Last Updated: September 3, 2025 | Reading Time: Reference Guide | Author: BlockFlow Editorial Team

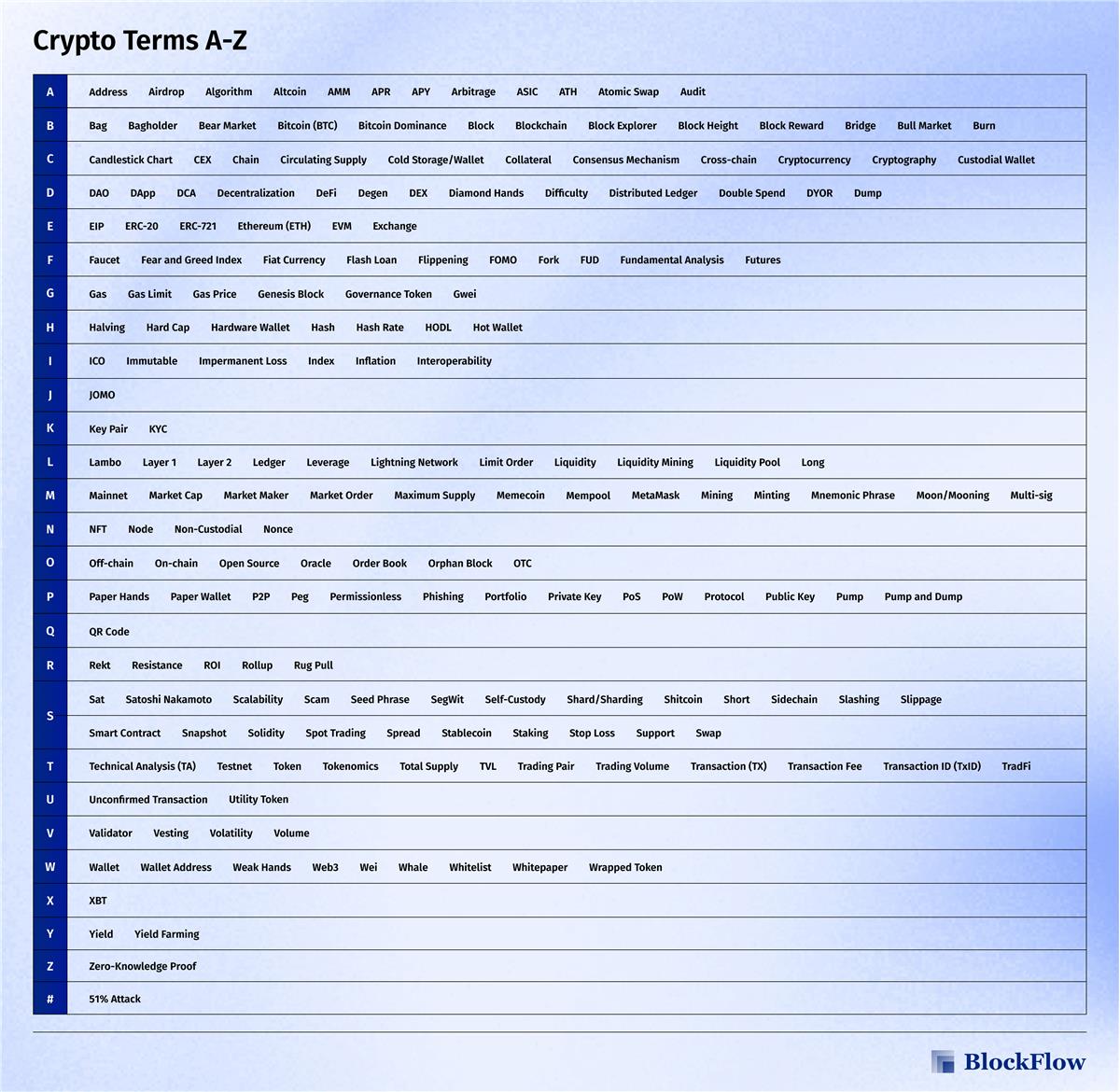

About This Glossary

This comprehensive glossary covers 200+ essential cryptocurrency and blockchain terms. Whether you're reading your first crypto article or diving into DeFi, this reference guide will help you understand the language of digital assets.

💡 Pro Tip: Use Ctrl+F (or Cmd+F on Mac) to quickly search for any term.

A

Address

A string of letters and numbers used to send and receive cryptocurrency. Like an email address for your crypto.

-

Example: "My Bitcoin address starts with bc1q..."

Airdrop

Free distribution of tokens to wallet addresses, often used for marketing or rewarding early users.

-

Example: "Uniswap airdropped 400 UNI tokens to early users in 2020."

Algorithm

A set of rules that a computer follows to solve problems or complete tasks. Cryptocurrencies use algorithms for mining and consensus.

Altcoin

Any cryptocurrency that isn't Bitcoin. Short for "alternative coin."

-

Example: "Ethereum, Cardano, and Dogecoin are all altcoins."

AMM (Automated Market Maker)

A protocol that uses algorithms instead of order books to facilitate trading. Used by DEXs like Uniswap.

APR (Annual Percentage Rate)

The yearly interest rate without compounding. In DeFi, the simple interest you earn.

-

Example: "This pool offers 12% APR on USDC deposits."

APY (Annual Percentage Yield)

The yearly interest rate including compound interest. Usually higher than APR.

-

Example: "12% APR compounded daily equals 12.75% APY."

Arbitrage

Profiting from price differences of the same asset across different markets.

-

Example: "Buying BTC for $116,000 on one exchange and selling for $116,500 on another."

ASIC (Application-Specific Integrated Circuit)

Specialized hardware designed specifically for mining cryptocurrency, particularly Bitcoin.

ATH (All-Time High)

The highest price a cryptocurrency has ever reached.

-

Example: "Bitcoin's ATH was $69,000 in November 2021."

Atomic Swap

Direct cryptocurrency exchange between two parties without an intermediary.

Audit

Security review of smart contract code by professionals to find vulnerabilities.

B

Bag

Slang for someone's cryptocurrency holdings.

-

Example: "I'm holding heavy bags of ETH."

Bagholder

Someone holding cryptocurrency that has decreased significantly in value.

Bear Market

Extended period of declining prices, typically 20% or more from recent highs.

-

Example: "The 2022 crypto bear market saw Bitcoin fall from $69k to $16k."

Bitcoin (BTC)

The first and largest cryptocurrency, created by Satoshi Nakamoto in 2009.

Bitcoin Dominance

Bitcoin's market cap as a percentage of total crypto market cap.

-

Example: "Bitcoin dominance is currently 52%."

Block

A collection of transactions recorded on the blockchain. New blocks are added roughly every 10 minutes on Bitcoin.

Blockchain

A distributed ledger of transactions maintained by a network of computers. The foundation of all cryptocurrencies.

Block Explorer

Website or tool to view transactions, addresses, and blocks on a blockchain.

-

Example: "Etherscan is Ethereum's most popular block explorer."

Block Height

The number of blocks in a blockchain since the genesis block.

Block Reward

Cryptocurrency awarded to miners/validators for successfully adding a block.

Bridge

Protocol allowing assets to move between different blockchains.

-

Example: "I used a bridge to move ETH from Ethereum to Polygon."

Bull Market

Extended period of rising prices and optimistic sentiment.

Burn

Permanently removing tokens from circulation by sending to an inaccessible address.

-

Example: "Ethereum burns part of every transaction fee."

C

Candlestick Chart

Price chart showing open, close, high, and low prices for a period.

Centralized Exchange (CEX)

Traditional crypto exchange where the company controls your funds. Examples: Binance, Coinbase.

Chain

Short for blockchain. Different chains include Ethereum, Bitcoin, Solana.

Circulating Supply

The number of tokens currently available in the market.

Cold Storage/Wallet

Offline cryptocurrency storage, disconnected from internet. Most secure storage method.

Collateral

Assets pledged to secure a loan. In DeFi, often crypto locked in smart contracts.

Consensus Mechanism

Method by which blockchain networks agree on transaction validity. Examples: Proof of Work, Proof of Stake.

Cross-chain

The ability to interact between different blockchain networks.

Cryptocurrency

Digital currency secured by cryptography and operating on blockchain technology.

Cryptography

The practice of secure communication using codes and ciphers.

Custodial Wallet

Wallet where a third party controls your private keys. Example: Exchange wallets.

D

DAO (Decentralized Autonomous Organization)

Organization governed by smart contracts and token holders rather than traditional management.

-

Example: "MakerDAO governs the DAI stablecoin."

DApp (Decentralized Application)

Application running on blockchain rather than centralized servers.

DCA (Dollar-Cost Averaging)

Investment strategy of buying fixed dollar amounts regularly, regardless of price.

-

Example: "I DCA $100 into Bitcoin every Monday."

Decentralization

Distribution of power away from a central authority.

DeFi (Decentralized Finance)

Financial services using smart contracts instead of traditional intermediaries.

Degen

Slang for high-risk crypto trader. Short for "degenerate."

DEX (Decentralized Exchange)

Exchange operating without central authority. Examples: Uniswap, SushiSwap.

Diamond Hands

Holding an asset despite volatility or losses.

-

Example: "I have diamond hands - not selling my BTC."

Difficulty

Measure of how hard it is to mine a new block. Adjusts based on network hash rate.

Distributed Ledger

Database spread across multiple nodes, with no central administrator.

Double Spend

Attempting to spend the same cryptocurrency twice. Blockchain prevents this.

DYOR (Do Your Own Research)

Common advice to research before investing.

Dump

Rapid selling causing price to fall dramatically.

E

EIP (Ethereum Improvement Proposal)

Formal proposal for changes to Ethereum network.

-

Example: "EIP-1559 changed Ethereum's fee structure."

ERC-20

Technical standard for tokens on Ethereum blockchain.

ERC-721

Technical standard for NFTs on Ethereum.

Ethereum (ETH)

Second-largest cryptocurrency, platform for smart contracts and DApps.

EVM (Ethereum Virtual Machine)

The runtime environment for smart contracts on Ethereum.

Exchange

Platform for buying, selling, and trading cryptocurrencies.

F

Faucet

Website dispensing small amounts of free cryptocurrency.

Fear and Greed Index

Sentiment indicator showing market emotions from 0 (extreme fear) to 100 (extreme greed).

Fiat Currency

Government-issued currency like USD, EUR, GBP.

Flash Loan

Uncollateralized loan that must be repaid within the same transaction.

Flippening

Theoretical event where Ethereum's market cap surpasses Bitcoin's.

FOMO (Fear Of Missing Out)

Anxiety that others are profiting while you're not participating.

-

Example: "FOMO caused me to buy at the top."

Fork

Change to blockchain protocol rules. Can be hard fork (incompatible) or soft fork (compatible).

FUD (Fear, Uncertainty, Doubt)

Negative information spread to influence market sentiment.

Fundamental Analysis

Evaluating an asset based on technology, team, adoption, and use cases.

Futures

Contracts to buy/sell an asset at a predetermined price in the future.

G

Gas

Fee paid to execute transactions on Ethereum and similar networks.

-

Example: "Gas is high today - $50 for a simple transfer!"

Gas Limit

Maximum gas you're willing to pay for a transaction.

Gas Price

Amount paid per unit of gas, measured in Gwei on Ethereum.

Genesis Block

The first block in a blockchain.

Governance Token

Token giving holders voting rights in protocol decisions. Examples: UNI, AAVE.

Gwei

Unit of Ethereum. 1 Gwei = 0.000000001 ETH.

H

Halving

Event reducing block rewards by 50%. Bitcoin halves every 4 years.

-

Example: "The next Bitcoin halving is in 2028."

Hard Cap

Maximum supply of a cryptocurrency that will ever exist.

Hardware Wallet

Physical device storing private keys offline. Examples: Ledger, Trezor.

Hash

Fixed-length fingerprint of variable-size data, fundamental to blockchain security.

Hash Rate

Computational power being used to mine and process transactions.

HODL

Misspelling of "hold" that became a meme meaning long-term holding.

-

Example: "Just HODL through the dip."

Hot Wallet

Wallet connected to internet. Convenient but less secure than cold storage.

I

ICO (Initial Coin Offering)

Fundraising method where new projects sell tokens to investors.

Immutable

Cannot be changed. Blockchain transactions are immutable once confirmed.

Impermanent Loss

Temporary loss experienced when providing liquidity due to price divergence.

Index

Basket of cryptocurrencies tracked as one unit.

Inflation

Increase in token supply over time.

Interoperability

Ability of different blockchains to communicate and share information.

J

JOMO (Joy Of Missing Out)

Being happy about not participating in a risky investment.

K

Key Pair

Public and private keys that work together for cryptocurrency transactions.

KYC (Know Your Customer)

Identity verification required by regulated exchanges.

-

Example: "Coinbase requires KYC before you can trade."

L

Lambo

Lamborghini - meme symbol of crypto wealth.

-

Example: "When lambo?" means "When will we get rich?"

Layer 1

Base blockchain network like Bitcoin or Ethereum.

Layer 2

Solutions built on top of Layer 1 for scaling. Examples: Lightning Network, Arbitrum.

Ledger

Record of all transactions. Can refer to blockchain or hardware wallet brand.

Leverage

Using borrowed funds to increase position size.

-

Example: "10x leverage means borrowing 9x your capital."

Lightning Network

Layer 2 payment protocol for fast, cheap Bitcoin transactions.

Limit Order

Order to buy/sell at specific price or better.

Liquidity

How easily an asset can be bought/sold without affecting price.

Liquidity Mining

Earning rewards for providing liquidity to DeFi protocols.

Liquidity Pool

Smart contract holding tokens for decentralized trading.

Long

Betting that price will increase.

M

Mainnet

Production blockchain where real transactions occur with actual value.

Market Cap

Total value of all coins in circulation. Price × Circulating Supply.

Market Maker

Entity providing liquidity by offering to buy and sell.

Market Order

Order to buy/sell immediately at current market price.

Maximum Supply

Total amount of tokens that will ever exist.

Memecoin

Cryptocurrency created as joke or meme. Examples: DOGE, SHIB.

Mempool

Pool of unconfirmed transactions waiting to be included in blocks.

MetaMask

Popular browser wallet for Ethereum and EVM chains.

Mining

Process of validating transactions and creating new blocks using computational power.

Minting

Creating new tokens or NFTs.

Mnemonic Phrase

Another term for seed phrase - words to recover wallet.

Moon/Mooning

Dramatic price increase.

-

Example: "This coin is mooning!"

Multi-sig (Multi-signature)

Wallet requiring multiple signatures to authorize transactions.

N

NFT (Non-Fungible Token)

Unique digital asset representing ownership of specific item.

Node

Computer maintaining a copy of the blockchain.

Non-Custodial

You control your private keys, not a third party.

Nonce

Number used once in mining to find valid block hash.

O

Off-chain

Transactions or data outside the blockchain.

On-chain

Transactions or data recorded on the blockchain.

Open Source

Code that's publicly available for review and contribution.

Oracle

Service providing external data to smart contracts. Example: Chainlink.

Order Book

List of buy and sell orders on an exchange.

Orphan Block

Valid block not included in the main chain.

OTC (Over-the-Counter)

Trading directly between parties without an exchange.

P

Paper Hands

Selling at the first sign of loss or volatility.

Paper Wallet

Private keys printed on paper for cold storage.

Peer-to-Peer (P2P)

Direct interaction between parties without intermediaries.

Peg

Fixed exchange rate between two assets. Stablecoins peg to fiat.

Permissionless

Open to anyone without needing approval.

Phishing

Scam attempting to steal private keys or passwords through deception.

Portfolio

Collection of cryptocurrency investments.

Private Key

Secret code controlling access to cryptocurrency. Never share this!

-

Example: "Lost private key = lost funds forever."

Proof of Stake (PoS)

Consensus mechanism using staked tokens instead of mining.

Proof of Work (PoW)

Consensus mechanism using computational power (mining).

Protocol

Rules governing blockchain operation.

Public Key

Derived from private key, used to generate addresses.

Pump

Rapid price increase, often artificial.

Pump and Dump

Scheme to inflate price then sell for profit.

Q

QR Code

Square barcode encoding wallet addresses for easy scanning.

R

Rekt

Slang for "wrecked" - suffering major losses.

-

Example: "I got rekt buying at ATH."

Resistance

Price level where selling pressure prevents further increase.

ROI (Return on Investment)

Percentage gain or loss on an investment.

Rollup

Layer 2 scaling solution bundling transactions.

Rug Pull

Scam where developers abandon project with investor funds.

S

Satoshi (Sat)

Smallest unit of Bitcoin. 1 BTC = 100,000,000 Satoshis.

Satoshi Nakamoto

Pseudonymous creator of Bitcoin.

Scalability

Blockchain's ability to handle increasing transactions.

Scam

Fraudulent scheme to steal money or crypto.

Seed Phrase

12-24 words to recover wallet. Most important backup!

-

Example: "Write seed phrase on paper, never digital."

Segregated Witness (SegWit)

Bitcoin upgrade increasing transaction capacity.

Self-Custody

Controlling your own private keys.

Shard/Sharding

Splitting blockchain into pieces for scalability.

Shitcoin

Derogatory term for low-quality cryptocurrency.

Short

Betting that price will decrease.

Sidechain

Separate blockchain connected to main chain.

Slashing

Penalty for validator misbehavior in PoS.

Slippage

Difference between expected and actual trade price.

Smart Contract

Self-executing code on blockchain with terms directly written in.

Snapshot

Record of blockchain state at specific point.

Solidity

Programming language for Ethereum smart contracts.

Spot Trading

Buying/selling for immediate delivery.

Spread

Difference between buy and sell prices.

Stablecoin

Cryptocurrency maintaining stable value, usually $1. Examples: USDC, USDT.

Staking

Locking tokens to support network operations and earn rewards.

Stop Loss

Order to sell if price falls to certain level.

Support

Price level where buying pressure prevents further decrease.

Swap

Exchange one token for another.

T

Technical Analysis (TA)

Analyzing price charts and patterns to predict movements.

Testnet

Test blockchain for development without real value.

Token

Cryptocurrency unit. Can represent various assets or utilities.

Tokenomics

Economic model of a token including supply, distribution, and incentives.

Total Supply

All tokens that currently exist (including locked).

Total Value Locked (TVL)

Total assets deposited in DeFi protocol.

-

Example: "Aave has $12 billion TVL."

Trading Pair

Two currencies that can be traded against each other.

-

Example: "BTC/USDT trading pair."

Trading Volume

Amount of cryptocurrency traded in given period.

Transaction (TX)

Transfer of value on blockchain.

Transaction Fee

Cost to process transaction on network.

Transaction ID (TxID)

Unique identifier for blockchain transaction.

TradFi

Traditional finance - banks, stock markets, etc.

U

Unconfirmed Transaction

Transaction not yet included in a block.

Utility Token

Token providing access to product or service.

V

Validator

Node verifying transactions in Proof of Stake networks.

Vesting

Gradual release of tokens over time.

Volatility

How much and how quickly price changes.

Volume

Amount traded in specific period.

W

Wallet

Software or hardware storing cryptocurrency keys.

Wallet Address

Public identifier for receiving cryptocurrency.

Weak Hands

Investors who sell at first sign of trouble.

Web3

Decentralized internet built on blockchain technology.

Wei

Smallest unit of Ethereum. 1 ETH = 10^18 Wei.

Whale

Individual or entity holding large amounts of cryptocurrency.

-

Example: "A whale just moved 1,000 BTC."

Whitelist

List of approved participants for token sale or NFT mint.

Whitepaper

Technical document explaining cryptocurrency project.

Wrapped Token

Token representing another cryptocurrency on different blockchain.

-

Example: "WBTC is Bitcoin wrapped for use on Ethereum."

X

XBT

Alternative ticker symbol for Bitcoin.

Y

Yield

Return earned on investment, often from staking or lending.

Yield Farming

Maximizing returns by moving assets between DeFi protocols.

Z

Zero-Knowledge Proof

Cryptographic method proving something without revealing the information itself.

#

51% Attack

Attack where entity controls majority of network hash rate.

📚 How to Use This Glossary

For Learning:

-

Read through alphabetically to build comprehensive knowledge

-

Focus on bold terms in articles you're reading

-

Bookmark for quick reference

For Writing:

-

Ensure you're using terms correctly

-

Link to specific definitions when writing

For Trading:

-

Understand terms before executing trades

-

Review DeFi terms before using protocols

🎯 Most Important Terms for Beginners

If you're just starting, focus on understanding these essential terms first:

-

Wallet - Where you store crypto

-

Private Key - Your password (never share!)

-

Seed Phrase - Backup words

-

Address - Where people send you crypto

-

Gas - Transaction fees

-

Exchange - Where to buy crypto

-

Market Cap - Total value metric

-

Stablecoin - Crypto pegged to $1

-

DYOR - Always research first

-

HODL - Long-term holding strategy

📈 Terms Trending in 2025

-

Account Abstraction - Simplifying wallet UX

-

Layer 2 - Scaling solutions

-

RWA (Real World Assets) - Tokenizing physical assets

-

Intents - New transaction paradigm

-

Restaking - Earning additional yield on staked assets

-

Modularity - Blockchain architecture trend

🔄 Regular Updates

This glossary is updated monthly to include new terms and trends. Last major update: August 2025

Have a term we missed? Contact us at @blockflow.news

📚 Next Steps in Your Crypto Journey

Ready to dive deeper? Check out these related guides:

💬 Join the Conversation

Have questions about cryptocurrency? Join our community:

-

Follow @BlockFlow_News for daily updates

-

Subscribe to our newsletter for weekly insights

-

Join our Telegram group for discussions

About the Author: This comprehensive glossary is maintained by the BlockFlow Editorial Team to help newcomers and experienced users navigate the evolving language of cryptocurrency and blockchain technology. The BlockFlow Editorial Team consists of cryptocurrency researchers, blockchain developers, and financial journalists with over many years of combined experience in digital assets. This guide is regularly updated to reflect the latest developments in the cryptocurrency space.

Note: Definitions are simplified for clarity. For technical specifications, consult project documentation.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always do your own research and consult with financial professionals before making investment decisions.

PEPE0.00 5.77%

PEPE0.00 5.77%

TON1.52 -0.83%

TON1.52 -0.83%

BNB882.79 1.14%

BNB882.79 1.14%

SOL124.54 1.76%

SOL124.54 1.76%

XRP1.91 1.41%

XRP1.91 1.41%

DOGE0.12 0.47%

DOGE0.12 0.47%

TRX0.30 -0.32%

TRX0.30 -0.32%

ETH2935.49 2.11%

ETH2935.49 2.11%

BTC88547.93 0.97%

BTC88547.93 0.97%

SUI1.45 0.87%

SUI1.45 0.87%