Aster's $ASTER token surged 1,650% on its first day after TGE, positioning itself as a privacy-focused perpetual DEX that uses zero-knowledge technology for hidden orders to serve institutional traders, differentiating from Hyperliquid's performance-first approach in the rapidly growing $3.48 trillion DEX derivatives market.

Author: TechFlow

On September 17, Aster successfully completed its Token Generation Event (TGE), with the $ASTER token delivering a first-day performance that significantly exceeded market expectations.

Trading chart shows the token generated over $310 million in total volume within its first 24 hours, while attracting more than 330,000 unique wallet addresses. Opening at $0.03015, $ASTER reached an intraday peak of $0.528, marking an impressive single-day rally of approximately 1,650%. Concurrently, the platform's Total Value Locked (TVL) experienced a dramatic surge from $350 million to $1 billion.

The exceptional launch performance underscores a critical market dynamic in the decentralized exchange sector. Industry analysts note that post-airdrop success for DEX platforms ultimately depends on two fundamental factors: product utility and user adoption. These metrics determine a project's ability to generate sustainable revenue streams for token buybacks, creating a virtuous cycle that supports long-term token value appreciation.

This raises a strategic question for the sector: With Hyperliquid having established market dominance through its "performance-first" approach—capturing significant market share in perpetual DEX trading with monthly volumes exceeding $330 billion—what alternative strategies remain viable for competing platforms?

Aster's product architecture suggests a compelling answer to this challenge. In June, Binance founder Changpeng Zhao highlighted a critical gap in current DEX infrastructure, noting on social media: "if you're looking to purchase $1 billion worth of a coin, you generally wouldn't want others to notice your order until it's completed." He emphasized that perpetual DEXs require sophisticated "dark pool" functionality to serve institutional-grade trading needs.

Aster, formed through the strategic merger of Astherus and APX Finance and backed by YZi Labs (formerly Binance Labs), has positioned itself squarely within this privacy-centric market segment. Rather than competing directly with Hyperliquid's performance-optimized model, the platform addresses a distinct pain point in decentralized trading.

The core challenge Aster tackles centers on blockchain's inherent transparency: How can large-scale traders execute significant positions without suffering from front-running and adverse market impact in an environment where transaction data is publicly visible?

This strategic positioning reflects a broader question facing emerging players in mature DeFi sectors: Should new entrants attempt to outperform established leaders on existing metrics, or identify and capture underserved market segments through differentiated value propositions? Aster's privacy-first approach may provide valuable insights into successful competitive positioning in an increasingly crowded decentralized finance landscape.

Aster's Product Code: Finding Its Position in the Perpetual DEX Space

Dual-Mode Architecture Addresses Market Segmentation

To understand Aster's product design, one must examine its dual-mode architecture, which precisely serves two fundamentally different user segments through specialized interfaces.

Simple Mode targets retail traders who prioritize execution speed and high-risk strategies. The interface features one-click ordering, automated MEV (Maximal Extractable Value) protection, and leverage up to 1001x. This leverage offering significantly exceeds industry standards—while Hyperliquid provides 50x and most centralized exchanges offer 100-125x leverage, Aster has pushed this figure into four digits. Though this may appear aggressive, it directly targets a specific demographic of high-risk traders seeking maximum capital efficiency.

Pro Mode serves as the domain for institutional and professional traders. This environment provides comprehensive order book depth, advanced charting tools, algorithmic trading capabilities including grid trading, and sophisticated order management features such as the Hidden Orders functionality detailed below.

The platform's fee structure positions it competitively within the perpetual futures landscape. Public disclosures indicate Aster charges maker fees of 0.010% and taker fees of 0.035%, compared to Hyperliquid's 0.015%/0.045% structure. While these differences may appear minimal, high-frequency traders can realize significant cost variations across large trading volumes.

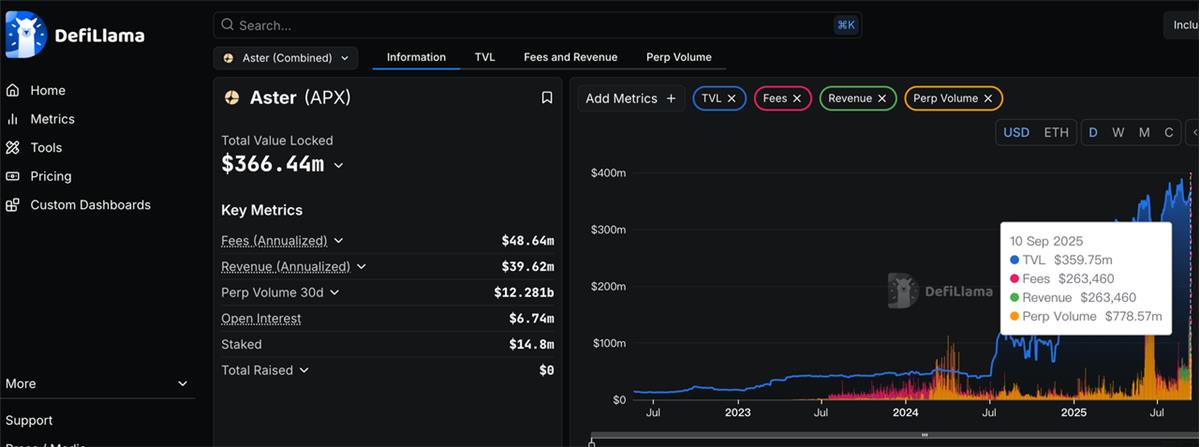

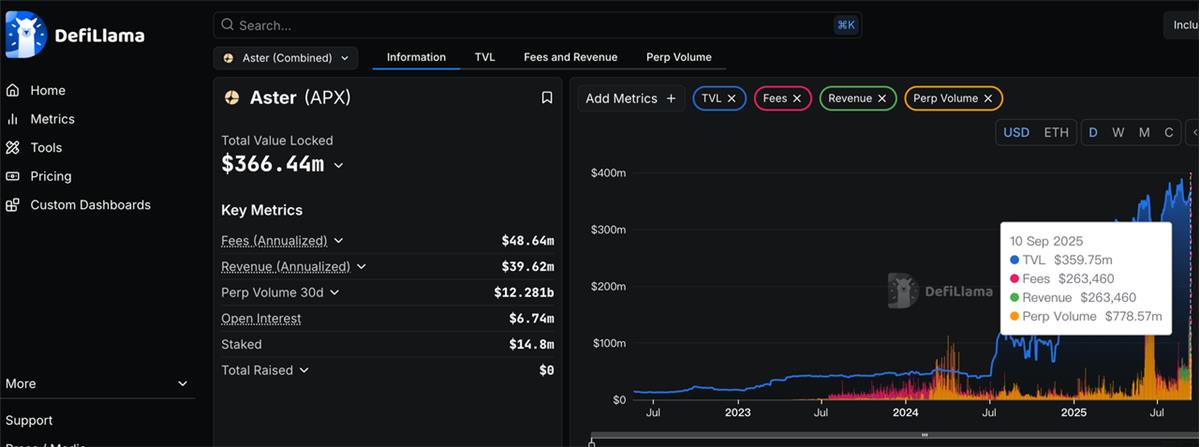

Cross-chain capability represents another significant feature. Aster supports over seven blockchain networks, including BNB Chain, Ethereum, Solana, and Arbitrum, enabling users to manage assets seamlessly without traditional cross-chain bridging requirements. As of September 2024, the platform's TVL has reached $360 million, demonstrating substantial market recognition.

Particularly noteworthy is the U.S. equity perpetual contract offering. Aster provides 24/7 trading for multiple blue-chip stocks including Apple, Microsoft, and NVIDIA, with all settlements conducted entirely in crypto.

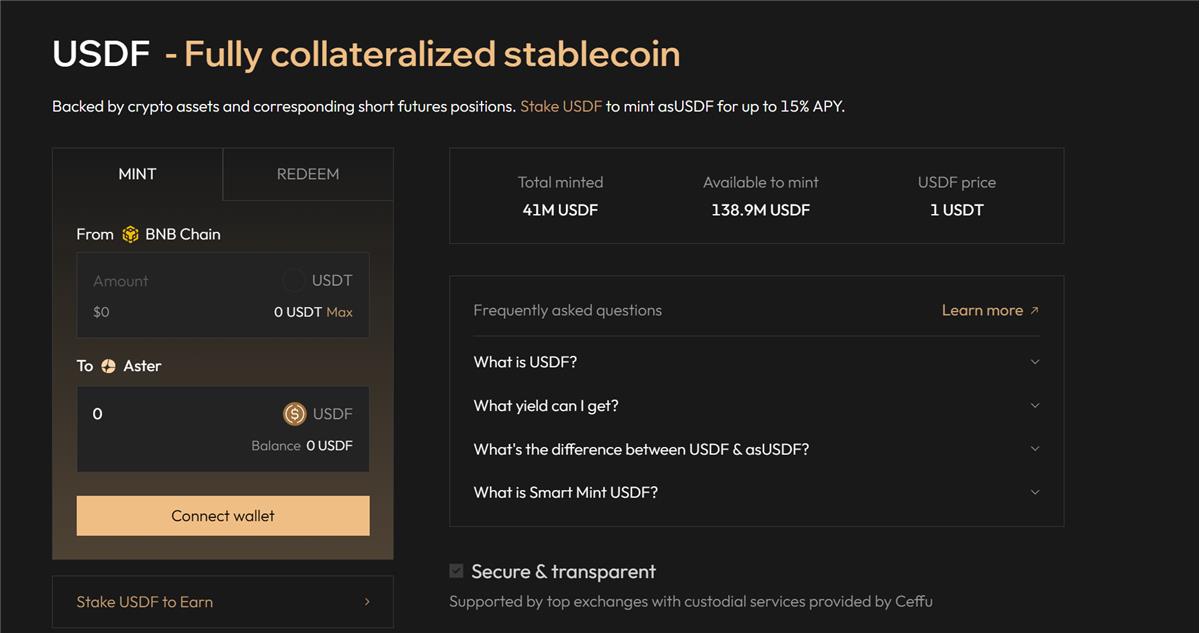

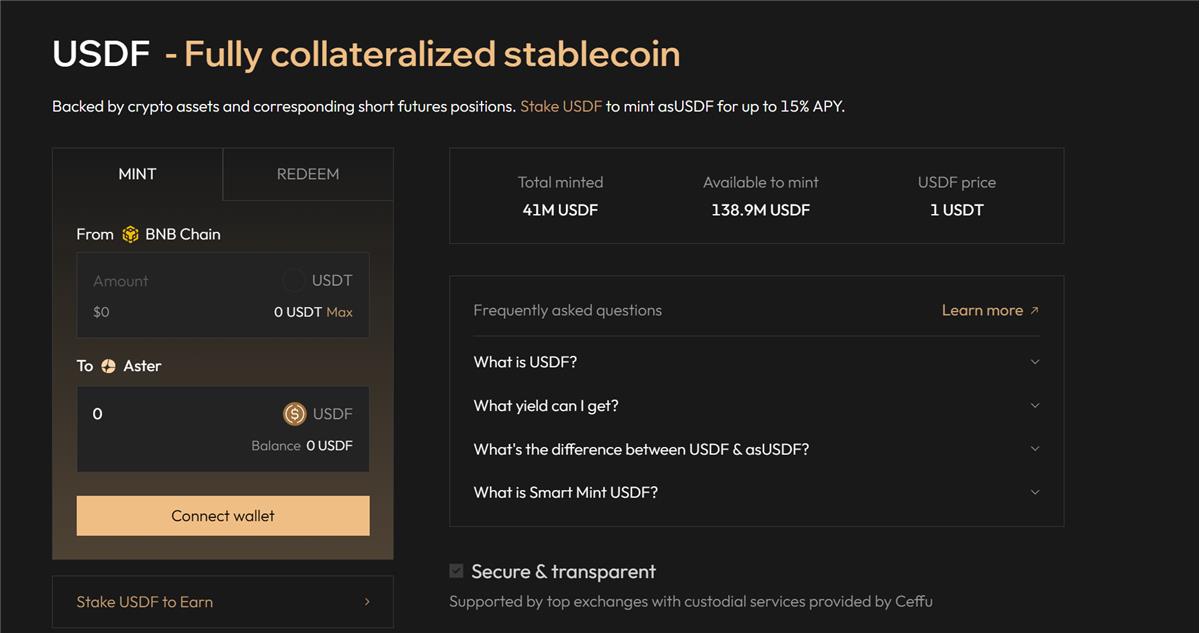

USDF Integration Enhances Capital Efficiency

Beyond trading functionality innovations, Aster's capital efficiency enhancements prove equally significant. In traditional perpetual trading environments, USDT or USDC used as margin remains idle in accounts, generating no returns. Aster addresses this inefficiency by offering USDF as a margin option.

USDF represents a delta-neutral yield-bearing stablecoin issued by Lista DAO that generates returns by deploying underlying assets into low-risk DeFi protocols. As a key component of the BNB Chain ecosystem, USDF not only provides stable yields for users but also enhances on-chain TVL stability.

Current platform data shows USDF deposits offer 4.5% APY, while utilizing USDF as trading margin generates approximately 12.2% APY—impressive yields in the current market environment.

To incentivize USDF adoption, Aster provides holders with a 20x points multiplier within its airdrop program. The Trade & Earn initiative caps individual account participation at 100,000 USDF for trading reward calculations, encouraging adoption while preventing large holders from monopolizing the reward pool.

Zero-Knowledge Privacy Features Target Institutional Needs

After examining Aster's overall product architecture and capital efficiency innovations, the Hidden Orders feature emerges as another key differentiator.

In November 2023, prominent trader James Wynn established a long position exceeding $100 million on Hyperliquid, with this substantial position fully exposed on the public order book. Other market participants quickly identified this "whale" position and began coordinated attacks. Through systematic price manipulation, they successfully triggered cascading liquidations, ultimately costing Wynn over $20 million in unrealized profits.

For institutions and large traders executing substantial orders, visibility often translates to additional costs and strategic disadvantages.

Aster's Hidden Orders feature, built on zero-knowledge proof technology, provides a comprehensive solution. When traders activate order hiding in Pro mode, order information becomes encrypted through ZK circuits, allowing only the matching engine to verify order validity without accessing specific details. Orders maintain standard price-time priority while remaining completely invisible until execution.

This functionality enables large traders to execute sophisticated strategies on decentralized exchanges without concerns about front-running or predatory sniping. Privacy-conscious institutional traders now have access to a robust new option in the DeFi derivatives landscape.

$3.48T Market Drives DEX Specialization: Privacy, Speed, and Tools Define New Competitive Landscape

If 2024 marked the breakout year for perpetual decentralized exchanges, then 2025 represents the critical juncture where competitive dynamics crystallize into distinct market segments.

dYdX's previously released annual report shows DEX derivatives trading volume grew 132% in 2024, reaching $1.5 trillion, with projections for 2025 hitting $3.48 trillion for the full year. This growth rate far exceeds spot DEXs and has forced CEXs to take serious notice of this emerging force.

Within this rapidly expanding ecosystem, platforms have pursued markedly different strategic trajectories.

Hyperliquid stands as the undisputed market leader, having captured significant market share through its focus on execution quality and user experience. Aster has deliberately chosen an alternative path, concentrating on addressing a distinct market inefficiency: institutional trading privacy.

This strategic positioning reflects sophisticated market analysis. Perpetual DEX users can be segmented into three primary categories: retail speculators prioritizing leverage and fee structures, professional traders emphasizing execution quality and analytical tools, and institutions plus high-net-worth individuals valuing privacy and market depth above other considerations. While Hyperliquid has effectively served the first two segments, the institutional privacy requirements appear to represent an underserved market opportunity.

Latest DefiLlama metrics show that Aster recorded approximately $16.7 billion in trading volume over the past 30 days, with growth momentum accelerating significantly. The platform achieved a monthly trading volume record of $34 billion in June 2025, bringing cumulative trading volume to over $517 billion. These metrics have firmly positioned Aster within the first tier of perpetual DEX platforms. Considering the platform completed its rebranding only in March 2024, this growth trajectory demonstrates exceptional market traction.

From this analytical perspective, Aster's privacy-centric approach represents market expansion rather than direct competition with Hyperliquid. When addressable markets reach sufficient scale, platforms with differentiated positioning can establish sustainable competitive advantages based on specialized feature sets. This mirrors the current centralized exchange landscape, where Binance, Coinbase, and OKX maintain distinct market positions while serving different user demographics and regional requirements.

The emerging "one leader, many strong players" pattern suggests the perpetual DEX sector is maturing beyond winner-take-all dynamics toward a more nuanced competitive environment where specialized platforms can capture meaningful market share through targeted value propositions.

Not a Lone Wolf: The Powerful BNB Chain Ecosystem

In the crypto zone, "who invested in you" often carries as much weight as "what you do." For Aster, the backing of YZi Labs (formerly Binance Labs) represents more than a mere vote of confidence—it could fundamentally shape the platform's trajectory.

When Astherus and APX Finance announced their merger to form Aster in March, YZi Labs' endorsement served as a crucial market signal. In a DeFi landscape saturated with countless "innovations," projects with institutional backing enjoy a distinct advantage in establishing user trust and market credibility.

However, the true value extends beyond symbolic support. YZi Labs' endorsement opens doors to potential ecosystem resource sharing. While YZi Labs now operates independently, its team's deep roots in Binance Labs—and their intimate understanding of the Binance ecosystem—create valuable soft connections that could prove pivotal during critical junctures, whether seeking liquidity support or forging strategic partnerships.

Where Hyperliquid chose the path of independent development—rejecting VC investment and avoiding multi-chain expansion—Aster has clearly embraced ecosystem collaboration as its growth strategy. The platform has already secured partnerships with key BNB Chain ecosystem players, including PancakeSwap, Trust Wallet, and SafePal. Each partnership addresses specific strategic objectives.

The PancakeSwap integration stands out as particularly significant. As BNB Chain's largest DEX commanding billions in liquidity, PancakeSwap represents a natural user acquisition channel. While specific liquidity-sharing mechanisms remain undisclosed, the partnership suggests potential user base interconnectivity—positioning Aster as the go-to perpetual trading platform for PancakeSwap's existing user base.

Partnerships with Trust Wallet and SafePal tackle the critical user onboarding challenge. With these wallets serving tens of millions of users globally, direct integration enables seamless access to Aster's platform without requiring separate website visits—a convenience factor that cannot be understated in user acquisition.

Perhaps most intriguingly, Aster's partnership with Four.meme—a meme coin launch platform on BNB Chain—targets the highly active meme coin trading community. Given meme coin traders' propensity for high-leverage speculation, this user demographic alignment appears strategically sound.

Aster's partnership approach follows a clear strategic rationale: in DeFi, liquidity remains the scarcest resource. Rather than building from ground zero, the platform seeks to rapidly acquire initial liquidity and user base through strategic alliances. While this approach involves revenue sharing, it significantly mitigates cold start challenges that plague most new DEX launches.

An often-overlooked aspect of Aster's positioning is its technical heritage from the merger. Zero-knowledge proofs, while theoretically elegant, demand exceptional engineering capabilities for practical implementation—particularly in high-frequency trading environments. This explains why, despite years of ZK technology discussion, large-scale DEX implementations remain scarce.

Aster's technical foundation stems directly from this strategic merger. Combined, Astherus and APX Finance processed over $258 billion in trading volume pre-merger—experience that, coupled with YZi Labs' backing, provides Aster with distinctive development advantages.

This comprehensive ecosystem approach isn't unique to Aster. Across the perpetual DEX landscape, platforms are increasingly seeking ecosystem alignment: Jupiter leverages the Solana ecosystem, while Vertex previously benefited from Arbitrum support.

This trend suggests ecosystem alignment is emerging as a new competitive dimension in perpetual DEX competition—transforming the battleground from purely product and technology comparisons to contests of underlying ecosystem resources and strategic partnerships. Success in the next generation of DeFi may depend less on isolated innovation and more on the ability to orchestrate comprehensive ecosystem collaborations that deliver liquidity, users, and strategic advantages from day one.

Breaking Through

Aster's opportunity lies not in trying to become "the next Hyperliquid," but in becoming the first Aster. The on-chain DEX market is large enough to accommodate players with different positioning.

The key lies in execution capability within the limited time window ahead.

The Hidden Orders feature needs genuine institutional adoption. This requires not just technical refinement, but also market education and trust building. The actual value of this feature needs validation in real trading. More institutional traders are beginning to focus on on-chain privacy protection possibilities. If Aster can provide stable, efficient hidden order execution, it will naturally attract these users.

Collaboration with the Binance ecosystem needs concrete implementation. While officials have only confirmed that $ASTER will launch on "major exchanges," the market widely expects it to land on Binance. Given YZi Labs' background, if this materializes—whether through direct listing or Launchpool—it would be tremendously bullish.

The value of ecosystem collaboration needs genuine release. YZi Labs' portfolio synergy, liquidity sharing with PancakeSwap, user onboarding integration with Trust Wallet—if these resources can be effectively activated, they will create powerful network effects.

$ASTER's confirmed launch on major exchanges is just the beginning. More importantly, how to convert these ecosystem advantages into actual user growth and trading volume increases.

Timing is also crucial. As the crypto market's institutionalization accelerates, demand for professional trading tools is growing. If Aster can establish its footing during this window and build its user base, it has the opportunity to secure a position in the perpetual DEX market.

Ultimately, Aster's success may lie in proving that the perpetual DEX market can accommodate multiple models. The market will provide the answer. In the multiple trade-offs between transparency and privacy, performance and functionality, centralization and decentralization, different choices will attract different users. Hyperliquid proved the viability of the performance route; now it's Aster's turn to validate the value of its own path.

Regardless of the outcome, competition itself is victory. It drives innovation, gives users more choices, and makes the entire ecosystem richer. This might be DeFi's most fascinating aspect: there are always new possibilities, always someone trying different paths.

Connect with us:

Telegram: t.me/blockflownews

Twitter: x.com/BlockFlow_News

PEPE0.00 -3.52%

PEPE0.00 -3.52%

TON1.35 -1.09%

TON1.35 -1.09%

BNB624.01 -2.42%

BNB624.01 -2.42%

SOL84.95 -3.04%

SOL84.95 -3.04%

XRP1.43 -1.60%

XRP1.43 -1.60%

DOGE0.09 -2.20%

DOGE0.09 -2.20%

TRX0.28 -0.23%

TRX0.28 -0.23%

ETH2040.19 -4.00%

ETH2040.19 -4.00%

BTC69847.37 -0.91%

BTC69847.37 -0.91%

SUI0.94 -3.31%

SUI0.94 -3.31%