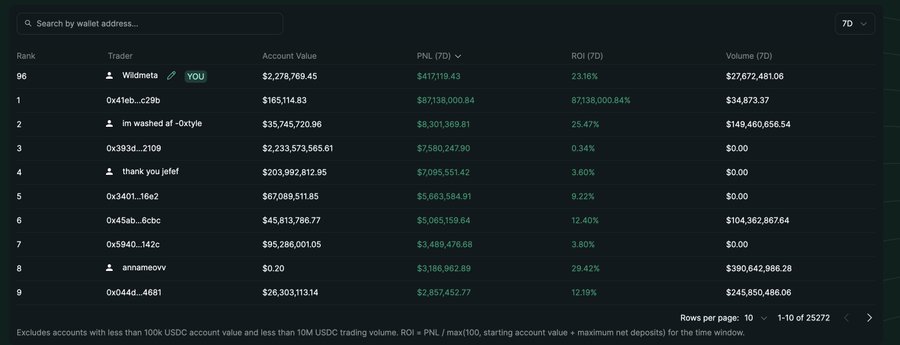

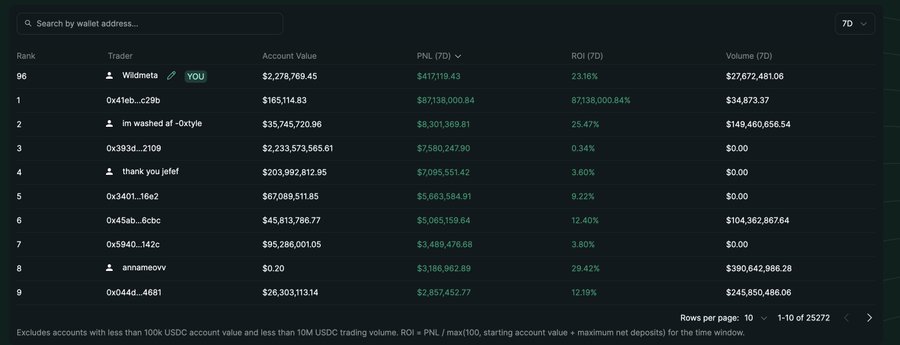

A founder lost $2 million in a 3-minute liquidation on Hyperliquid the same day his team won first place at their hackathon, leading him to pivot his trading platform Wildmeta toward protecting traders from the emotional mistakes that cost him everything.

Republished with permission of @c_kevin75

I am the founder of @wildmetaHQ , building a mobile interface for @HyperliquidX while trading perps on it every day. On September 22nd, I lived through the most extreme day of my life as both a trader and a builder.

In the afternoon, I was liquidated on Hyperliquid, $2 million in just three minutes. By the evening, my team won first place at the Hyperliquid first in-person Hackathon @hlh_build with our AI trading agent.

From $2.27M to $250k, back to standing on stage with @chameleon_jeff , shaking hands, taking photos.

It was the most torn feeling I’ve ever had: losing everything in the market, while gaining recognition as a builder.

The Collapse

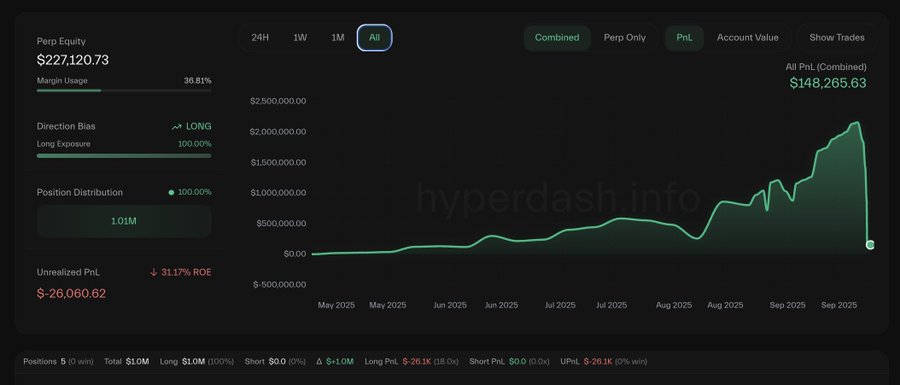

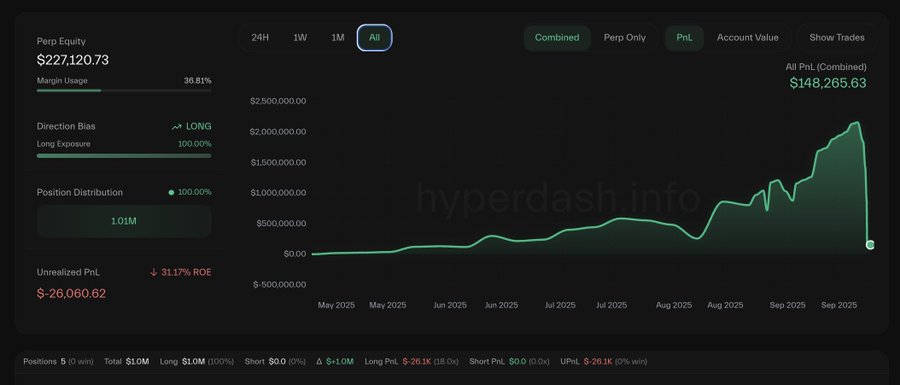

Since April, I had turned $100k into $2.27M trading on Hyperliquid. I built it all by relentlessly long $HYPE and $ETH, adding size, hedging, compounding.

From $100k → $1M took me 4 months.

From $1M → $2M+ took in just 1 month.

As my account grew, so did my risk. I traded more frequently, cared only about growing faster, chasing $10M.

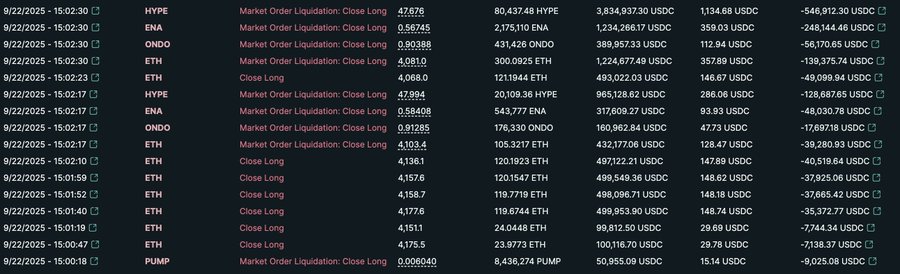

On September 22nd, I woke up to see $HYPE crashing while ETH was still stable.I thought: “I should short ETH to hedge.”But greed whispered: “Wait for a better entry.”

Minutes later, ETH collapsed.

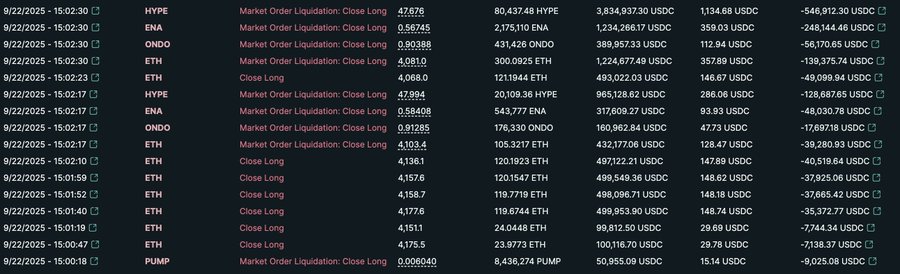

While recording our Hackathon demo video, my screen lit up with the red margin ratio. I tried to reduce the ETH position. Too slow. Then ENA, ONDO, HYPE—all liquidated in sequence.

3 minutes. $2 million gone. $250k left.

I was in shock. I still wanted to buy the dip, but bots were already scavenging liquidations. I forced myself back into focus: the Hackathon demo.

The High in Hackathon

That evening, our product was shortlisted. We demoed. Jeff listened intently.

Finally, the winner was announced: our team.

I walked on stage, shook Jeff’s hand, and even gave him a hug.

Inside, my head was still stuck with my Hyperliquid liquidated positions.

That night made one truth crystal clear:

I didn’t lose because I can’t trade.

I lost because I couldn’t beat human nature.

Greed made me size up. Greed made me hesitate to hedge and stop loss.

In trading, you can overcome fear with greed, but it’s almost impossible to let fear stop greed.

I started to think, how should I trade again? and how to continue building the Wildmeta product?

The True Direction for Wildmeta

It took me until the next morning to realize the true direction—to turn bloody lessons into product features.

Because I know:

One moment of hesitation turns profit into loss.

One missed operation can erase months of gains.

Wildmeta is not about pushing users to deposit or overtrade.

It’s about protecting what you’ve already earned:

-

Learn directly from other traders’ real wins and liquidations;

-

Get unemotional, instant risk alerts—and strategy help to execute;

-

Split funds into sub-accounts, so greed doesn’t make you risk everything.

I paid $2 million in tuition for this realization.

Now I want to embed it into the product.

Because in trading, only the money you withdraw is profit. Realized/Unrealized PnL numbers are just noise.

Hyperliquid’s Tradeoffs

Hyperliquid has both strengths and challenges when it comes to liquidity and liquidation.

On the strong side, markets like BTC, ETH, HYPE, and SOL have built up deep liquidity and tight spreads. For traders, the experience feels almost like a CEX: transparent data, non-custodial settlement, no KYC, smooth execution.

But in smaller altcoin markets, liquidity can get thin. When volatility spikes, liquidations don’t always clear as efficiently. To protect HLP stakers, Hyperliquid’s engine uses a more aggressive and strict liquidation system

I saw this during the crash: ETH stopped around $4000 on Binance, but dropped to $3909 on Hyperliquid because cascading long liquidations pushed the price lower.

In practice, part of the risk that would normally sit with HLP stakers is shifted to traders through stricter liquidation rules.

This isn’t just a weakness—it’s also how the system stays healthy, and it could be improved with market-adaptive liquidation rules.

For builders like us at Wildmeta, this creates a clear opportunity: giving traders better tools to track their margin ratio, manage liquidation risk, and adapt faster in these high-stress conditions.

The Mission

September 22nd is a special day.

It made me realize Wildmeta is not my side project—it’s my mission.

From liquidation to first place in Hackathon, I saw both the cruelty and beauty of this ecosystem.

Now, we’re integrating our Hackathon AI features into Wildmeta, to build a true risk-control app for Hyperliquid traders.

Liquidation isn’t the end. It’s where Wildmeta begins.

PEPE0.00 -4.16%

PEPE0.00 -4.16%

TON1.34 -2.77%

TON1.34 -2.77%

BNB617.66 -3.58%

BNB617.66 -3.58%

SOL82.72 -5.70%

SOL82.72 -5.70%

XRP1.40 -3.77%

XRP1.40 -3.77%

DOGE0.09 -3.65%

DOGE0.09 -3.65%

TRX0.28 -0.31%

TRX0.28 -0.31%

ETH2010.57 -5.50%

ETH2010.57 -5.50%

BTC68810.74 -2.74%

BTC68810.74 -2.74%

SUI0.92 -4.70%

SUI0.92 -4.70%