Bitcoin just hit a new ATH and reach $120K. With Q2 crypto VC funding topping $10B, the strongest quarter since early 2022, new capital is flowing back into the space. But with over a dozen major blockchains competing for attention, builders and investors must do due diligence. Wyoming’s state-led blockchain scoring program offers a data-driven lens, ranking networks by speed, security, adoption, and more.

We break down the top-ranked chains using the latest, corrected model that fairly compares them on equal terms. Also: why some popular chains like XRP or Tron were disqualified.

Key Evaluation Metrics

To demystify the criteria behind these scores, here is a brief, plain-English explanation of each metric used in the blockchain scoring program:

● Network Stability (in years):Measures how long the chain has operated without a critical reorg or technical failure. Longevity reflects reliability, which builds trust for institutional users.

● Active Users:Based on average daily wallet addresses over the quarter. A larger user base signals strong adoption and active engagement.

● Total Value Locked (TVL):Total USD value of assets locked in DeFi apps. High TVL indicates capital confidence and economic depth within the ecosystem.

● Stablecoin Market Capitalization:Total value of stablecoins on-chain. This shows real-world utility as a financial settlement layer.

● Transactions per Second (TPS):Measures actual throughput capacity. High TPS chains can handle real-world volumes like payments and gaming.

● Fees per Transaction:Cost in USD to send a basic transaction. Lower fees improve accessibility, especially for retail and micro-payments.

● Block Time:Time to produce a new block. Shorter times mean faster transaction confirmations and better UX.

● Transaction Finality:Time until a transaction is irreversible. Fast finality is crucial for settlement, preventing double-spends or delays.

● Privacy Features:Whether the blockchain supports advanced or optional privacy tools. Privacy enables sensitive use cases, but must balance with compliance.

● Interoperability Features:Ability to integrate with other chains or bridges (e.g., via CCIP or native bridges). Cross-chain compatibility is vital for asset and liquidity movement.

● Smart Contract Features:Support for complex on-chain logic and programmability. Enables DeFi, automation, and custom application layers.

● Use Cases:Number and scale of stablecoin-relevant deployments. Demonstrates proven applications and utility.

● Existing Partnerships:Active collaborations with payment companies or governments. Validates enterprise interest and real-world trust.

● Entity Activity: Evaluates past legal/regulatory violations of the blockchain's operating entity. Clean records improve credibility.

● Team Activity:Investigates the leadership’s legal background. A clean history minimizes governance and reputation risk.

● Technical Formidability:Assesses history of exploits, downtime, or major hacks. A secure chain earns more trust.

● Network Availability:Tracks uptime and performance reliability. Critical for consistent stablecoin operation.

● Bug Bounties:Presence of formal reward programs for white-hat testing. Encourages proactive security hardening.

● Codebase Maintenance:Measures code update frequency and dev activity. Active repositories show ongoing innovation and issue response.

Updated Rankings: Who Leads and Why

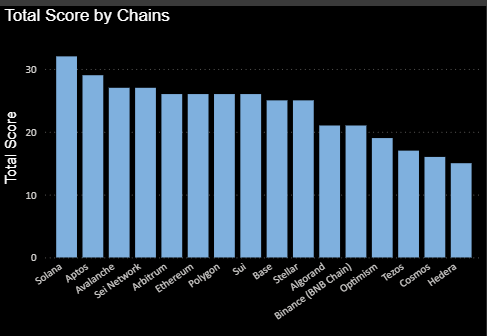

Figure 1: Updated total scores for leading blockchains (higher is better)data

source:Bitfox.ai

Solana earned the top score overall (32), with Aptos second (29) after model corrections to remove two metrics that were not applicable in early evaluations. Solana leads with 32 points, followed by Aptos (29), Sei & Avalanche (27), Arbitrum & Ethereum (26). The scores reflect speed, cost, security, and usage. Some sources might list Aptos with a score of 32, but it includes two metrics that were not part of earlier evaluations, such as for Solana. Therefore, to ensure a fair comparison, the scores of Aptos and a few others have been adjusted by removing those two additional metrics.

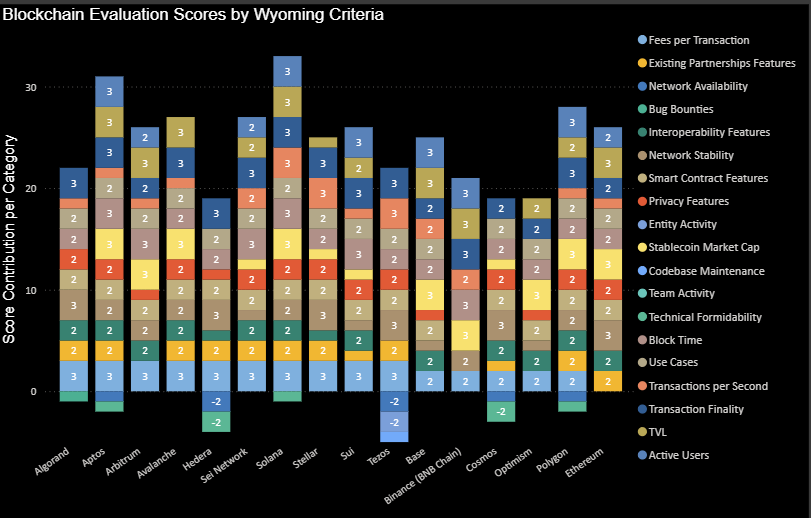

Why did Solana and Aptos come out on top? In short, they demonstrate an unusually strong balance of speed, low costs, and growing adoption. Solana’s score benefits from exceptional throughput (thousands of TPS) and ultra-low fees, plus a sizable user base and DeFi ecosystem (over $10B TVL at its peak). Aptos, a newer entrant, scored high thanks to its innovative tech (built on the Move language for safety), quick finality (~1 second), and an exploding developer ecosystem – though being only ~2 years old, it has a shorter track record (hence a slightly lower stability score than Solana). Avalanche and Sei both excel in specific areas – Avalanche offers fast finality and a unique subnet architecture for scalability, while Sei is purpose-built for high-speed trading with instant finality – earning them solid scores in performance metrics. However, Avalanche’s current active usage and TVL are lower than Solana’s, and Sei is still building out its ecosystem, keeping their overall scores a bit behind the leaders. Meanwhile, Ethereum scored lower not due to security or decentralization (where it’s superb), but due to relatively slow throughput and high fees under present conditions. The scoring rubric penalized Ethereum on performance (it has ~12s blocks, ~15 TPS, and often >$2 average fees), so despite its 9-year stability and massive ecosystem, its total came in around 26 points. This highlights the program’s emphasis on technical efficiency and cost, viewing them as critical for builders. L2 networks like Arbitrum and Optimism also saw mixed results: Arbitrum scored well on low fees and decent user count, but like Ethereum it has long finality (relying on Ethereum’s 10+ minute settlement) and only a couple years of history. Still, Arbitrum’s strong DeFi growth gave it a 26. Other chains such as Polygon, Sui, Base, and Stellar clustered in the mid-20s, each with their own strengths and weaknesses in the criteria.

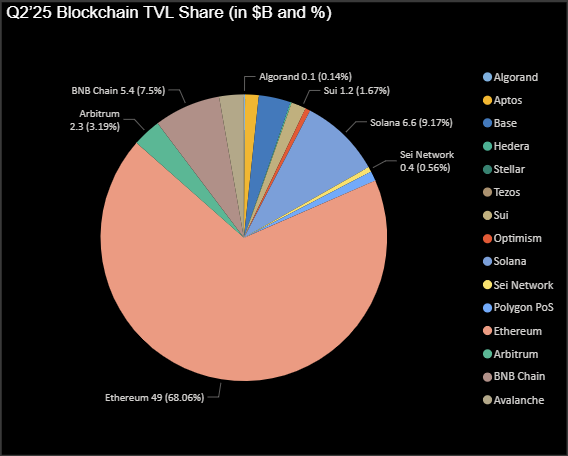

Figure 2: Ethereum dominates DeFi market but still falls behind due to low technical efficiencydata

source:Bitfox.ai

In summary, platforms that combine high performance (speed, capacity), low transaction costs, and growing user adoption tend to outrank those that are very mature but slower/expensive. Solana and Aptos exemplify that balance currently. Ethereum remains the most battle-tested and decentralized, but was outscored on “performance” metrics. It’s worth noting the scoring model also included some “Additional” factors (beyond the core speed/usage metrics). For example, things like support for compliance features, tool availability, etc. These contributed extra points to chains like Stellar and Solana (and initially to Aptos), but the latest update removed two such factors that were not meant for early evaluations. This adjustment mainly affected Aptos – reducing its score by 3 points – ensuring Solana holds the top spot alone. The overall takeaway is clear: post-ATH, builders should weigh fundamentals like throughput, finality, and user traction very highly when picking a chain.

Figure 3: Breakdown of each chain’s total score by evaluation criteria.

Comparative Analysis of the Top 5 Blockchains: Beyond Speed

This section expands the analysis of the top 5 chains from Wyoming’s scoring—Solana, Aptos, Avalanche, Sei, and Ethereum—by incorporating broader metrics such as compliance, privacy, tooling, and ecosystem maturity based on data from Q4’24 and Q1’25 scoring sheets.

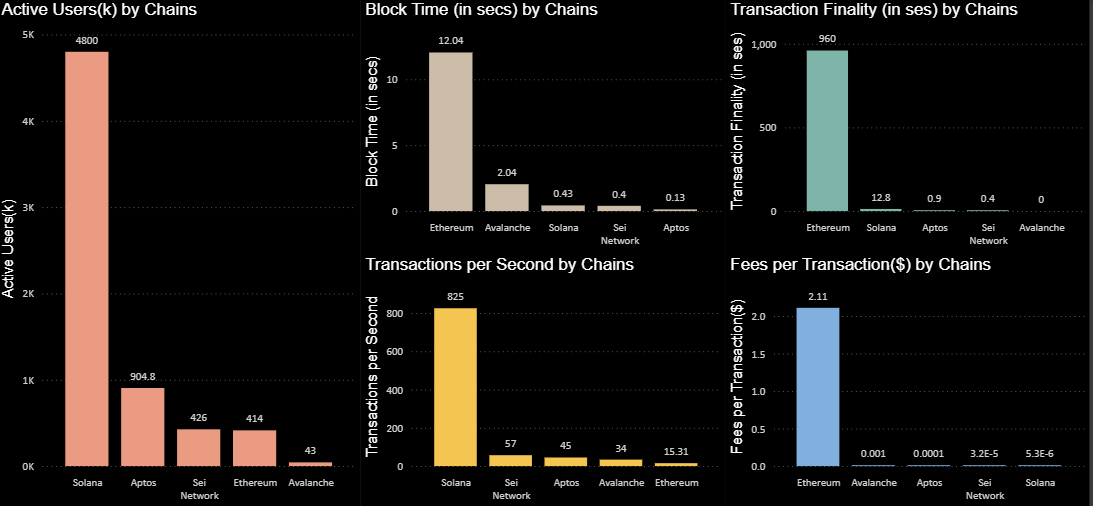

Figure 4: Key metrics for top 5 blockchains (Solana, Aptos, Avalanche, Sei,Ethereum).data

source:Bitfox.ai

1. Solana: High Performance, Low Cost, Broad Ecosystem

● Tech Strength: Solana dominates on throughput (>1,000 TPS) and has ultra-low fees (~$0.003). It also boasts fast finality (~13 seconds) and sub-second block times.

● Users & Adoption: With over 4.8 Quarterly active addresses, Solana has the highest engagement of any chain evaluated. It ranks #2 in TVL with $6.6B locked, showing high user trust.

● Compliance & Extras: Solana meets core regulatory-friendly features (analytics support, on-chain data access), but lacks a native freeze function. It gained additional points for tooling, analytics integration, and developer ecosystem maturity.

● Privacy & Risks: Solana does not emphasize privacy tools and has experienced outages in the past. However, recent upgrades have stabilized the chain.

2. Aptos: Fast Finality, Young but Growing

● Tech Strength: Aptos impresses with sub-second finality(0.9s),0.13s block times and minimal fees($0.0001).It scored full marks on fees, finality, and smart contract capacity.

● Adoption & Ecosystem: Around 904k active users and growing DeFi footprint. Strong VC support and over 1,000 active developers.

● Compliance & Bonus Factors: Aptos earned points for governance structure, developer support, and analytics integration. It initially received credit for new metrics (emerging markets, foundation support) but those were removed in this analysis to level the field.

● Privacy & Risks: Aptos lacks built-in privacy features and is still relatively new (launched late 2022), which led to a lower stability score. Still, no major incidents have occurred.

3. Avalanche: Fast Settlement and Customization

● Tech Strength: Avalanche delivers ~2s block time and ~1s finality via Snowman consensus. Real usage TPS is moderate (~5–10 TPS) but scalable through subnets.

● Adoption & Usage: Only ~43K active users and ~$1.2B TVL. This low adoption kept its user and stablecoin metrics modest.

● Compliance & Flexibility: Offers asset freeze options and robust governance tools. Gained extra points for interoperability and customizable subnets. Tooling support and analytics compatibility also rated positively.

● Privacy & Risks: No native privacy mechanisms. Moderate decentralization (1,500 validators). Considered technically solid with clean operational history.

4. Sei Network: Specialist Chain for Finance

● Tech Strength: Sei has near-instant finality (~400ms) and negligible fees (<$0.0005). It is tailored for high-frequency trading apps.

● Adoption & Maturity: ~426K Quarterly users and $400M TVL, with a still-growing ecosystem.

● Compliance & Features: Sei scored well on additional criteria like stability, analytics compatibility, and lack of reorgs. Its institutional-focused design aligns with regulated use.

● Privacy & Risks: Lacks privacy functionality, but has had no outages. Limited validator set and youth (launched 2023) lowered its decentralization and stability score.

5. Ethereum: Security Giant, Slower Performer

● Tech Strength: Ethereum scored lower on performance (15–30 TPS, 12s blocks, $1+ fees), but is unmatched in decentralization and security.

● Adoption & TVL: Still #1 in DeFi with ~$49B TVL and an extensive app ecosystem. Tens of millions of users across mainnet and L2s.

● Compliance & Ecosystem: Lacks freeze function at base layer but excels in auditability, openness, and dev tools. Major custody and analytics support.

● Privacy & Risks: Does not natively support privacy transactions. Considered the most stable and transparent platform.

Why Some Chains Didn’t Qualify

Not all popular chains made it past Wyoming’s initial eligibility screening. The state applied a strict binary filter—chains either passed all critical requirements or were excluded from scoring. These requirements ensured regulatory readiness, transparency, and baseline decentralization. The key criteria included:

● Permissionless Network: Anyone can transact or deploy applications without approval.

● Validator Onboarding: Validators must be able to join freely, not handpicked.

● On-Chain Analytics Support: The chain must allow transaction tracking and integrate with analytics tools.

● Transparent Supply: Total token supply and issuance must be publicly visible.

● Freeze/Seize Capability: The protocol must offer some form of asset control in legal scenarios.

● Custody & Compliance Support: Major custody or analytics vendors must support the chain.

According to the decision made by Wyoming :

● Tron was excluded due to centralized validator onboarding and missing analytics/custody vendor support. Its validator model (27 fixed representatives) and lack of protocol-level freeze tools made it non-compliant.

● XRP Ledger failed on validator openness. It uses a Unique Node List (UNL), a curated list of validators, violating the permissionless onboarding rule. Despite supporting token freezing and having transparent supply, this governance structure led to disqualification.

● Cardano was excluded mainly for lacking protocol-level freeze/seize capability. Its architecture prioritizes decentralization, but not compliance functionality.

● Monero was ineligible due to lack of on-chain analytics and a fully private transaction model, making auditability impossible.

● Other chains like Cronos and EOS also failed one or more of these binary checks, often due to limited validator openness or missing transparency tools.

These filters weren’t about tech specs or user numbers—they were about whether a chain could support public-sector or regulated stablecoin use. Wyoming’s framework reflects priorities that future institutional-grade platforms will increasingly have to meet.

Conclusion: Beyond the Hype, Fundamentals Matter

In the wake of Bitcoin’s ATH and the flood of new capital into the crypto space, it’s easy to get caught up in hype. But as this rigorous evaluation shows, not all blockchains are equal when it comes to technical prowess and practicality for building. Factors like throughput, scalability, cost-efficiency, finality speed, and proven reliability are critical. Solana’s and Aptos’s top rankings highlight that next-generation architectures can significantly outperform older networks on these fronts – potentially offering better user experiences and scalability for DApps. At the same time, Ethereum’s ubiquity and security aren’t discounted – but builders must acknowledge its current limitations (which is why Layer-2 solutions exist, though those come with their own trade-offs as seen with Arbitrum/Optimism scores).

Perhaps most importantly, the “softer” factors (governance, compliance, ecosystem support) should not be ignored. Some very prominent chains were excluded entirely because they lack features that serious enterprises or regulators expect. For builders and investors, this means you should evaluate not just a chain’s TPS or TVL, but also its openness, transparency, and support ecosystem. A blockchain that can’t easily be analyzed or integrated with compliance tools might pose risks down the road.

Post-ATH, the industry’s focus is shifting from speculative gains to building real applications that can scale to millions of users. The Wyoming scoring initiative reflects this maturation – emphasizing tangible metrics over hype. If you’re considering where to deploy your next smart contract or which platform’s ecosystem to bet on, look at the data: speed, security, cost, community. The top-ranked chains in this program earned their spots by excelling in those areas. By using a similar analytical lens – and paying attention to why some chains failed the bar – you’ll be better equipped to choose a blockchain platform that can carry your project or investment to success in this new phase of the market.

PEPE0.00 -3.23%

PEPE0.00 -3.23%

TON1.35 -0.71%

TON1.35 -0.71%

BNB623.28 -2.02%

BNB623.28 -2.02%

SOL84.80 -2.70%

SOL84.80 -2.70%

XRP1.42 -1.40%

XRP1.42 -1.40%

DOGE0.09 -1.63%

DOGE0.09 -1.63%

TRX0.28 -0.25%

TRX0.28 -0.25%

ETH2037.20 -3.89%

ETH2037.20 -3.89%

BTC69803.33 -0.47%

BTC69803.33 -0.47%

SUI0.94 -2.76%

SUI0.94 -2.76%