Aptos is building a regulatory-compliant "global trading engine" focused on DeFi, stablecoins, and payments, prioritizing sustainable app revenue to become the top revenue-generating Layer 1 blockchain.

Aptos emerged as a standout at this year's Korea Blockchain Week, rolling out a series of strategic announcements that signal its regulatory clout and market ambitions. The momentum is undeniable: Aptos Labs CEO Avery Ching was appointed to the U.S. CFTC's Digital Asset Market Advisory Committee—a clear sign the project is gaining traction in high-level regulatory circles.

In Korea, Aptos secured major wins. Bithumb and Upbit, the nation's top two exchanges, now support USDT deposits and withdrawals on the Aptos network. Even more significant, One of Korea's five largest conglomerates Lotte announced plans to expand its blockchain operations on Aptos.

We spoke with Ash Pampati, Seior Vice President of the Aptos Foundation, about what's next.

When asked about Aptos' core areas of development, Ash was direct:

"The long-term strategic focus of Aptos is DeFi. Our ultimate goal is to build the world's leading trading engine. But unlike other public chains that specialize in a single domain, Aptos is uniquely positioned to lead across DeFi, stablecoins, payments, and decentralized storage. We're building a robust blockchain infrastructure to create an ecosystem where innovation can thrive freely."

Looking ahead to the next year, Ash's answer reinforced this sense of clarity:

"For me, there is only one priority: to become the No.1 public chain in terms of application revenue. The key to a successful ecosystem lies in enabling different types of companies and founders to generate revenue, sustain operations, and grow into unicorns. We will provide comprehensive support to help them achieve this."

In the conversation that follows, Ash shares how Aptos is differentiating itself in an increasingly competitive landscape of Layer 1 platforms and how its vision of becoming a "global trading engine" shapes its path forward.

Four Strategic Fronts: Aptos' Path to Billion-User Scale

Q: It's a pleasure to have this opportunity for a deep conversation with you. Since some Chinese users may not yet be familiar with your background, could you start by introducing yourself? Please share a bit about your past experiences and your current responsibilities at Aptos.

Ash: Absolutely! I'm Ash Pampati, Senior Vice President at the Aptos Foundation. My role is all about supporting the Aptos ecosystem and making sure two critical things happen. First, great businesses don't just survive on Aptos, they thrive. Second, investors and the community actually enjoy being part of this journey. My main job is keeping these elements in perfect harmony and building a vibrant ecosystem that works for everyone.

Q: Looking back over the past year, how has Aptos evolved compared to a year ago? Could you walk us through some of the key milestones along the way?

Ash: Sure! Aptos originated from the Libra (later became Diem) project at Meta, where the core idea was to create better rails for transferring money through apps with billions of users—whether it's Instagram, WhatsApp, or other global platforms—while doing so in a permissionless manner. This philosophy and technology are still at the heart of Aptos today.

Over the past year, our focus has been twofold: growing our on-chain economy and strengthening enterprise interest in the blockchain. Given our roots at Meta, we had a lot of trust built with enterprises and financial institutions, which made it easier to onboard and deepen relationships with these partners once we spun out. Additionally, we prioritized ensuring a thriving on-chain economy.

Specifically, we've made several key advancements:

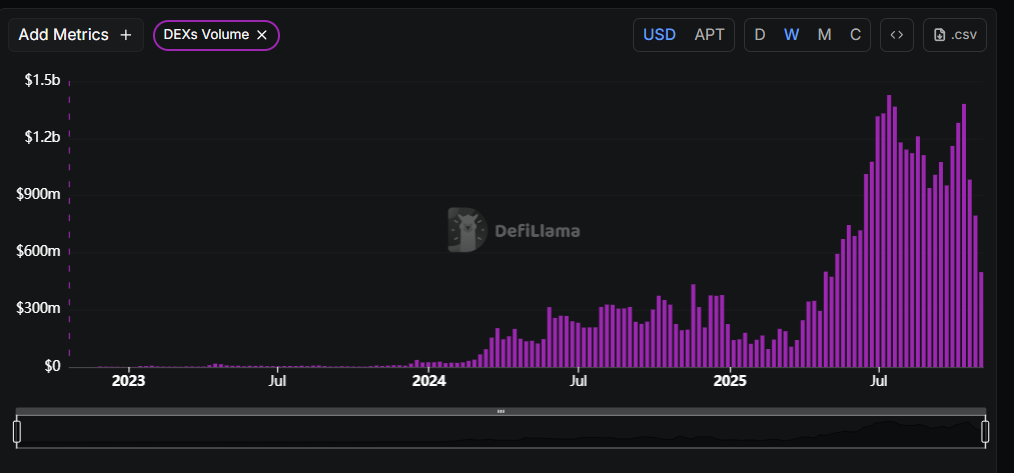

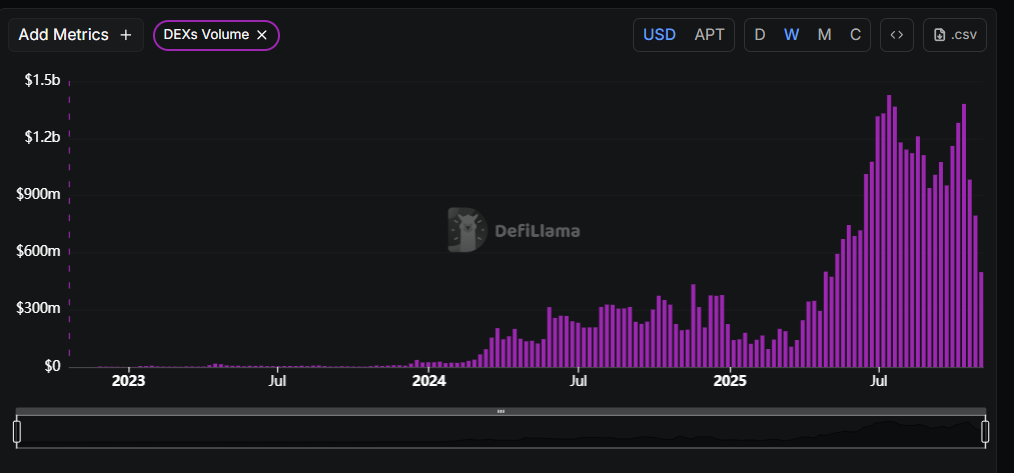

First, the native trading activity on Aptos' decentralized exchange continues to grow steadily. Currently, our daily trading volume has surpassed $150 million, placing us among the top 10 blockchains globally.

Second, the trading and circulation of Aptos stablecoins have seen significant expansion. In just the month of July, our stablecoin trading volume reached approximately $60 billion, despite being a relatively young public chain in terms of stablecoin integration.

Another metric I'm particularly focused on is whether the applications built on Aptos are generating real revenue and establishing sustainable business models. What's exciting is that, over the past month, we've already entered the top 10 across all blockchains in terms of application revenue.

Q: You mentioned some of the successful apps building on Aptos and generating revenue. Can you describe the current state of the Aptos ecosystem? Are there any standout projects you'd like to highlight?

Ash: The current state of the Aptos ecosystem is that it's a sleeping giant, but it's waking up. We have a unique philosophy at Aptos: we believe the next big unicorn will come from a founder who is native to Web3. While institutional and enterprise interest is important, we need people who live and breathe the Web3 industry every day to help guide growth. This is what drives us when we think about projects and startups in our ecosystem.

Let me break this down into a few areas:

-

DeFi

DeFi is a term that's often used, but we see it as the backbone of the global trading engine, and Aptos is fully focused on advancing it. We've made tremendous strides in the trading venues space by onboarding new native decentralized exchanges (DEXs) that are centralizing liquidity. A great example is Hyperion, which was incubated in partnership with our official Chinese community organization Movemaker in February. By June, it was already a top DEX on Aptos, and by July, it completed its token generation event. This is the kind of ecosystem growth we want to see.

-

Money Markets and Lending

We've deployed with Aave, the first non-EVM chain for its protocol, which demonstrates the level of institutional trust we've built, particularly with enterprise-grade technologies like Chainlink. This partnership sets the foundation for institutional adoption and liquidity coming on-chain. We've also seen significant growth in products like XBTC and BTC Fi, which are putting Bitcoin to work in DeFi, particularly within the Asian market.

-

New Projects and Innovation

We are incredibly bullish about a new project coming from Aptos Labs called Decibel, a native exchange integrated with the Aptos blockchain. The reason a fast and secure blockchain like Aptos is so crucial is because we want to onboard billions of people to the on-chain economy. Trading is a key activity in this space, whether it's crypto assets, traditional assets, or other innovative things that have yet to come to Web3, such as streaming or AI. We're building the global trading engine that will allow these innovations to thrive.

One of the projects that will unlock new content and innovation is Shelby, a decentralized storage project built in conjunction with Jump Crypto. It may sound like a boring term, but we firmly believe there's a better way to do cloud storage. Shelby will offer 1) usability without compromise, at a lower cost than traditional Web2 services like GCP, AWS, or Azure, and 2) Web3 incentives, enabling creators and users to exchange value the way Web3 is uniquely designed to do.

-

Overcoming the Bottleneck of Data

One of the biggest barriers to mainstream Web3 adoption has always been data. That bottleneck is preventing the mass adoption of billion-user apps. With Shelby, we believe we've solved that problem. By addressing this issue, we're unlocking the potential for Web3 to reach mainstream audiences.

When I look at the Aptos ecosystem, I confidently say that it is a sleeping giant. We're on the cusp of something much bigger, and the innovations we're working on are going to power the next phase of Web3 development.

Regulatory Milestone: Aptos CEO Joins CFTC Advisory Committee

Q: "DAT" has been a hot topic lately, with many blockchains making related moves. Does Aptos have plans in this area, and if so, what can you share with us?

Absolutely, we do have plans, and there's a lot to look forward to in this area. What I can share is that the DATs we're working on will be unique—something that hasn't been done before. While many projects have taken a "copycat" approach to DATs, we're focused on making ours truly distinct and tailored to Aptos.

The reason this is important is because we recognize there's a whole segment of investors—specifically equity investors—who haven't yet participated in crypto tokens. With our DAT initiative, these investors will now have access to the upside that comes from blockchain innovation.

Our ambition is large,we're building with the goal of onboarding a billion users to the blockchain. Through collaborations like Decibel and Shelby, which we're co-developing with partners like Jump Crypto, along with the startups and founders we're nurturing, we're positioning Aptos to be ready for mass adoption. The DAT initiative is a key part of that vision, providing access to groundbreaking innovation in blockchain and opening doors to new opportunities for investors and users alike.

Q: Recently, Aptos Labs CEO Avery spoke before the U.S. Congress and has been appointed as a member to the CFTC's GMAC Digital Assets Market subcommittee. From your perspective, what is the significance of these for Aptos, and what kind of impact might they have?

I don't like to view this as significant only for Aptos; rather, it's a milestone for the entire blockchain industry. Avery’s participation is pivotal for the broader space. Having him engage directly with Congress provides valuable clarity on how blockchain can thrive in the U.S. regulatory landscape. His appointment to the CFTC’s GMAC subcommittee will further help ensure that blockchain has a clear, solid path forward. And I’m confident Avery is uniquely qualified to fulfill this responsibility with great dedication.

Avery’s philosophy is that, at his core, he’s an engineer. As an engineer, his focus is on solving technological challenges with elegance and precision. His vision is to see global economies run on blockchain infrastructure. This focus drives us to continually improve, and even though Aptos is already one of the fastest blockchains, we are always working to make it even better.

Ultimately, Avery’s appointment is not just a win for Aptos; it’s a win for the entire crypto space in the U.S. It will help advance the conversation around blockchain technology and its role in the global economy.

Q: Avery recently became the CEO of Aptos Labs. How has his leadership impacted the direction of the company, and what kind of innovation or changes can we expect under his leadership?

Avery has a unique approach to leadership. Some people are great at taking something from 0 to 1, while others excel at scaling. Avery is more of the “1 to 100” kind of leader. His philosophy as CEO is that tech is non-negotiable. We believe that the next wave of adoption will be driven by great tech, and that’s why we continue to improve it every day.

Avery’s focus has also been on accelerating our ecosystem. In his first month as CEO, he pushed for a 10x expansion of our ecosystem, and I believe he’s setting the stage for immense growth. He’s deeply embedded in the ecosystem and works closely with startup founders and builders. Combining this approach with our institutional roots makes Aptos uniquely positioned for the next phase of growth.

Q: In the Chinese community, people are sometimes uncertain about what Aptos’ focus areas are—whether it’s DeFi, gaming, or the rising trend of RWA. Could you clarify what the current strategic priorities are?

Absolutely, and thank you for the insightful question. At Aptos, our long-term priority is DeFi, but it’s guided by the broader vision of becoming the global trading engine. Recently, I published an article outlining the products that can be built on Aptos—this includes structured financial products, delta-neutral vaults, and how decentralized exchanges (DEXs) can evolve into the perpetual contracts (perps) world. Concentrating liquidity across Web3 is a major area of focus, and this constitutes about 80% of our attention. We are very opinionated about which teams we support, always focusing on the right projects that align with these principles.

In addition to DeFi, we’re heavily invested in money movement—a sector with two main components: stablecoins and payments. Stablecoins, for us, are not just for trading; they have the potential for real-world impact, such as remittances and microloans, areas where traditional financial systems fall short. We see them as a crucial part of the future and are committed to supporting this ecosystem. Payments, on the other hand, is an area where we believe certain blockchain protocols, like Aptos, offer a distinct advantage in providing better infrastructure and rails for payments.

Furthermore, we are exploring decentralized storage solutions with projects like Shelby, which will empower enterprises and consumer apps to build on a fully distributed system. With Shelby, developers can build decentralized applications like YouTube or AI machine learning models on the blockchain, which are areas we are particularly excited about in the coming 6 to 12 months.

Aptos isn’t just focused on one of these areas; we aim to excel across all of them. Unlike other chains that specialize in one specific aspect, we believe Aptos can handle DeFi, stablecoins, payments, and decentralized storage equally well.

When it comes to the user experience, we believe that the future of Web3 products will resemble Web 2.5—meaning that users won’t even realize they’re interacting with blockchain technology. The key is to provide an exceptional user experience, as seamless as traditional social platforms. And for that to happen, we need an extremely fast blockchain—no friction allowed. If users encounter even a minute of delay, they’ll abandon the app. This focus on speed, affordability, and abstraction makes Aptos an ideal platform for startups.

One great example is KGeN, which started as a distribution platform for gaming companies. They pivoted to focus on human verification for AI models, a critical need due to the surge in AI-driven applications. Their use of blockchain, specifically Aptos, allowed them to scale rapidly without incurring significant costs—something that would have been prohibitively expensive with other blockchains. As a result, Cajun is now the largest non-DeFi revenue-generating protocol in Web3, trending toward a $40 million+ ARR this year.

These are just some of the exciting projects and entrepreneurs who are uniquely succeeding on Aptos. The broader vision is to offer an ecosystem where innovation thrives, powered by our robust blockchain infrastructure.

DeFi First: Aptos' Long-Term Strategic Vision

Q: As you mentioned earlier, do you believe that RWA, stablecoins, and Decibel will drive a new wave of growth in DeFi — perhaps making it more popular than ever before?

I do agree with that perspective.

First, let’s talk about stablecoins. From the very beginning, stability has been one of our highest priorities. Our original vision was simple — to enable every U.S. dollar to move efficiently and securely across an application ecosystem serving billions of users.

Recently, we’ve integrated three major stablecoins — USDT, USDC, and USDe — and also connected PayPal USD (PYUSD) through LayerZero. Compared to chains like Ethereum or Solana, Aptos is still relatively young, yet we’ve managed to integrate such a wide range of stablecoins in a short period of time. To give you one example: Aptos is now the second-largest native deployment chain for USDT, second only to Tron.

What does this tell us? Stablecoins naturally gravitate toward the most advanced technical stacks to achieve broader adoption. For us, this is not only a defining moment for Aptos, but also a time for technology to be truly recognized and appreciated in Web3. One of our most important missions right now is bringing the next billion users on-chain.

Second, I believe that financial inclusion in DeFi is critical — making it accessible to people like my father, or your friends and family. This kind of inclusion is less dependent on market cycles but represents a more sustainable approach — allowing capital to participate in a global, permissionless economy and generate real utility. Rain or shine, we believe inclusive DeFi is the key to mass adoption.

Finally, the question becomes: how do we channel this mechanism into trading? That’s where Decibel becomes truly interesting. Deployed on Aptos, Decibel isn’t just about high-risk perpetual trading. It emphasizes yield generation, collateralization through returns, and mechanisms that make capital flow more efficiently.

When I jokingly say that “DeFi is a little boring,” it’s only because the term has been around for nearly a decade. What we’re really building is a global trading engine — it may not sound as catchy, but its significance is profound.

Q: Could you share more about Aptos' dedicated plans in the areas of RWAs and AI?

Sure. To start with RWAs , Aptos is already ranked among the top 3 or 4 blockchains in this space, which is quite an achievement given how new we are. This speaks volumes about the institutional trust in our technology, particularly the security of EVM、SVM. Just like stablecoins, we're a newer chain, but we’ve quickly gained the confidence of institutions. They see the security and reliability of Move as critical for bringing liquidity on-chain.

However, there's still a key element missing, and that’s the utilization of these RWAs in DeFi for retail users. How can users take advantage of these assets? The term RWA is a bit too broad— it could refer to stocks, stablecoins, fractionalized real estate, or any asset of value. Each of these assets has a different purpose in decentralized trading. For example, some RWAs might be used as collateral for borrowing, while others could be traded on perpetual contracts. There’s a broad range of possibilities for how these assets can be utilized, and for us, that’s the next focus—how to truly unlock and innovate on the use of RWAs across the decentralized ecosystem. We've already gained the market’s trust and proven ourselves in terms of TVL in RWAs. Now, we want to lead the way in driving their utilization.

On the AI front, I look at AI in two main ways. The first is how AI can act as an accelerant for founders, helping them build quickly and intelligently on the chain. One project we've been focused on at Aptos Labs is Giomi, a unique full-stack suite for developers. It provides built-in infrastructure, RPCs, indexes, and a user interface to easily build and deploy any DApp. AI is playing a key role in speeding up development and enabling smarter applications across the board—whether it's for DeFi, SocialFi, or other areas.

The second aspect of AI I’m exploring is how users interact with AI-driven data. Currently, data is provided to centralized companies, and they return aggregated responses based on that data. But I believe users will increasingly want to control the data they feed into these engines. Blockchain is just beginning to find its application in this space, and we’re actively looking for specific teams who have strong opinions and innovations around this area. We want to onboard them and support their efforts.

Q: Aptos has collaborated with OKX to incubate new projects. Do you think this model will continue? Will you be focusing more on venture capital or institutional partnerships moving forward?

A: Yes, I definitely think so. And I believe the way to make this work is for the foundation to take a more hands-on, opinionated approach to guide where we want to see development. One of the earlier criticisms of Aptos was around our focus. Builders were asking, "What exactly is Aptos focused on? How do I know if my project should be built on Aptos or Ethereum?" We've taken a different approach by being very clear and focused on specific sectors and use cases that are critical for growth on the network.

Our approach involves three key elements:

First, being very opinionated about the sectors and use cases that are essential for building on Aptos, and being ready to provide both support and funding for those initiatives.

Second, collaborating with partners—whether investors or other key stakeholders—who share our commitment to those use cases and to the growth of the Aptos ecosystem.

Third, ensuring bottom-up, localized support for builders. We want to ensure that developers, no matter where they are, have access to the resources they need. This includes mentorship, local community support, and funding options, either from Aptos or third-party partners.

For instance, Movemaker has been an important partner for us. They represent us in Hong Kong, which is a key hub for Web3 innovation. Through our partnership with Movemaker, we’ve been able to support projects like Hyperion, Goblin Finance, and Delta Neutral Vaults—all of which are working to build real, scalable businesses. These are just a few examples of how we’re fostering local and regional ecosystems. And we’ve only been working with Movemaker for about six months, yet we’ve already seen such exciting progress.

So, yes, I think this model is one that we want to expand on and continue. We’ll definitely be working more closely with both institutional partners and VCs to help scale the ecosystem and incubate more impactful projects.

Q: So, if I understand correctly, Aptos is building infrastructure for AI, and this will benefit projects that want to leverage your data or build on the platform. You’ve also reached out to traditional institutions and companies to help integrate AI into their systems. Is that right?

Yes, exactly. The beauty of Aptos is that we have deep roots in Web2—specifically in Silicon Valley—where we have strong relationships with major tech centers and financial institutions. These connections give us a unique advantage. Any builder that comes to us can benefit from our network, and we actively help cross-pollinate, introducing them to potential partners and stakeholders from both traditional industries and the emerging Web3 space. Our goal is to make it easier for developers to tap into both Web2 and Web3 ecosystems to accelerate their projects.

Meeting Asia's Sophisticated Crypto Communities on Their Terms

Q: Since we’re speaking here at KBW, I’d love to hear your perspective on the Asian market. How do you envision Aptos' role in the Asian market, especially in China and Korea?

Absolutely. When we think about Asia, we don’t view it as just a single entity. It's a diverse region with deep cultural differences and sentiments, and we acknowledge that fully. For markets like Greater China, Japan, and Korea, one common thread that unites them is their highly intelligent communities. I would even argue that the crypto communities in Asia are more knowledgeable and technical compared to many in the West. These communities don’t just follow trends—they analyze chains, evaluate fundamentals, and scrutinize the teams behind projects, almost like professional analysts. This is something we deeply respect and understand, which is why we focus on collaborating with these communities, listening to their feedback, and implementing their insights quickly.

For Korea, we’re very excited to partner with top firms like Upbit and Bithumb, as we recently announced for USDT. This kind of partnership helps us connect with local users and enables them to transact with the world's fastest dollar, right where they live. This direct, localized approach is crucial for building trust and understanding the value of Aptos in a way that resonates with the market.We’re really focused on being present and engaged on the ground. Similar to how we’ve worked with Movemaker, our approach in Korea is about providing support directly within the market. We want our community to know that they can always reach someone at the foundation. Whether it’s for partnership inquiries, technical support, or general engagement, we’re committed to being accessible and responsive. It’s about building trust and fostering a long-term relationship with the local community, so they feel supported and understood.

Japan is especially interesting right now due to its crypto-friendly regulatory changes. We believe these new policies are going to unlock a lot of opportunities in Japan—not just for trading, but for innovation and development. Japan is very similar to the Greater China and Korea markets in terms of its approach to crypto, so we are excited about the potential for growth and innovation there. We aim to be not just present in Japan but also active in helping to shape the local policy landscape, much like we’ve been involved in policy discussions in the U.S. Our goal is to support Japan’s regulatory evolution and help foster a healthy crypto ecosystem in the region.

Q: You’ve also announced a partnership with Lotte this morning—can you share more on that?

A: Yes, absolutely. The partnership with Lotte is an important step for us. It’s about becoming a part of the cultural fabric of the region. What people use every day, how they engage with technology, and where they find value in those daily experiences. By collaborating with established companies like Lotte, we are able to integrate our infrastructure into a platform that people already trust and use. This not only strengthens our presence in the region but also ensures that we are powering critical backend technology for these key players.

Q:The partnership with Expo 2025 in Japan has been a particularly exciting announcement. What was the strategic thinking behind this collaboration, how has it gone so far, and can we expect similar initiatives in the future?

We're truly honored to be part of this collaboration, and the strategic thinking behind it is rooted in our deep respect for the significance of World Expo, particularly within the Greater Asia community. For many people in the region, attending the World Expo is almost like a pilgrimage. In fact, some members of our founding team, particularly from China, have shared personal stories about how, as kids, they would board a train to visit the Expo. That’s how meaningful it is. It holds a special place in the hearts of many, and it resonates deeply with us.

From a strategic standpoint, this collaboration is about real-world adoption of blockchain technology. Aptos has always believed that blockchain will become the invisible infrastructure powering real-world use cases. And, even though we're still early in the process, the results so far have been exciting. We’ve already seen over 500,000 new accounts created, with over 4.5 million transactions conducted in those accounts. This is a great indicator of real-world adoption—these are regular users, not just crypto enthusiasts, getting involved in the ecosystem.

This partnership with World Expo is just the beginning, and we see it as part of a broader strategy to drive adoption across different markets. We are already looking at similar enterprise partnerships in other Asian markets. Just like how we’ve worked with Latte in Japan, we expect to expand our presence in various regions and continue to collaborate with large enterprises to build bridges between blockchain technology and real-world applications. The future looks very promising, and we’re excited to see how these efforts unfold across other markets as well.

Becoming the Top Revenue-Generating Blockchain Ecosystem

Q: If you could only focus on three priorities for the next year, which ones would you consider the most important?

If I had to, I’d boil it down to one key focus: App revenue leadership across all chains. The core of an ecosystem’s success is when a diverse range of businesses and founders can generate revenue, sustain their operations, and grow into unicorns.

To achieve this, we focus on a few critical areas:

Concentrated Liquidity on Aptos: Ensuring that decentralized finance (DeFi) accelerates with concentrated liquidity and projects like Decibel coming live.

Shelby’s Role in Data: Shelby will help us solve the data bottleneck issue, enabling new types of products and services to be built on-chain.

Native Token Launches: We want to see new types of tokens natively launching and being actively traded on Aptos.

These are all crucial for creating an environment where founders can build sustainable, profitable businesses on Aptos.

Q: Many people often compare Aptos with Sui, especially in the context of competition. How do you view this competition, and how do you position Aptos in relation to other projects like Sui?

A: I don’t really think about competing with Sui. Instead, I focus on competing with ourselves. What I mean by that is, when you look at the metrics, Aptos has made huge strides in terms of on-chain fundamentals. We're consistently ranking in the top 10 for TVL, daily trading volume, RWAs, and stable coin volume. We’re focused on improving these metrics because that’s how you drive adoption.

When it comes to project funding, my philosophy is simple: if a team believes that our technology can uniquely support them in building something great, then I’ll never hold them back from expanding to other chains if needed. I want builders to feel empowered to grow and scale, not boxed into one ecosystem.

The key difference between Aptos and Sui is our philosophy. Avery, our CEO, was the head of blockchain engineering at Meta, where he led the development of the production-ready blockchain. The technology we use today is a direct result of that work. It’s why so many other projects, like Polygon and StarkNet, use the same technology. Our success with parallel consensus and execution proves that the market values elegant, composable technology, which is why many are choosing Aptos as their base layer.

Q: Finally, how do you view the significance of token prices and the long-term vision for Aptos?

I see the token itself as a product. For a Layer 1 blockchain, the token is absolutely critical—it’s like crude oil beneath the ground, fueling our vehicle. We firmly believe in this.

Secondly, I think the market has yet to fully grasp the scale of the impact we are making, but we are confident that understanding will come soon.

Thirdly, we are committed to long-term thinking. My strong sense is that many projects that frequently make headlines today may not exist in a few years, but we will.

My perspective might be a bit 'spicy' – token price is important, but ultimately, everything comes down to the team behind the project and what they care about. Many projects focus solely on token speculation without building anything substantive, which is counterproductive—it hurts both themselves and their communities, and it slows down the development of the entire industry.

We focus on long-term growth, aiming to build sustainable solutions while pursuing reasonable progress in compliance. Our goal is to drive adoption and innovation in the blockchain space, and we are confident that Aptos will continue to play a significant role in the industry’s future. I believe that teams with a long-term vision are ultimately the ones who succeed.

Connect with us:

Fast News: t.me/blockflownews

Insights: x.com/BlockFlow_News

PEPE0.00 -3.36%

PEPE0.00 -3.36%

TON1.35 -0.35%

TON1.35 -0.35%

BNB622.05 -1.83%

BNB622.05 -1.83%

SOL84.59 -1.83%

SOL84.59 -1.83%

XRP1.42 -1.04%

XRP1.42 -1.04%

DOGE0.09 -1.32%

DOGE0.09 -1.32%

TRX0.28 -0.21%

TRX0.28 -0.21%

ETH2029.71 -2.69%

ETH2029.71 -2.69%

BTC69642.46 -0.52%

BTC69642.46 -0.52%

SUI0.94 -2.20%

SUI0.94 -2.20%