Plasma, a stablecoin-focused blockchain infrastructure project, launches its mainnet beta on September 25 with $2 billion in stablecoin assets, marking the largest day-one stablecoin liquidity in blockchain history.

Plasma, a blockchain infrastructure project designed specifically for stablecoin operations, announced today that its mainnet beta will go live on Thursday, September 25 at 8:00 AM ET, positioning itself as the 8th largest blockchain by stablecoin liquidity with $2 billion in assets active from day one.

The launch will mark a historic milestone, with Plasma becoming the largest chain by day-one stablecoin liquidity in history. The $2 billion in stablecoins will be deployed across more than 100 DeFi partners, including major protocols such as Aave, Ethena, Fluid, and Euler, delivering immediate utility through deep USDT markets and the lowest USDT borrow rates in the industry.

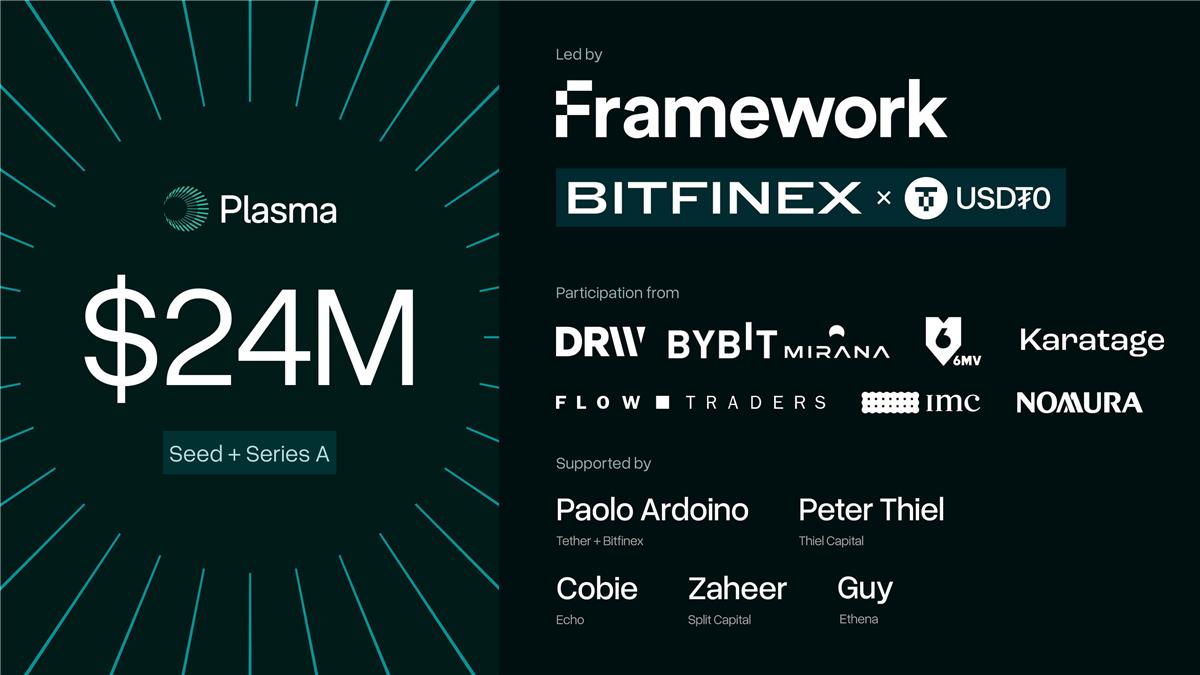

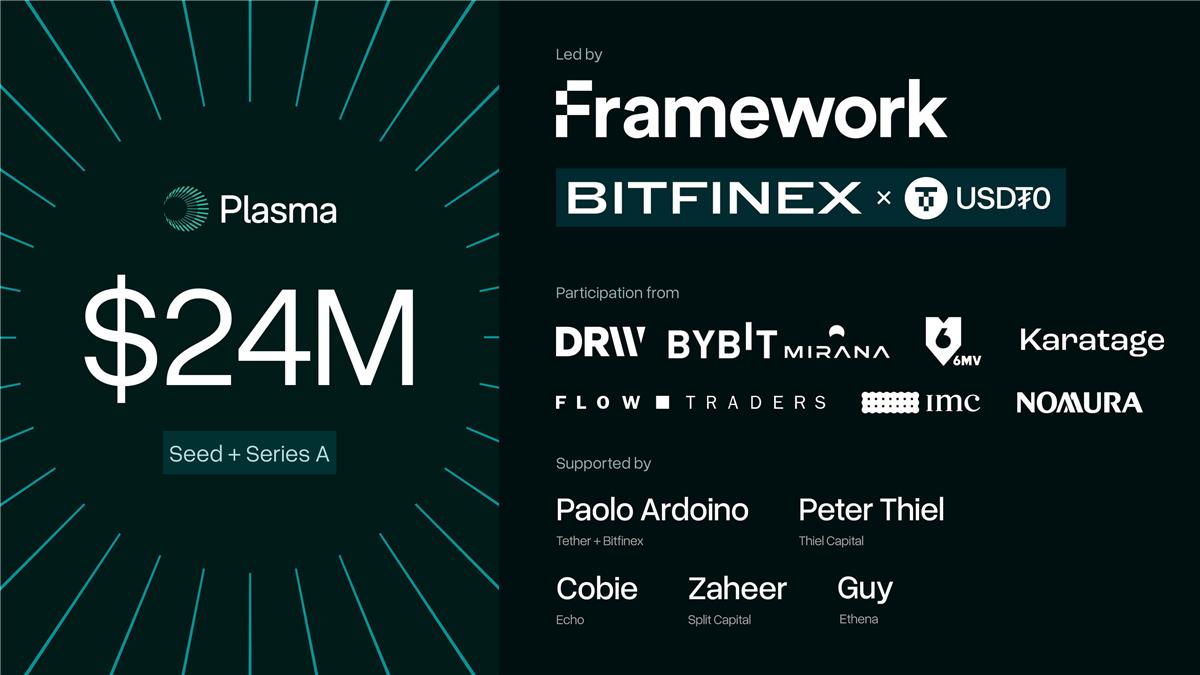

Plasma's journey to mainnet has been marked by record-breaking fundraising milestones. The project raised $24M across Seed and Series A rounds, led by Framework and Bitfinex/USDT, with participation from DRW/Cumberland, Bybit, Flow Traders, and notable angels including Paolo Ardoino and Peter Thiel.

The XPL token public sale attracted unprecedented interest, drawing $500M in commitments and exceeding the $50M cap by 7x. Over 1,100 wallets participated with a median allocation of approximately $35,000. Building on this momentum, Plasma partnered with Binance Earn to launch the first onchain USDT yield product, reaching a $1B cap and becoming the largest campaign in Binance Earn's history.

At mainnet beta, Plasma will introduce PlasmaBFT, a high-throughput consensus layer engineered for stablecoin flows. Users will move USD with zero fees using authorization-based transfers through app.plasma.to. The platform will bridge vault deposits to Plasma, allowing direct USDT withdrawals and completing the final launch phase.

During initial rollout, zero-fee transfers will be limited to Plasma's products, with plans to extend capability ecosystem-wide over time. App builders will leverage infrastructure designed for composability, speed, efficiency, and security at unprecedented scale.

The XPL token distribution reflects Plasma's commitment to broad community ownership. Ten percent of supply was sold to community members, while an additional 25 million XPL tokens will be distributed at launch to smaller depositors who completed verification. Plasma is reserving 2.5 million XPL for Stablecoin Collective members, with tiered distributions: OG members receive 30,000 XPL, Contributors get 15,000 XPL, and Early Contributors receive 7,500 XPL. For regulatory compliance, non-US participants receive XPL at mainnet launch, while US participants will receive tokens on July 28, 2026, twelve months after the public sale concluded.

The launch comes amid growing stablecoin appetite, highlighted by Circle's recent IPO surge over 250% from $31. "Circle up another 20% at the open and Plasma's $500M public token sale sold out in the first block. The people want exposure to stablecoins," noted crypto analyst Will Clemente.

Plasma positions stablecoins as the most significant financial innovation since money's creation. In emerging markets, stablecoins unwind decades of friction by preserving purchasing power overnight, compressing remittances from weeks to minutes, and enabling small businesses to accept payments without gatekeepers. Hundreds of millions already rely on digital dollars for saving, payments, and financial planning.

Connect with us:

Telegram: t.me/blockflownews

Twitter: x.com/BlockFlow_News

PEPE0.00 -4.62%

PEPE0.00 -4.62%

TON1.34 -1.98%

TON1.34 -1.98%

BNB619.70 -2.80%

BNB619.70 -2.80%

SOL82.82 -4.79%

SOL82.82 -4.79%

XRP1.40 -2.88%

XRP1.40 -2.88%

DOGE0.09 -3.76%

DOGE0.09 -3.76%

TRX0.28 -0.21%

TRX0.28 -0.21%

ETH2018.85 -4.20%

ETH2018.85 -4.20%

BTC68709.92 -2.32%

BTC68709.92 -2.32%

SUI0.93 -3.85%

SUI0.93 -3.85%