantial upside potential.

The surging demand for USDE is driven by a near risk-free arbitrage model coupled with high yields, reportedly around 20% annualized last year.

The mechanism involves staking ETH to generate returns, while simultaneously hedging risks via smart contract short positions and collecting funding fees.

This tight coupling with ETH’s performance implies that as long as Ethereum stays strong, ENA’s outlook remains bullish.

Uniswap

On August 12, the “DUNI” governance proposal was announced, triggering a short-term jump in UNI’s price by nearly 11%, pushing it close to $12. The proposal goes beyond a simple structural adjustment; it represents an ambitious effort to advance and mature the DAO governance framework.

If approved, it would establish the crucial legal foundation needed to implement the long-awaited “fee switch” mechanism—an issue that has been a major point of contention within the community for years. Since its introduction, the proposal has drawn significant attention for its potential to enhance DAO maturity and enable new fee mechanisms.

Amid a bullish market environment, UNI stands to gain considerable benefits from this governance evolution.

Ethereum Ecosystem Tokens to Watch

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial, investment, or trading advice.

PEPE0.00 -4.84%

PEPE0.00 -4.84%

TON1.30 0.96%

TON1.30 0.96%

BNB632.08 0.56%

BNB632.08 0.56%

SOL87.53 -0.25%

SOL87.53 -0.25%

XRP1.41 -2.57%

XRP1.41 -2.57%

DOGE0.10 -1.68%

DOGE0.10 -1.68%

TRX0.29 -0.59%

TRX0.29 -0.59%

ETH2041.42 -1.20%

ETH2041.42 -1.20%

BTC67710.92 -1.05%

BTC67710.92 -1.05%

SUI0.95 -0.61%

SUI0.95 -0.61%