US Core PCE inflation hit 2.9% as expected, keeping Bitcoin range-bound near $110K support while Ethereum shows relative strength at $4,411 amid concerns that persistent inflation may delay Fed rate cuts.

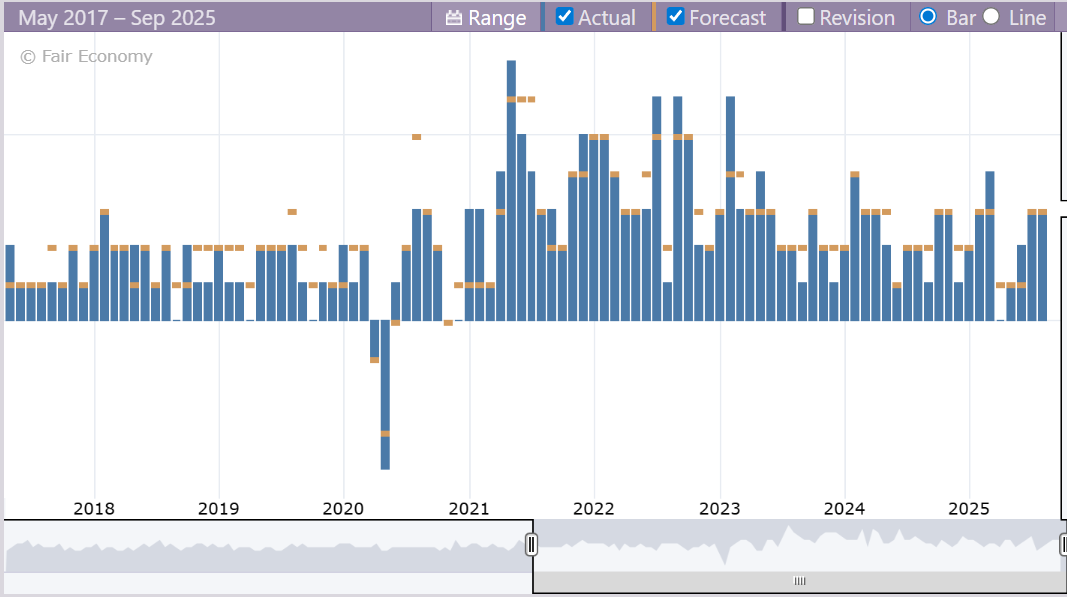

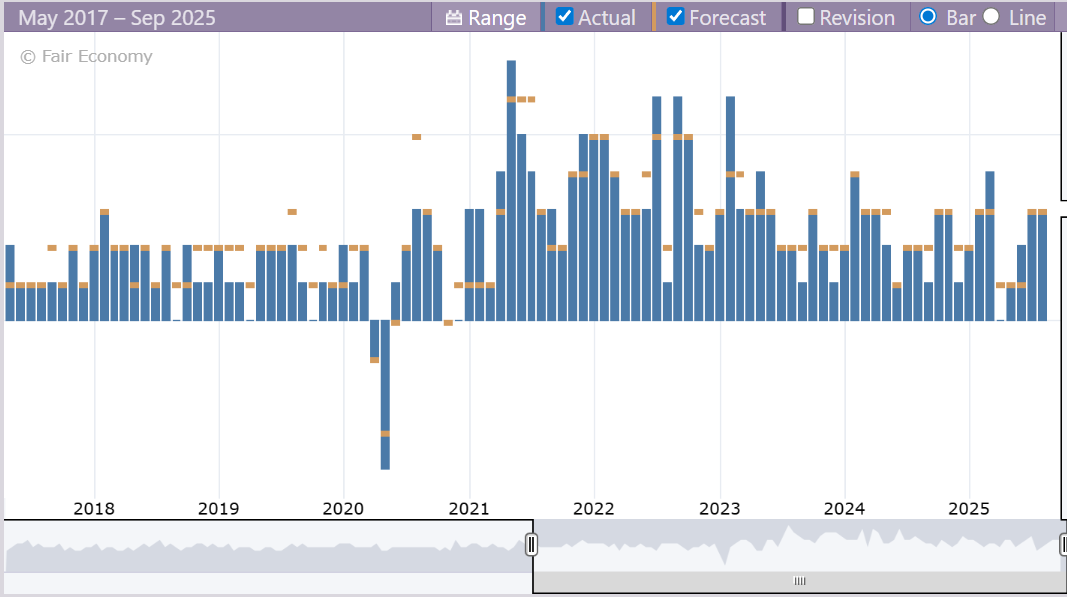

The latest US Core Personal Consumption Expenditures (PCE) data for July has delivered a mixed signal to cryptocurrency markets, with the 2.9% annualized reading meeting expectations but showing an uptick from the previous month's 2.8%. This development has significant implications for both Bitcoin and Ethereum as traders reassess Federal Reserve policy expectations and risk asset positioning.

The Core PCE increase, while anticipated, reinforces concerns about inflation's persistent nature. As the Federal Reserve's preferred inflation gauge, this metric excludes volatile food and energy prices to provide a clearer picture of underlying price pressures. The upward movement from 2.8% to 2.9% suggests that the disinflationary process remains challenging, potentially influencing the central bank's approach to monetary policy.

The data's impact extends beyond simple numbers, as it may make the Federal Reserve more cautious about potential rate cuts in September. While markets avoided a "surprise shock" by the data meeting expectations, the upward trend could prompt investors to recalibrate their expectations for a dovish policy pivot. This uncertainty comes amid a complex economic backdrop, with GDP growth holding steady at 2%, unemployment rising slightly from 4.1% to 4.2%, and manufacturing PMI rebounding strongly to 53.3 from 49.8.

Bitcoin currently trades at $110,892, positioning itself at a critical juncture following its correction from the August 14 high of $124,457. The cryptocurrency finds itself near key support levels between $108,762 and $109,324, while facing major resistance in the $113,450 to $116,874 range.

The PCE data presents both challenges and opportunities for Bitcoin. On the bearish side, the inflation persistence reinforced by the 2.9% reading may delay Federal Reserve rate cut expectations, creating headwinds for risk assets. Bitcoin's current position near critical support levels adds technical fragility to this fundamental concern.

However, several factors provide underlying support. The data meeting expectations prevented a more severe market shock, while recent Bitcoin ETF activity shows encouraging signs with four consecutive days of net inflows totaling $179 million as of August 28. This institutional money flow demonstrates continued long-term confidence despite short-term uncertainties.

Based on current conditions, Bitcoin appears most likely to remain range-bound between $109,000 and $113,000 in the near term. A more bearish scenario could see the cryptocurrency break below $108,762, potentially targeting the $105,000 to $107,000 range. Conversely, a bullish breakout above $113,450 could open the path toward $116,000, though this scenario appears less probable given current macro headwinds.

Ethereum presents a more constructive picture, trading at $4,411 with relatively stronger technical positioning compared to Bitcoin. The cryptocurrency has established solid support between $4,300 and $4,350, with resistance levels at $4,550 to $4,800. Notably, Ethereum has demonstrated superior relative strength during recent market consolidation.

The fundamental backdrop for Ethereum appears more supportive, with ETH ETFs showing particularly strong performance. Significant inflows of $455 million and $307 million on August 26-27 respectively highlight growing institutional interest. Additionally, accelerating Ethereum ecosystem development and broader institutional adoption provide fundamental underpinnings that may help the cryptocurrency weather macro uncertainties better than its peers.

Ethereum's technical support at $4,300 has proven resilient through multiple tests, suggesting a solid foundation for potential upward movement. The most probable scenario sees continued consolidation between $4,300 and $4,600, though a bullish break above $4,600 could target the $4,800 to $5,000 range. Downside risk appears limited, with the $4,070 level serving as deeper support if the $4,300 level fails.

The cryptocurrency market's response to the PCE data will largely depend on how it influences broader risk sentiment and Federal Reserve policy expectations. Both Bitcoin and Ethereum sit at technically significant levels that could determine their near-term trajectories.

Looking ahead, several catalysts warrant close attention. Additional economic data releases before the September Federal Reserve meeting will provide crucial insights into policy direction. Institutional fund flows, particularly through ETF vehicles, continue to serve as important sentiment indicators. Technical confirmations of key level breaks will likely trigger more significant directional moves.

The medium-term outlook remains cautiously optimistic despite near-term uncertainties. While the PCE data's imperfection may delay monetary easing expectations, continued institutional inflows demonstrate strong long-term allocation demand. The cryptocurrency market's current consolidation phase appears to be setting the stage for more significant moves once directional clarity emerges from both technical and fundamental perspectives.

This environment rewards patience and disciplined risk management over aggressive speculation, as markets navigate the complex interplay between persistent inflation concerns and evolving monetary policy expectations.

PEPE0.00 -4.02%

PEPE0.00 -4.02%

TON1.34 -2.72%

TON1.34 -2.72%

BNB617.73 -3.56%

BNB617.73 -3.56%

SOL82.60 -5.75%

SOL82.60 -5.75%

XRP1.40 -3.60%

XRP1.40 -3.60%

DOGE0.09 -3.56%

DOGE0.09 -3.56%

TRX0.28 -0.25%

TRX0.28 -0.25%

ETH2011.93 -5.39%

ETH2011.93 -5.39%

BTC68836.70 -2.66%

BTC68836.70 -2.66%

SUI0.92 -4.69%

SUI0.92 -4.69%