Hong Kong's largest crypto platform HashKey is heading to IPO with strong market dominance but faces challenges with crypto-linked revenue volatility and ongoing profitability concerns.

HashKey is poised for its public debut. On December 1, the operator of Hong Kong's largest licensed crypto trading platform cleared a decisive regulatory hurdle: the HKEX listing hearing. With JPMorgan, Haitong International, and Guotai Junan International acting as joint sponsors, the group has entered the final sprint toward an initial public offering.

From a sectoral vantage point, HashKey will become the second crypto-native entity to list on the HKEX, following OSL. Yet, the strategic divergence is marked: where OSL has carved a niche in institutional custody and brokerage, HashKey, originating as a retail exchange, boasts a broader operational scope, exposing it more directly to the caprice of crypto market cycles.

The prospectus, released post-hearing, offers the granular insights required to dissect the company’s inner workings. This analysis scrutinizes the ledger across four critical dimensions: revenue composition, financial health, user demographics, and the intricacies of its shareholding structure.

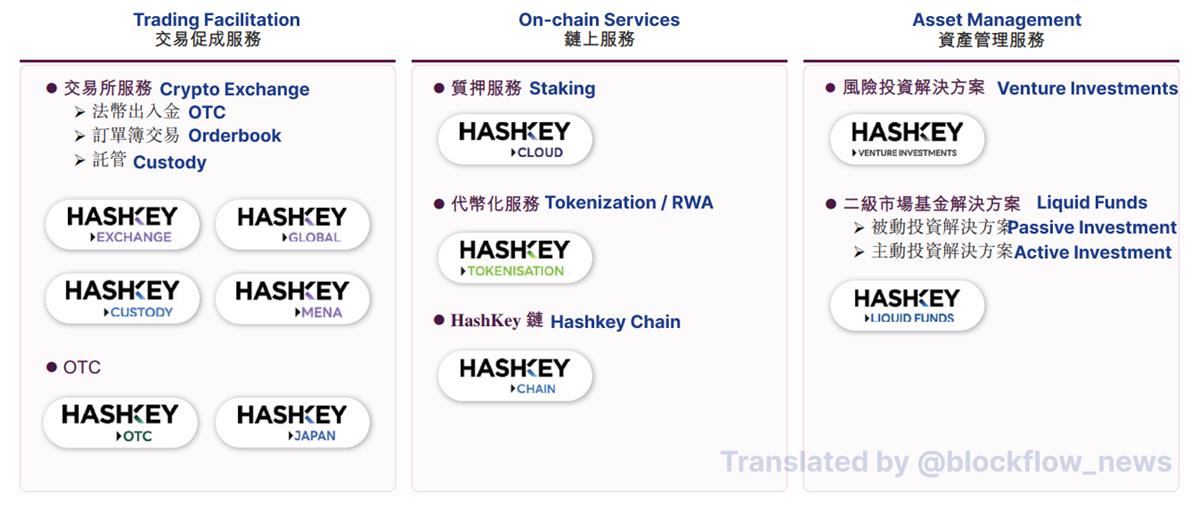

Business Architecture: Beyond the Exchange

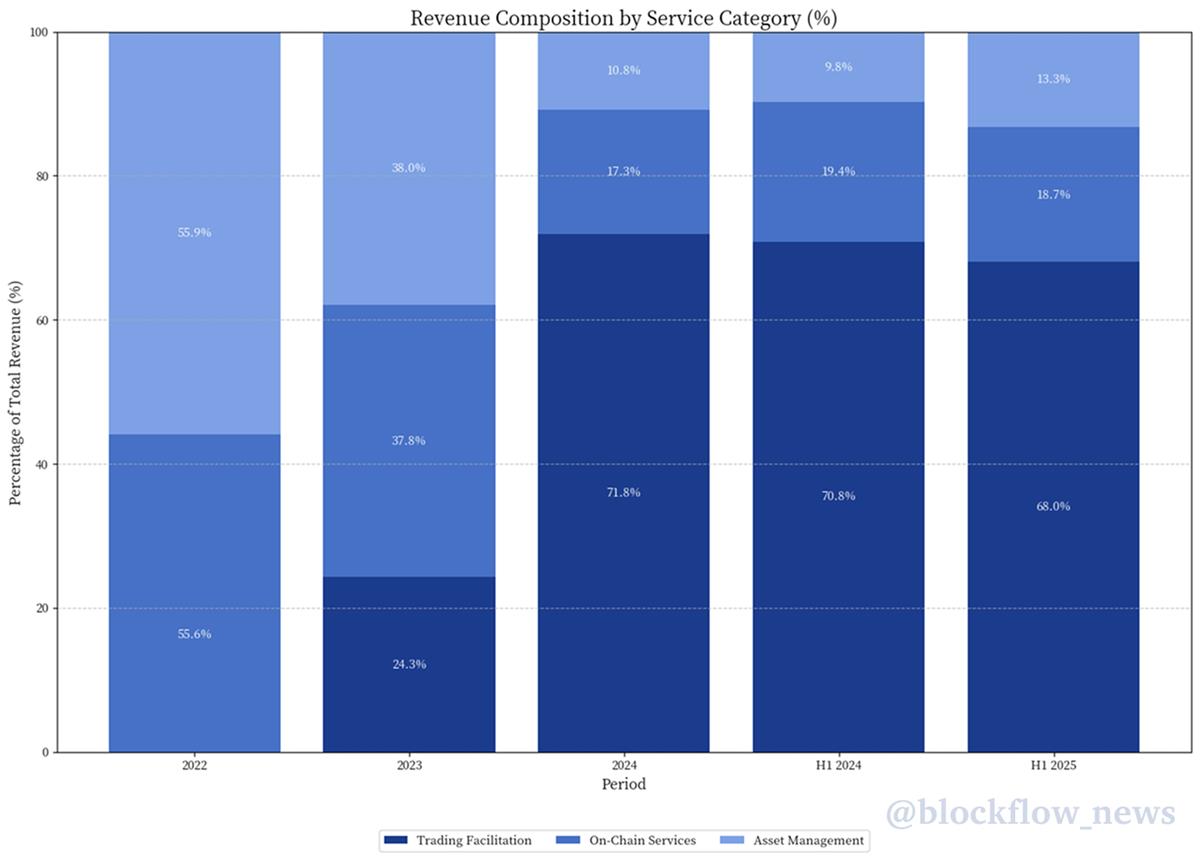

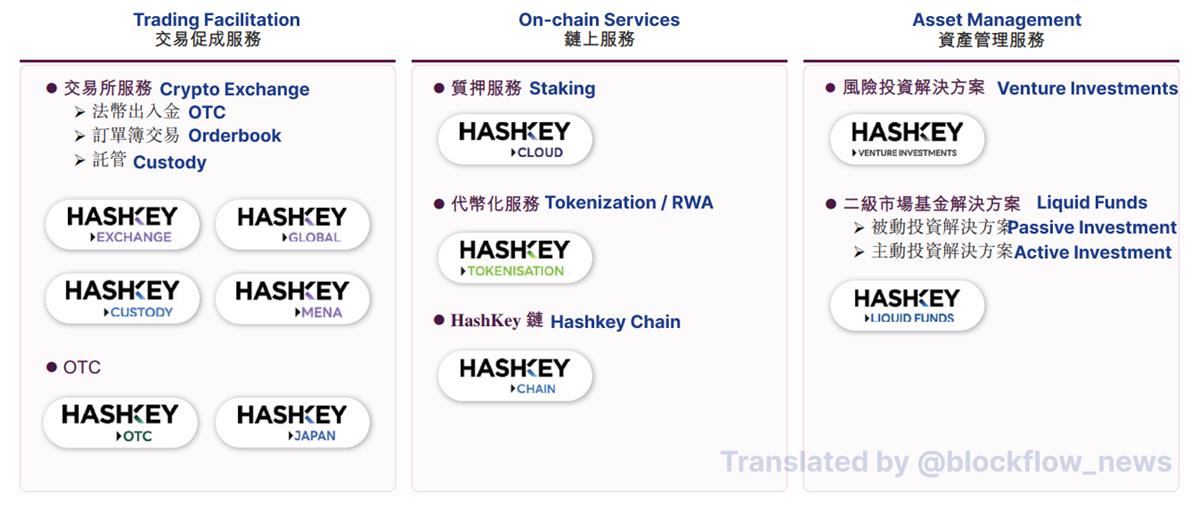

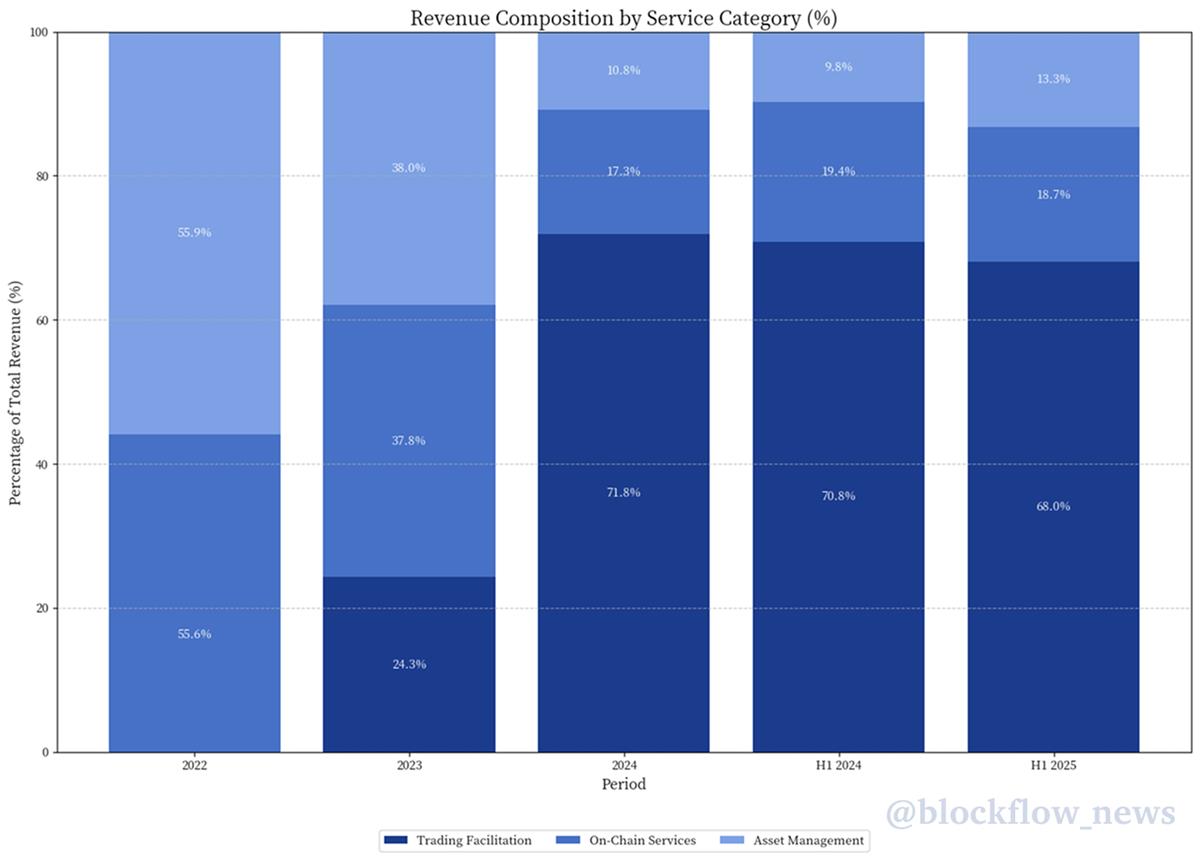

To characterize HashKey solely as a licensed venue is to overlook the complexity of its blueprint. The prospectus delineates a "comprehensive digital asset company," structured around three pillars: trading facilitation, on-chain services, and asset management.

The ambition is evident: to forge a closed-loop ecosystem spanning the entire value chain of trading, custody, staking, and asset management.

Trading Facilitation remains the bedrock. This segment encompasses the spot exchange and over-the-counter (OTC) services for high-volume execution. By September 2025, the platform had facilitated HK$1.3tn in spot volume, with client assets sitting at HK$19.9bn. On 2024 volumes alone, HashKey commands over 75 per cent of the licensed market in Hong Kong, positioning it as the region’s dominant onshore platform.

On-Chain Services offer differentiation. This vertical integrates staking, tokenization, and the HashKey Chain (a Layer 2 solution). The staking arm has achieved significant mass; as of September 2025, staked assets stood at HK$29bn, ranking HashKey as Asia's largest and the world's eighth-largest provider. Meanwhile, the tokenization unit is tasked with bringing real-world assets (RWA) onto the blockchain. Initially focused on financial instruments, it has eyes on commodities and energy.

Asset Management targets the institutional allocator. Through two flagship funds, HashKey managed HK$7.8bn in client assets by September 2025, executing over 400 investments ranging from early-stage venture capital to secondary market strategies.

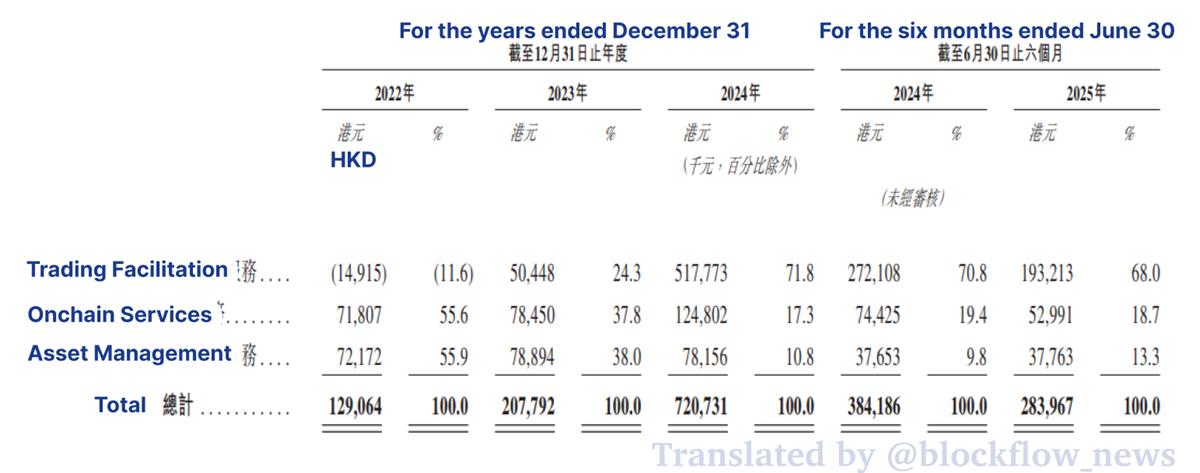

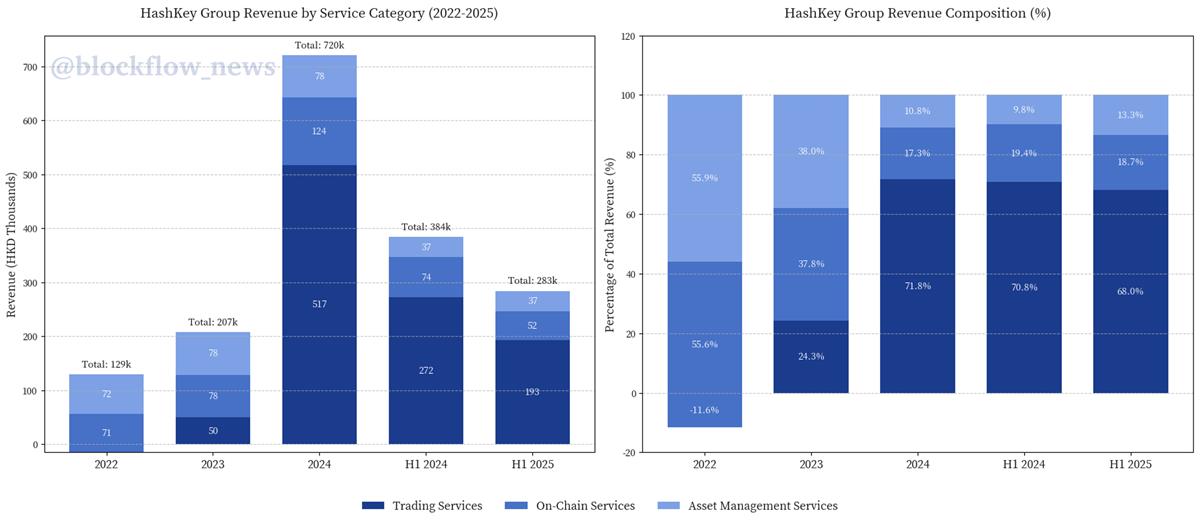

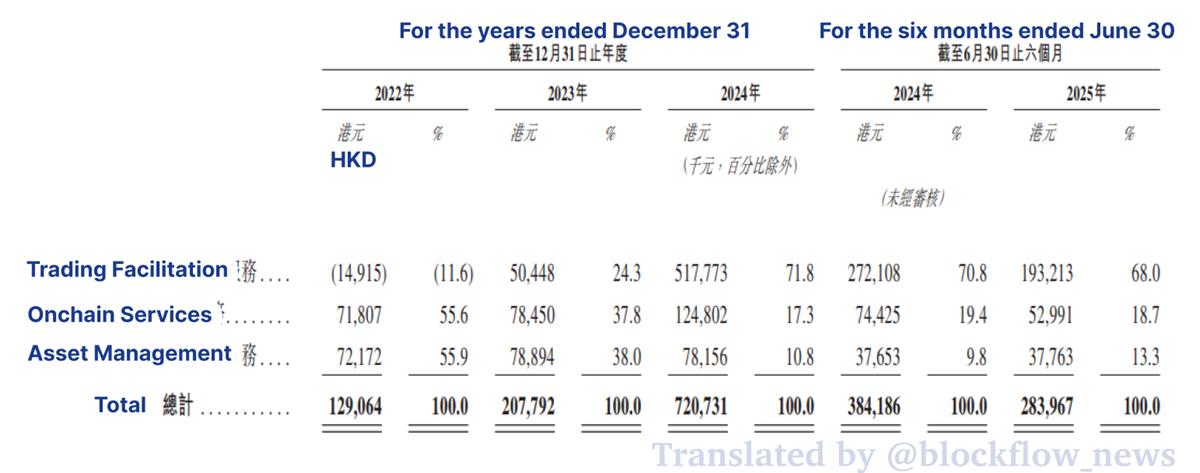

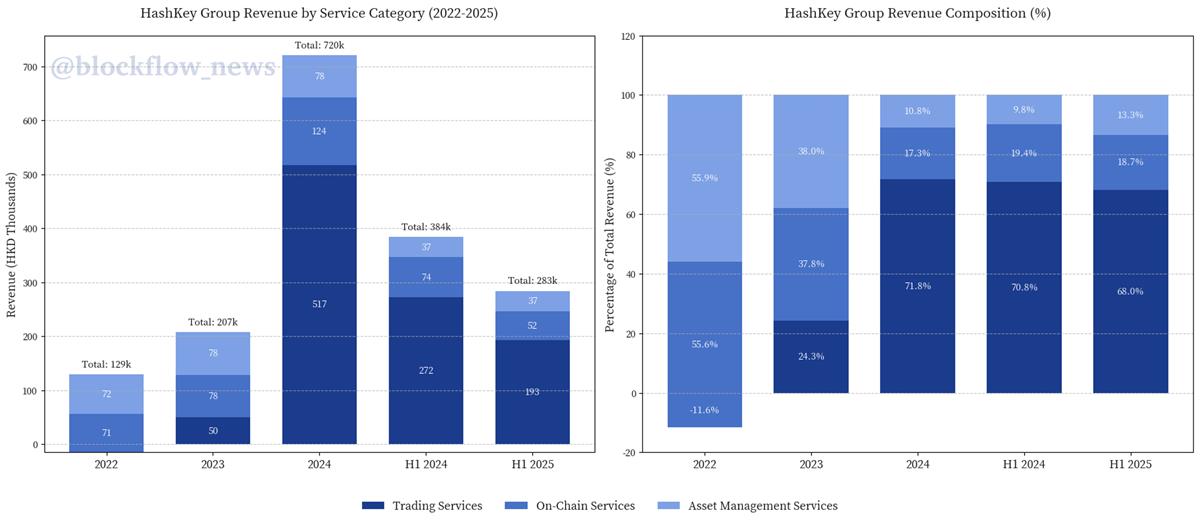

The revenue mix for the first half of 2025 underscores this diversification, yet highlights a persistent reliance on the core: trading facilitation generated 68 per cent of revenue, with on-chain services and asset management contributing 18.7 per cent and 13.3 per cent, respectively.

Revenue Dynamics: The Volatility Trap

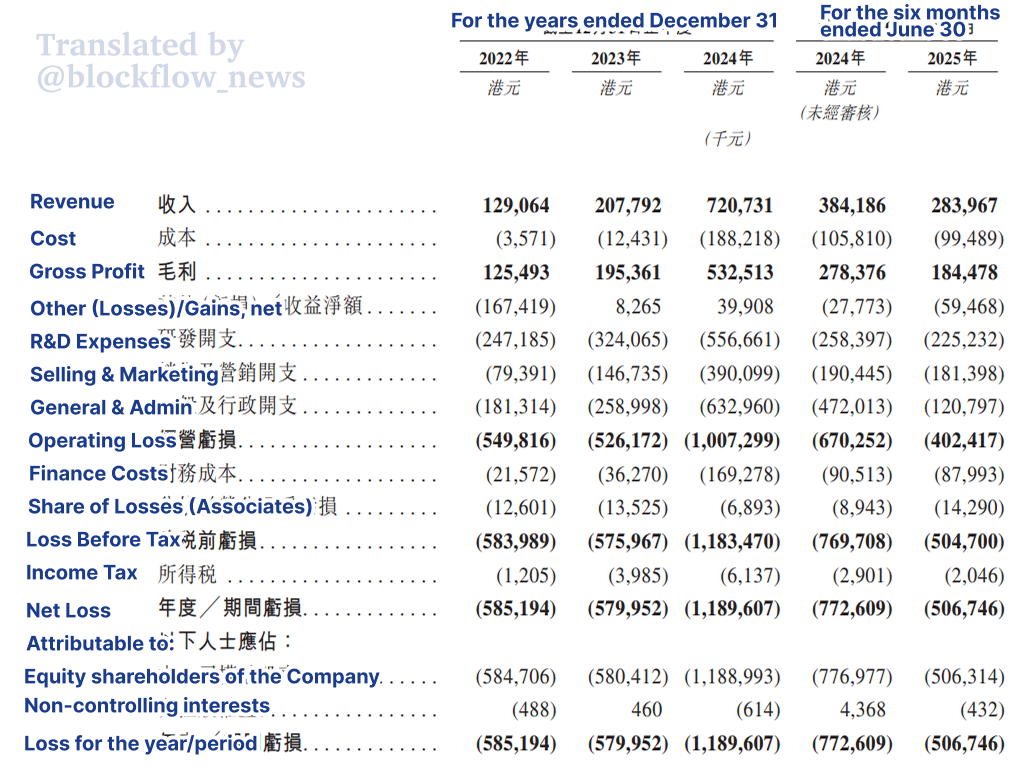

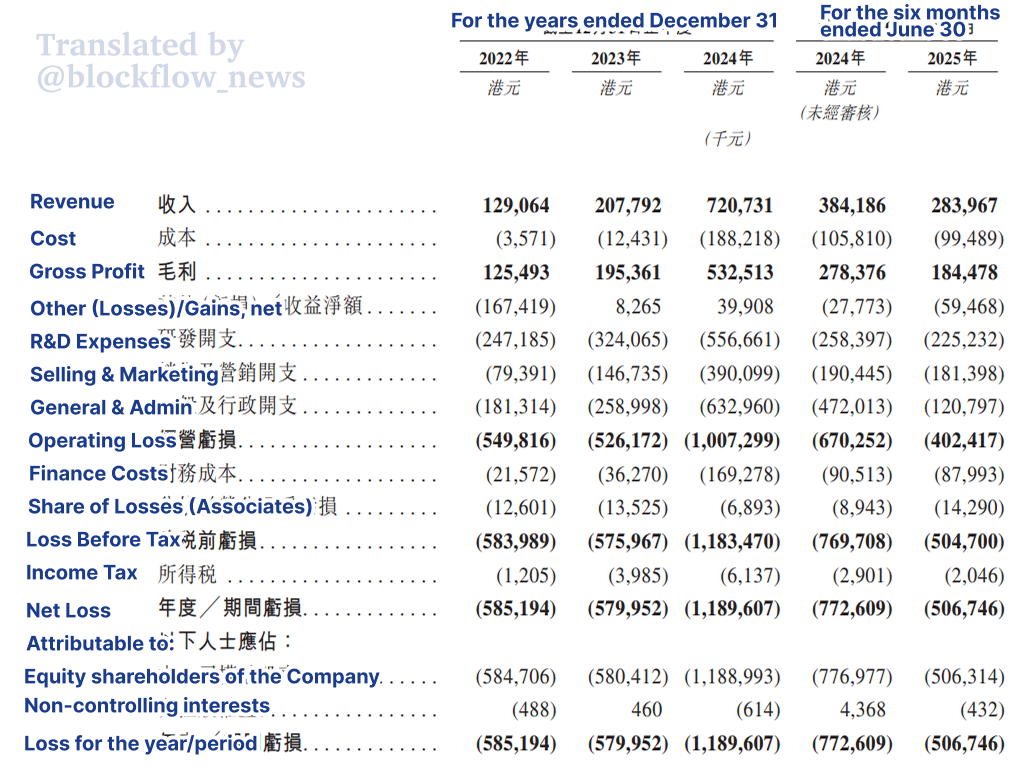

HashKey's revenue trajectory traces the classic boom-and-bust contours of the crypto sector. Revenue swelled from HK$129mn in 2022 to HK$208mn in 2023 (a 61 per cent rise) before skyrocketing 247 per cent to HK$721mn in 2024. It is a growth curve characteristic of a bull market beneficiary.

Yet, the momentum stalled abruptly in the first half of 2025. Revenue contracted 26 per cent year-on-year to HK$284mn, a reversal that demands scrutiny.

Dissecting the performance reveals the mechanics of this downturn:

Trading remains the undisputed revenue driver. In the first half of 2025, trading facilitation contributed 68 per cent of revenue, derived from commissions, OTC spreads, and fair value adjustments.

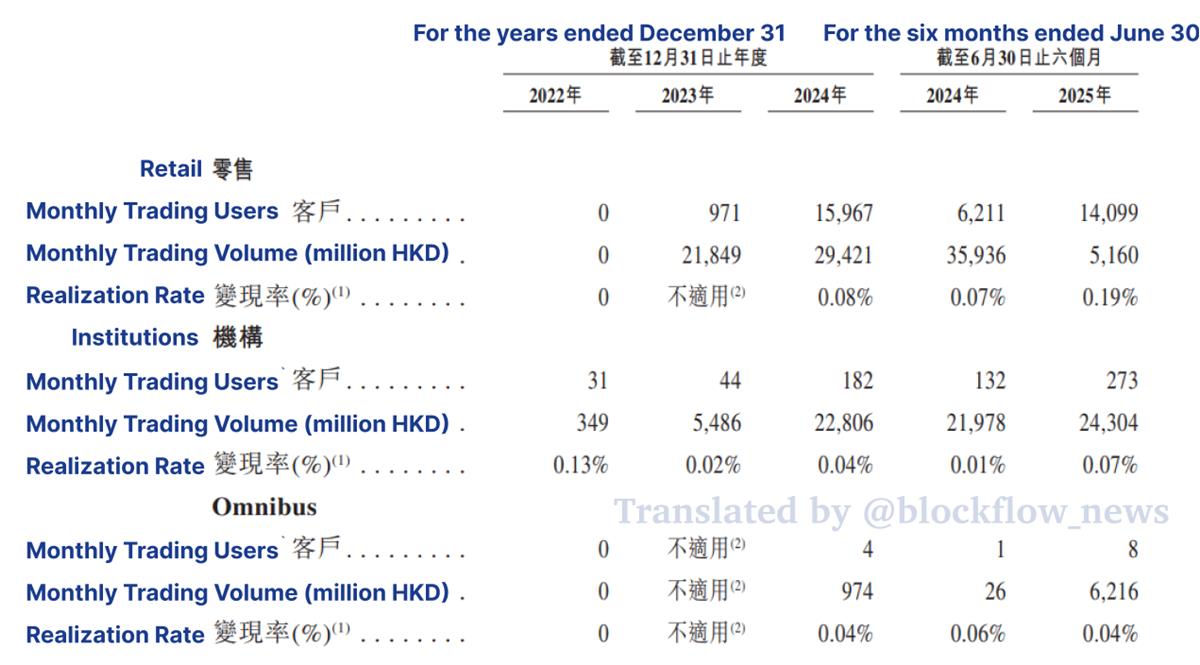

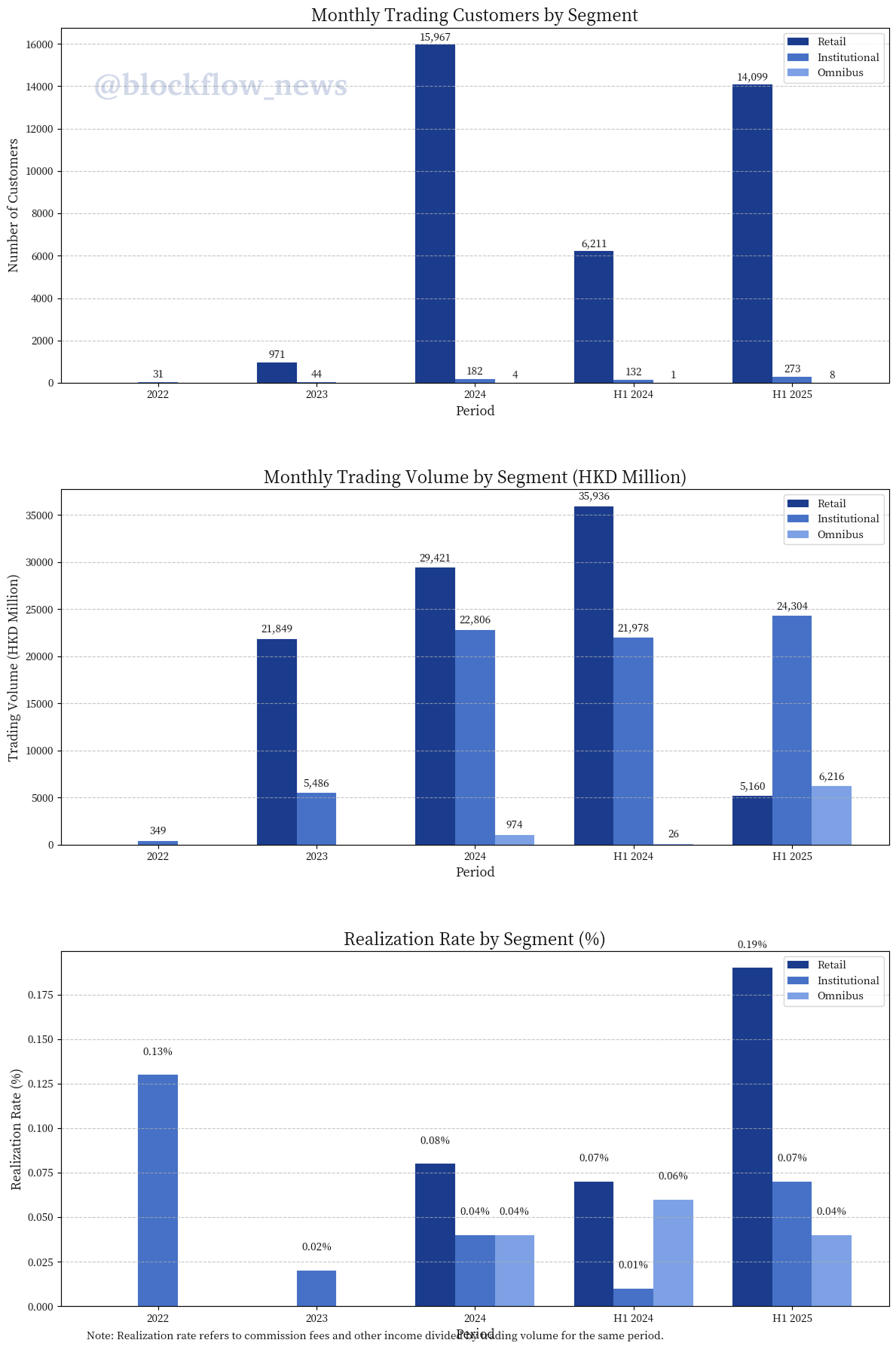

The prospectus illuminates two pivotal metrics: monthly active traders and monetization rates.

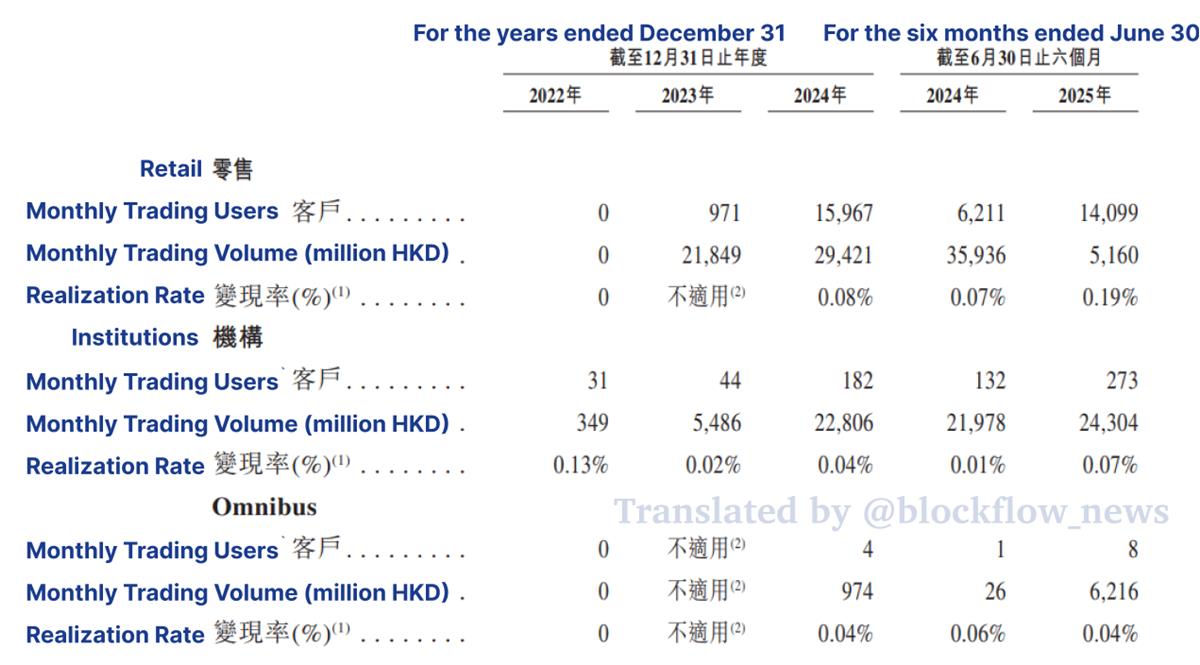

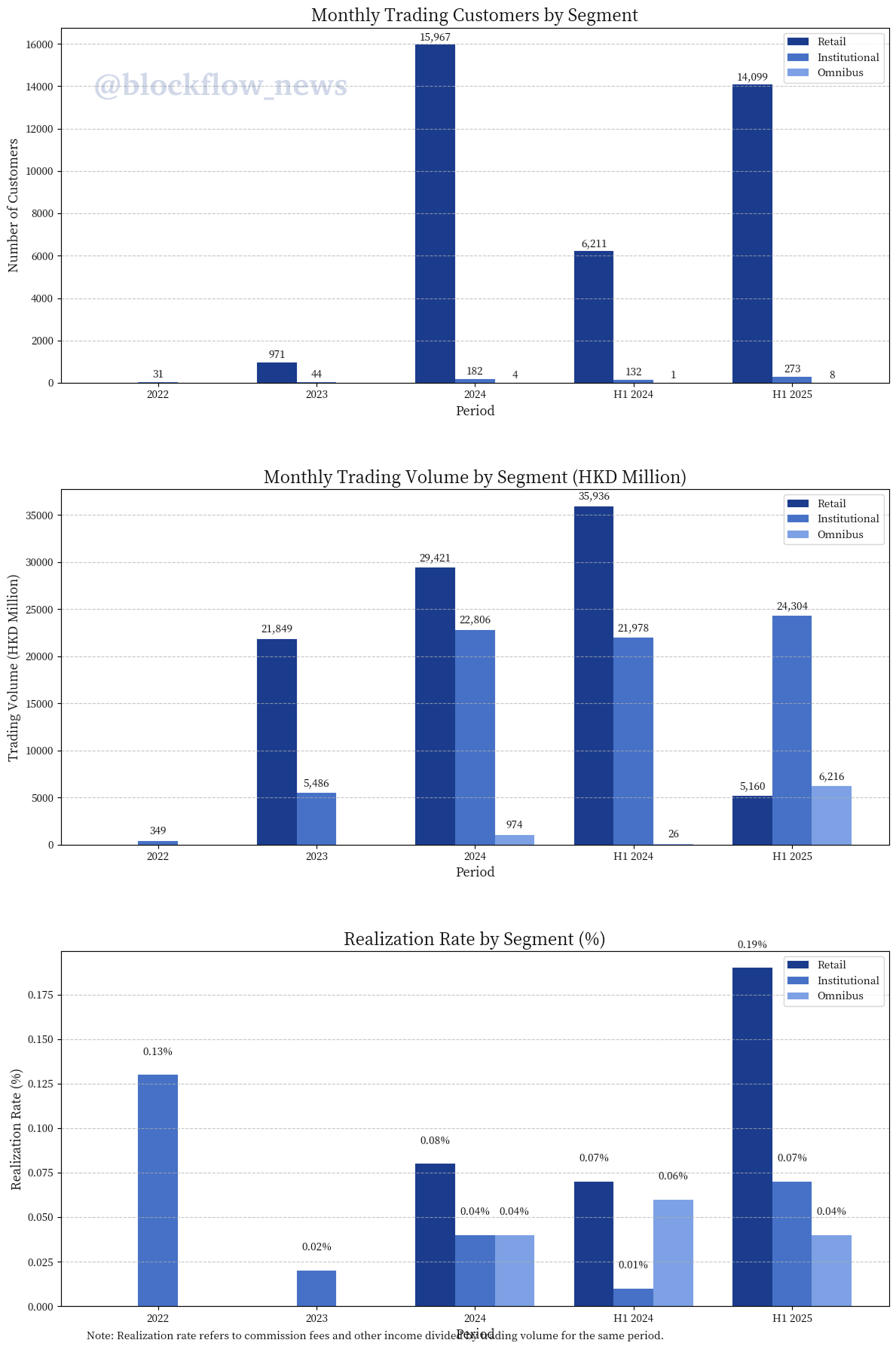

Retail activity is modest: monthly active retail traders slipped from roughly 16,000 in 2024 to 14,000 in the first half of 2025. Conversely, institutional clients, though fewer in number, drove the bulk of trading volume.

The monetization spread is telling: institutional clients pay an effective take rate of roughly 0.07 per cent, compared to 0.19 per cent for retail and a razor-thin 0.04 per cent for omnibus clients (partners). This pricing hierarchy reflects the trade-off between volume and margin.

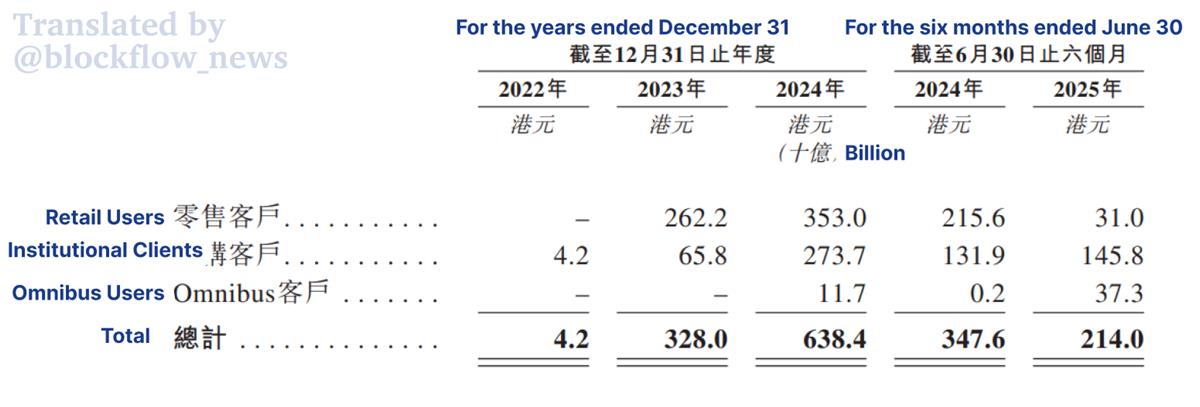

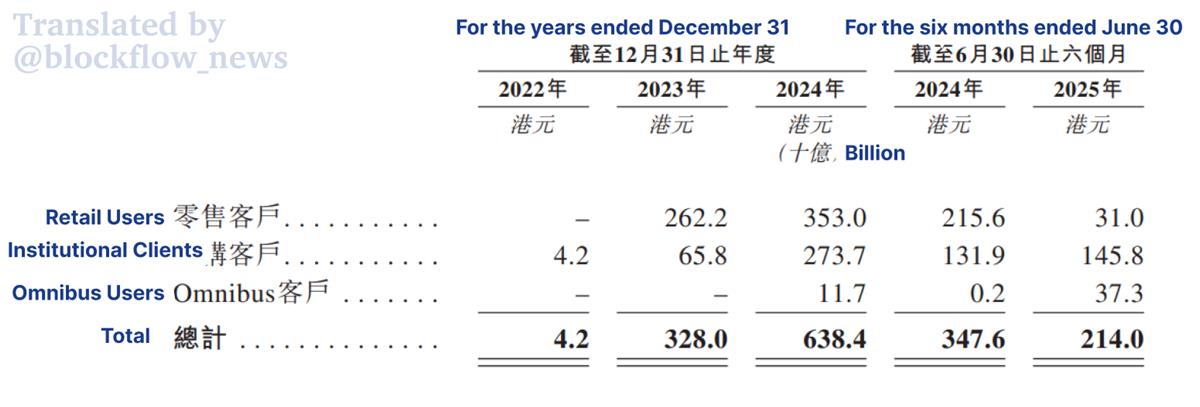

Volume volatility determines the bottom line. Trading volume collapsed from HK$347.6bn in H1 2024 to HK$214bn in H1 2025. The causes are twofold: a broader market cooling and a strategic retreat from the Bermuda market due to banking channel bottlenecks.

Emerging verticals are growing, but slowly. While on-chain services and asset management command higher gross margins, their scale is currently insufficient to hedge against the volatility of the trading desk.

The fundamental tension in HashKey’s model is laid bare: growth remains tethered to trading volumes, which are inextricably linked to market sentiment. For a public company, this dependency translates to low earnings visibility.

Client Metrics: The Institutional Pivot

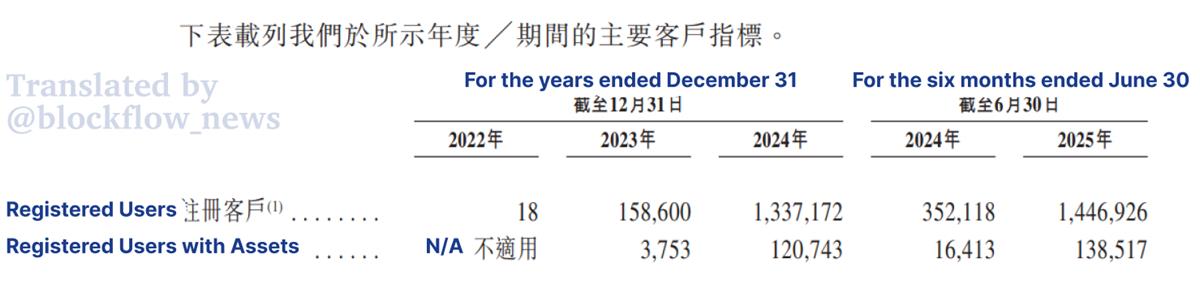

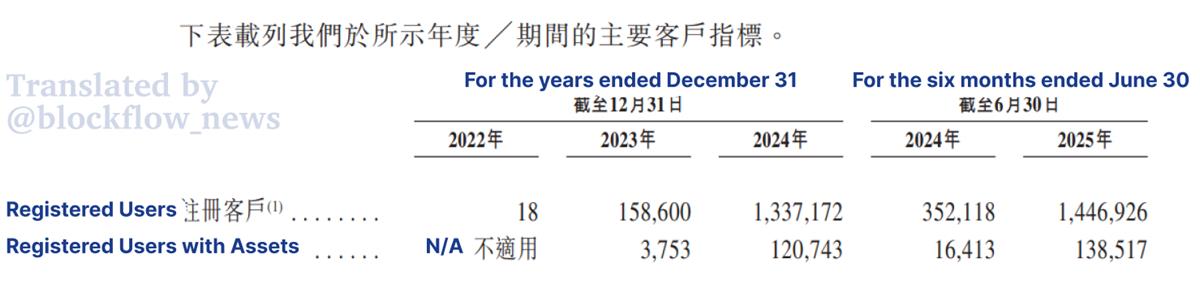

HashKey's user acquisition narrative is one of deceptive velocity. The headline figure (a surge from 18 registered users in 2022 to nearly 1.45mn by mid-2025) suggests exponential adoption. Yet, the more instructive metric lies in the conversion to funded accounts.

Of the 1.45mn registrants, only 138,500 (9.6 per cent) held assets on the platform as of June 2025. While this conversion rate has improved from a meager 2.4 per cent in 2023, it underscores the challenge of turning sign-ups into revenue-generating clients. The prospectus touts a 99.9 per cent retention rate for funded clients, a figure that demands context: retention here implies custody, not necessarily activity.

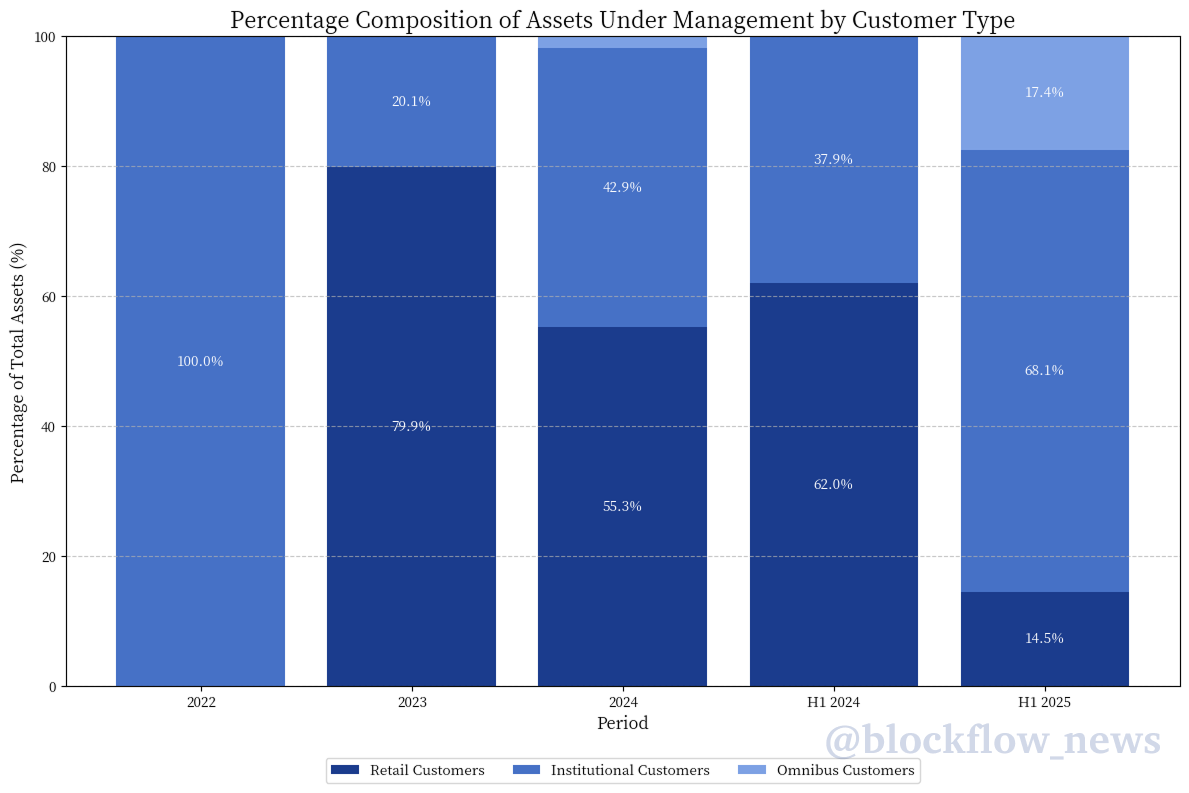

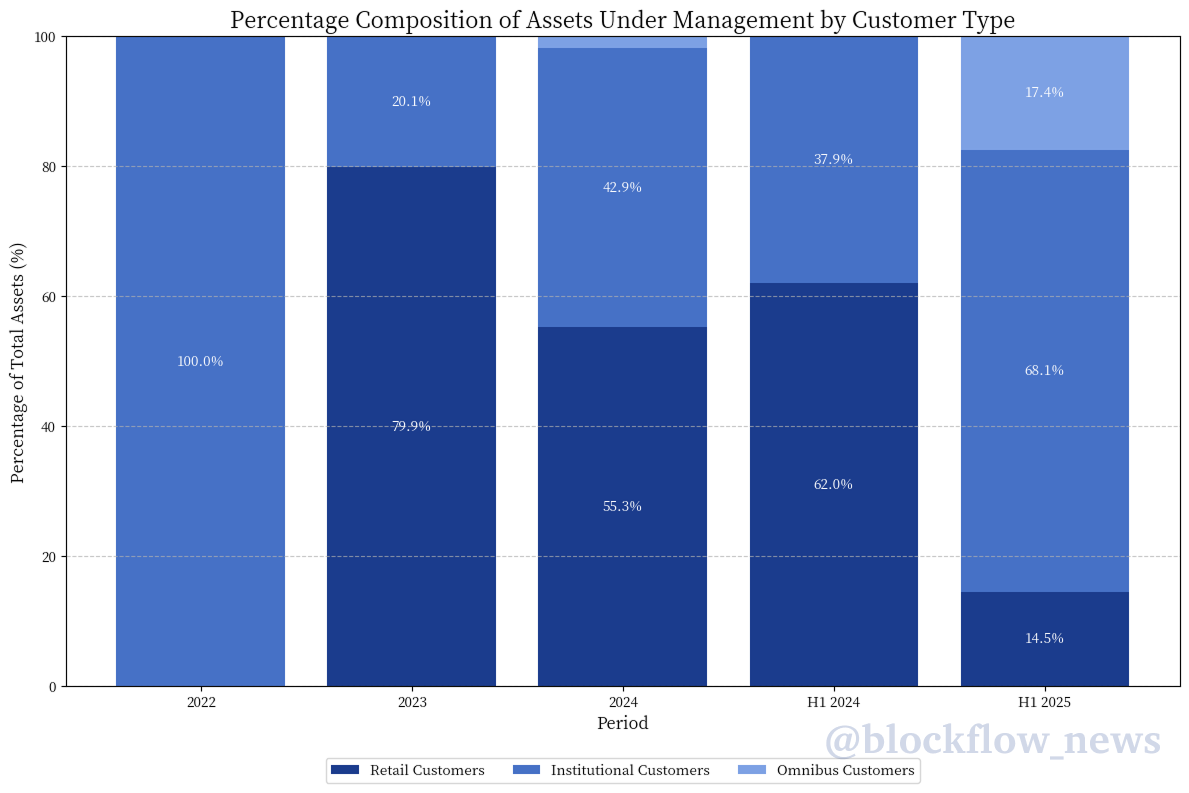

More significant is the structural rotation in the client base. HashKey is aggressively pivoting from a retail-centric model to an institutional one. Institutional volumes commanded 68 per cent of the flow in the first half of 2025, up from 62 per cent the previous year. Simultaneously, retail volume collapsed from HK$215.6bn to just HK$31bn, a precipitous drop reflecting both market apathy and a strategic de-emphasis on the retail segment.

The "Omnibus" channel (effectively a B2B2C wholesale model) is the emerging growth engine. Volumes here swelled from a negligible HK$200mn in H2 2024 to HK$37.3bn in H1 2025, signaling HashKey's intent to leverage partner networks rather than fight the costly war for direct retail acquisition.

Geographically, the retrenchment from Bermuda (driven by the absence of fiat rails) further concentrates the risk and reward within the Hong Kong jurisdiction.

Financials: The Elusive Path to Profitability

The path to the public markets is paved with red ink. HashKey’s financials reveal a company prioritizing scale and compliance infrastructure over immediate profitability.

Net losses widened from HK$580mn in 2023 to HK$1.19bn in 2024. The drivers of this deficit are threefold: a near-doubling of operating losses to HK$1.0bn; a surge in finance costs to HK$169mn; and, crucially, a HK$400mn swing in "other net losses," driven largely by fair value writedowns on digital assets.

This last item exposes a structural vulnerability: HashKey’s balance sheet acts as a shock absorber for crypto volatility. When asset prices fall, mark-to-market losses gnaw directly at the bottom line.

The first half of 2025 offered a mixed picture. Losses narrowed by 35 per cent to HK$506.3mn, but this optical improvement coincided with a 26 per cent drop in top-line revenue to HK$284mn. The revenue compression was acute in the trading division, where digital asset trading income plunged 75 per cent.

Gross margins, meanwhile, have come under pressure, retreating from 72.5 per cent to 65.0 per cent. This margin compression is a symptom of the "double squeeze": falling volumes reduce fee income, while declining asset prices erode the value of proprietary inventory.

Shareholding Structure: Who Gets the Pie?

In HashKey's shareholding structure, there are three key questions: Who controls this company? Who will benefit from the listing? And, which redeemable liabilities will eventually become whose equity?

The prospectus discloses that HashKey will have four controlling shareholders:

-

Lu Weiding: Non-executive Director, actual controller of Wanxiang Group

-

GDZ International Limited: Related entity

-

HashKey Fintech III: A subsidiary fund of the company

-

Universal Energy Co., Ltd. (Stock Code: 00090)

Since the prospectus is not yet finalized, the specific shareholding percentages of these four parties have not been disclosed, marked as "[redacted]" in the document.

In HashKey's power structure, two names must be mentioned:

Xiao Feng: Executive Director, Chairman and CEO. The prospectus refers to him as Dr. Xiao. He is an early promoter of the blockchain industry in China, formerly General Manager of Bosera Funds, and founded Wanxiang Blockchain Lab in 2015. In HashKey's narrative, Xiao Feng is the spiritual leader and strategic designer.

Lu Weiding: Non-executive Director, referred to as Mr. Lu in the prospectus. Chairman of Wanxiang Group. Wanxiang Group is one of China's largest automotive parts suppliers and a significant shareholder of HashKey. Through direct shareholding and employee stock ownership platform voting rights, Lu Weiding effectively controls a large number of voting rights in the company.

Lu Weiding also has a special right: he is entitled to exercise the voting rights attached to 578.6 million employee stock ownership plan shares held by the employee stock ownership platform according to the pre-IPO equity incentive plan. The prospectus discloses that the proportion of these shares in the issued shares after listing is also to be finalized.

In other words, the controlling shareholders not only hold shares directly but also indirectly control a large number of voting rights through the employee stock ownership platform. The prospectus clearly states:

"Immediately following the completion of [redacted] (assuming [redacted] and [redacted] are not exercised), the controlling shareholders will control approximately [redacted]% of the voting rights of the Company."

This is a highly concentrated shareholding structure, meaning that corporate governance after listing will be highly dependent on the will of the controlling shareholders.

The prospectus also discloses a noteworthy detail:

"During the track record period, HashKey Fintech III, GDZ International Limited, and HashKey Fintech II were all among the company's top five clients and are controlling shareholders or their related parties."

This indicates that HashKey's early revenue was highly dependent on related-party transactions. Although this proportion is decreasing, it still raises a question: how much of the company's commercialization capability is truly independent?

There is a similar situation on the supplier side. The prospectus discloses that Wanxiang Blockchain entities were among the top five suppliers in 2022, 2023, 2024, and the six months ended June 30, 2025, and are related parties of one of the company's shareholders.

Overall, the main beneficiaries of HashKey's listing include:

-

Controlling shareholders: Highest shareholding percentage (specific percentage pending final disclosure), plus additional voting rights controlled through the employee stock ownership platform

-

Pre-IPO investors: Will become significant shareholders after redeemable liabilities are converted to shares; listing is their key exit window

-

Employees: Hold 578.6 million shares through the employee stock ownership plan

-

Management: The prospectus discloses that in 2024, the company confirmed HK$566.2 million in equity incentive expenses, a one-time large-scale grant

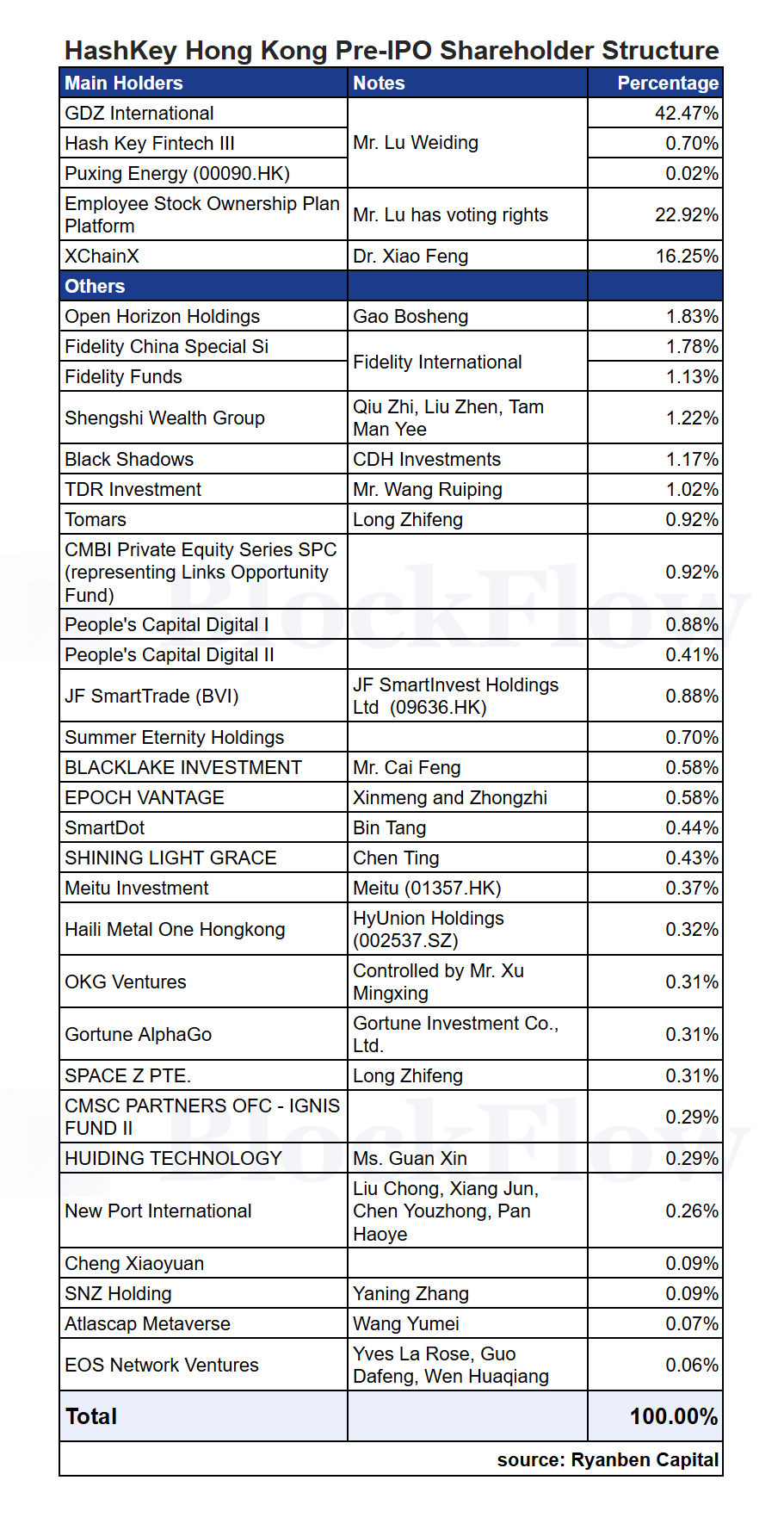

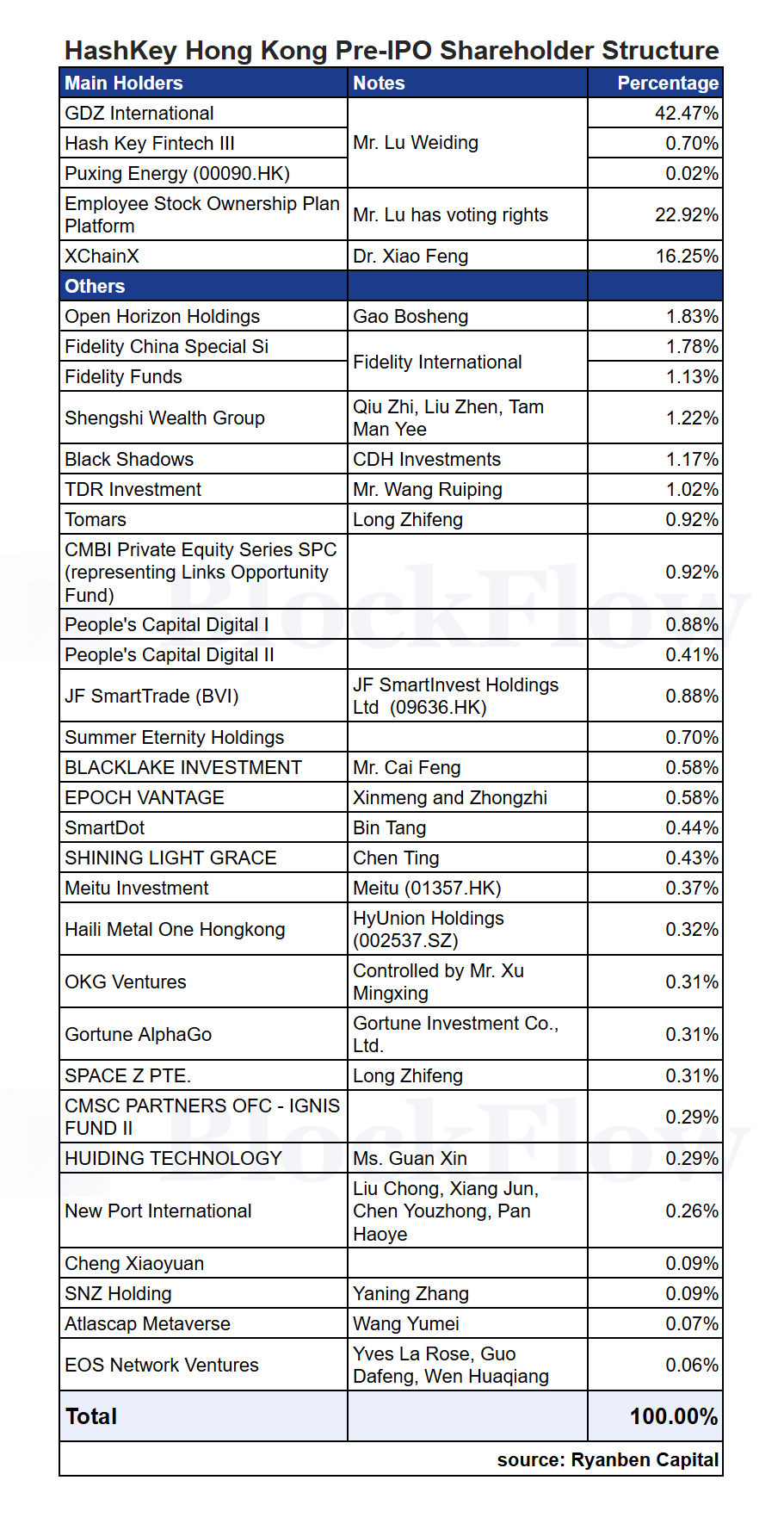

Beyond the prospectus, according to Ryanben Capital's disclosure of HashKey shareholder percentages, we have more detailed information for cross-reference.

This table confirms the earlier judgment: control is highly concentrated. GDZ International holds 42.47%, plus the employee stock ownership platform (22.92%, voting rights exercised by Lu Weiding) and XChainX (16.25%, held by Xiao Feng), the three together account for over 80%. The actual free float after listing will be very small.

Several types of shareholders on the list are worth noting:

First, traditional asset management institutions. Fidelity holds approximately 2.9% through two funds, which is uncommon in the shareholder lists of crypto companies, indicating that HashKey's "compliance narrative" is attractive to traditional institutions.

Second, Hong Kong and A-share listed companies. Meitu (01357.HK), JF SmartInvest Holdings Ltd. (09636.HK), and HyUnion Holding (002537.SZ) are all on the list. For these companies, investing in HashKey is a way to gain exposure to crypto assets.

Third, first-tier RMB funds. Gaorong Capital and CDH Investments are early investors. The listing is their main exit window.

Worth mentioning is that in the crypto industry, OKX and EOS have also invested.

What to Watch Next

After passing the hearing, HashKey enters the pricing and roadshow phase. According to Hong Kong stock market procedures, it typically takes two to three weeks from official offering to listing. By then, the issue price range, cornerstone investor list, and specific allocation of fundraising purposes will all be clear.

Several numbers are worth tracking:

First, valuation. Bloomberg previously reported that the fundraising would not exceed $500 million, but the specific price-to-sales ratio and whether it's at a premium or discount relative to OSL can only be calculated once pricing is announced.

Second, the composition of cornerstone investors. If traditional financial institutions (banks, securities firms, asset managers) are willing to be cornerstone investors, it indicates that institutions are buying into the "compliant crypto assets" narrative; if it's mainly crypto-native funds or related parties, that's another story.

Third, post-listing trading volume and share price performance. OSL's share price has been highly volatile after listing, with generally limited liquidity. HashKey is larger in scale, but the Hong Kong market's pricing ability for crypto asset targets remains unknown.

The prospectus is static, the market is dynamic. This document answers "who HashKey is," but the question of "how much it's worth" awaits the market's answer.

Follow us on X: @blockflow_news

PEPE0.00 -5.38%

PEPE0.00 -5.38%

TON1.31 -3.16%

TON1.31 -3.16%

BNB599.55 -5.81%

BNB599.55 -5.81%

SOL80.88 -5.57%

SOL80.88 -5.57%

XRP1.36 -5.37%

XRP1.36 -5.37%

DOGE0.09 -4.19%

DOGE0.09 -4.19%

TRX0.27 -1.04%

TRX0.27 -1.04%

ETH1948.74 -5.03%

ETH1948.74 -5.03%

BTC66931.15 -3.45%

BTC66931.15 -3.45%

SUI0.90 -5.21%

SUI0.90 -5.21%