Avantis (AVNT), a derivatives trading protocol on Base blockchain, surged 424% from $0.18 to $1.56 in six days following major exchange listings on Binance and Coinbase, backed by $12M in funding from top-tier investors including Pantera Capital and Founders Fund.

Avantis represents a sophisticated oracle-based synthetic derivatives exchange built on the Base blockchain, positioning itself as the "Hyperliquid of Base" with capabilities to trade both cryptocurrency and real-world assets with leverage up to 100x. Founded in 2023, the protocol enables users to trade a diverse range of assets including cryptocurrencies, stocks, forex, indices, commodities, and sports markets while maintaining self-custody of their funds.

The project's technical architecture leverages Base blockchain's scalability and low transaction costs to provide zero-fee perpetual contracts, creating a significant competitive advantage in the derivatives trading space. Users can earn yield by providing USDC liquidity to the protocol, establishing a dual-sided marketplace where traders access leverage while liquidity providers earn market-making rewards.

Avantis has secured $8M in seed from prestigious tier-one institutional investors including Pantera Capital, Founders Fund, Galaxy Digital, and Flowdesk in 2023.. This institutional backing provides not only capital but also strategic partnerships and market-making expertise that have contributed significantly to the token's successful exchange listing strategy and liquidity provision across multiple trading venues, offering strong validation of the project's technical capabilities and market potential.

The AVNT token operates on the Base blockchain with contract address 0x696f9436b67233384889472cd7cd58a6fb5df4f1, featuring a total supply of 1 billion tokens with 241,634,702 AVNT (24.16%) currently in circulation. The token maintains a current market capitalization of $292.82 million and fully diluted valuation of $1.21 billion, ranking #269 in market cap with active trading across 109 markets, while the current trading price of $1.2118 reflects strong market demand following recent developments with limited circulating supply creating additional scarcity dynamics that have contributed to price appreciation.

Avantis has emerged as one of the most explosive performers in the cryptocurrency market during September 2025, delivering a remarkable 424% price surge from its September 9th low of $0.1796 to an all-time high of $1.5624 on September 15th. The 24-hour trading volume of $1.88 billion represents an 11.7x increase from initial levels, with volume progressing from 160 million on September 9th to a peak of 1.875 billion on September 15th. This volume expansion, combined with sustained price appreciation, suggests genuine institutional demand rather than speculative pumping.

The primary catalyst for AVNT's price surge has been a cascade of major exchange listings that provided immediate liquidity and global market access:

- Binance - Listed with three trading pairs (AVNT/USDT, AVNT/BTC, AVNT/USDC) and margin trading capabilities

- Coinbase - Providing institutional credibility in Western markets

- Upbit - South Korea's largest exchange, offering access to Asian markets

- Bithumb - Additional Korean market exposure

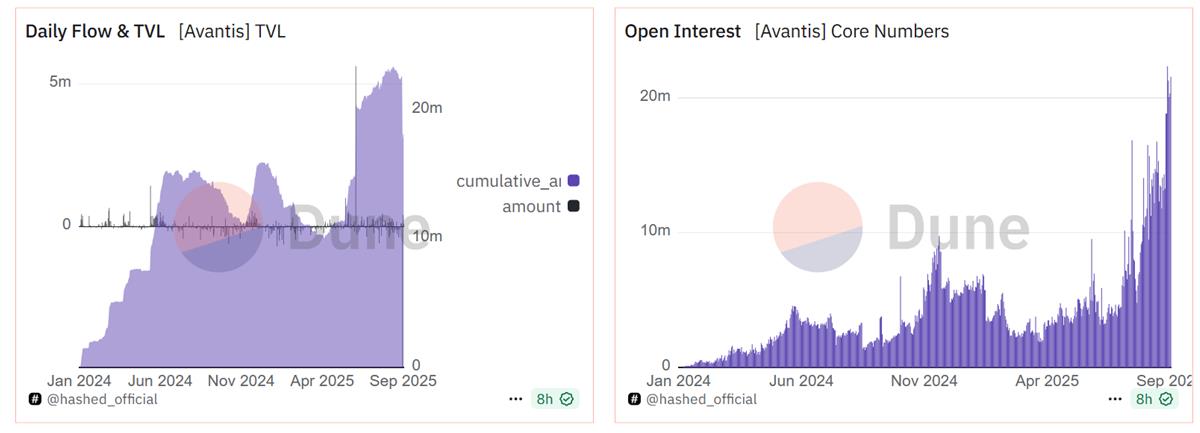

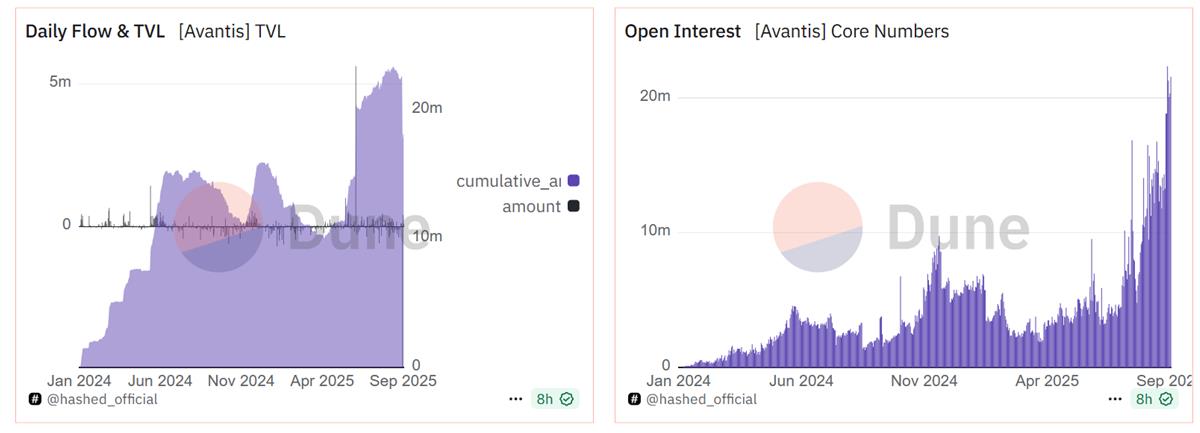

Avantis demonstrates exceptional growth momentum with its Total Value Locked (TVL) experiencing dramatic expansion from minimal levels in early 2024 to over 20 million by September 2025, indicating strong institutional and retail adoption of the protocol's derivatives trading capabilities. This organic growth in both TVL and Open Interest represents strong fundamental factors driving the token's explosive performance, as increased protocol usage and locked capital demonstrate genuine utility and adoption rather than speculative trading alone, providing a solid foundation for sustained price momentum.

https://dune.com/hashed_official/avantis

Additionally, the September 9th airdrop distribution to eligible users, coupled with the protocol's encouragement for recipients to stake their airdropped tokens, created additional buying pressure and reduced circulating supply, further amplifying the bullish momentum as staking mechanisms lock tokens away from immediate selling pressure while rewarding long-term holders with yield generation opportunities.

The convergence of major exchange listings, substantial institutional backing, and strong technical fundamentals positions Avantis as a potential leader in the next generation of decentralized derivatives trading. However, investors should exercise caution given the token's parabolic 424% surge and the inherent volatility associated with early-stage DeFi protocols. With only 24.16% of tokens currently in circulation and additional product launches planned for Q4 2025, including options trading and cross-chain expansion, AVNT's ability to maintain support above $1.00 will be critical for sustaining institutional confidence and continued adoption. The protocol's zero-fee structure and 100x leverage capabilities on Base blockchain create a compelling competitive moat, but the ultimate success will depend on sustained trading volume, liquidity provider participation, and the broader DeFi market's evolution in the coming months.

Connect with us:

- Telegram: t.me/blockflownews

- Twitter: x.com/BlockFlow_News

PEPE0.00 -4.16%

PEPE0.00 -4.16%

TON1.34 -2.77%

TON1.34 -2.77%

BNB617.66 -3.58%

BNB617.66 -3.58%

SOL82.72 -5.70%

SOL82.72 -5.70%

XRP1.40 -3.77%

XRP1.40 -3.77%

DOGE0.09 -3.65%

DOGE0.09 -3.65%

TRX0.28 -0.31%

TRX0.28 -0.31%

ETH2010.57 -5.50%

ETH2010.57 -5.50%

BTC68810.74 -2.74%

BTC68810.74 -2.74%

SUI0.92 -4.70%

SUI0.92 -4.70%