The collaboration between China Renaissance and YZi Labs is not just a financial commitment but a strategic move to integrate blockchain technology into mainstream financial services.

China Renaissance Holdings, a Hong Kong-listed investment bank and financial services company, has announced a groundbreaking strategic partnership with YZi Labs. The collaboration includes a $100 million investment specifically allocated to BNB assets, making China Renaissance the first Hong Kong-listed company to incorporate BNB into its dedicated digital asset allocation. This move is expected to elevate the firm's position in the blockchain and cryptocurrency space while fostering innovation within the BNB Chain ecosystem.

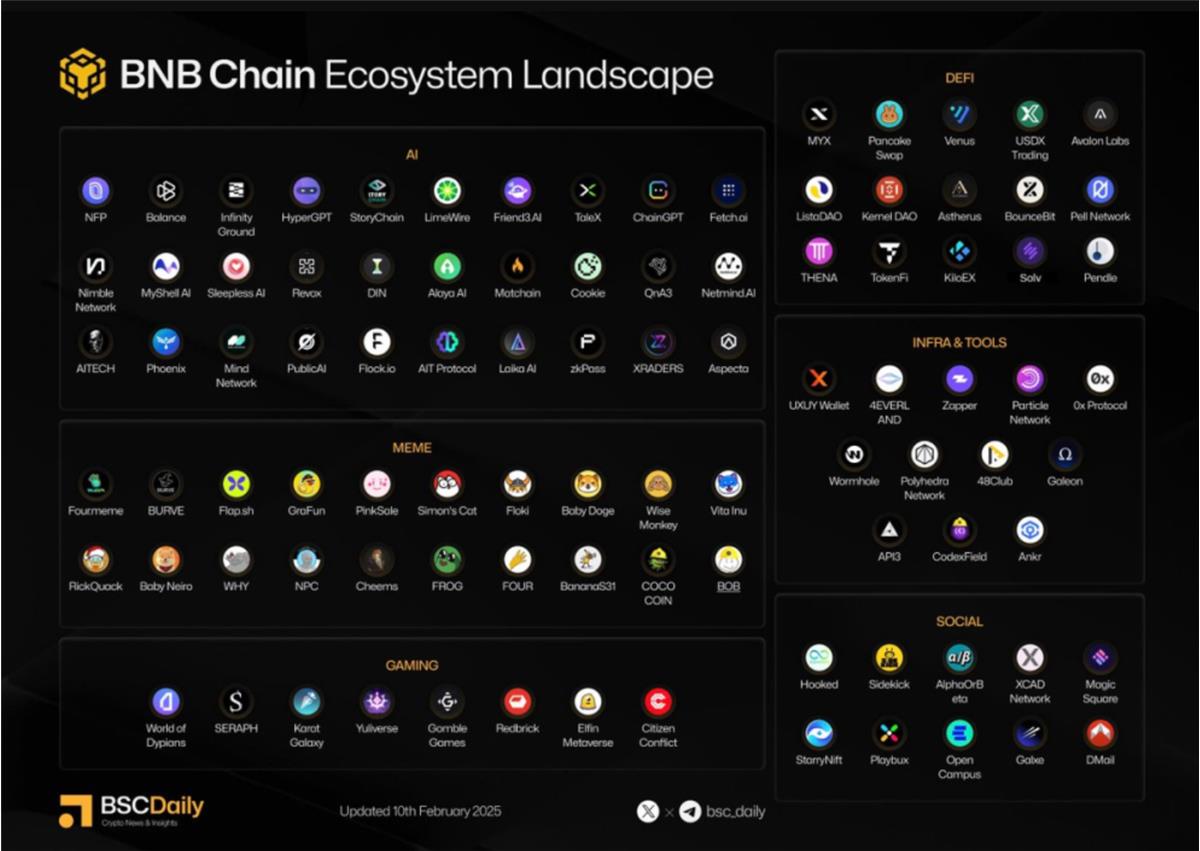

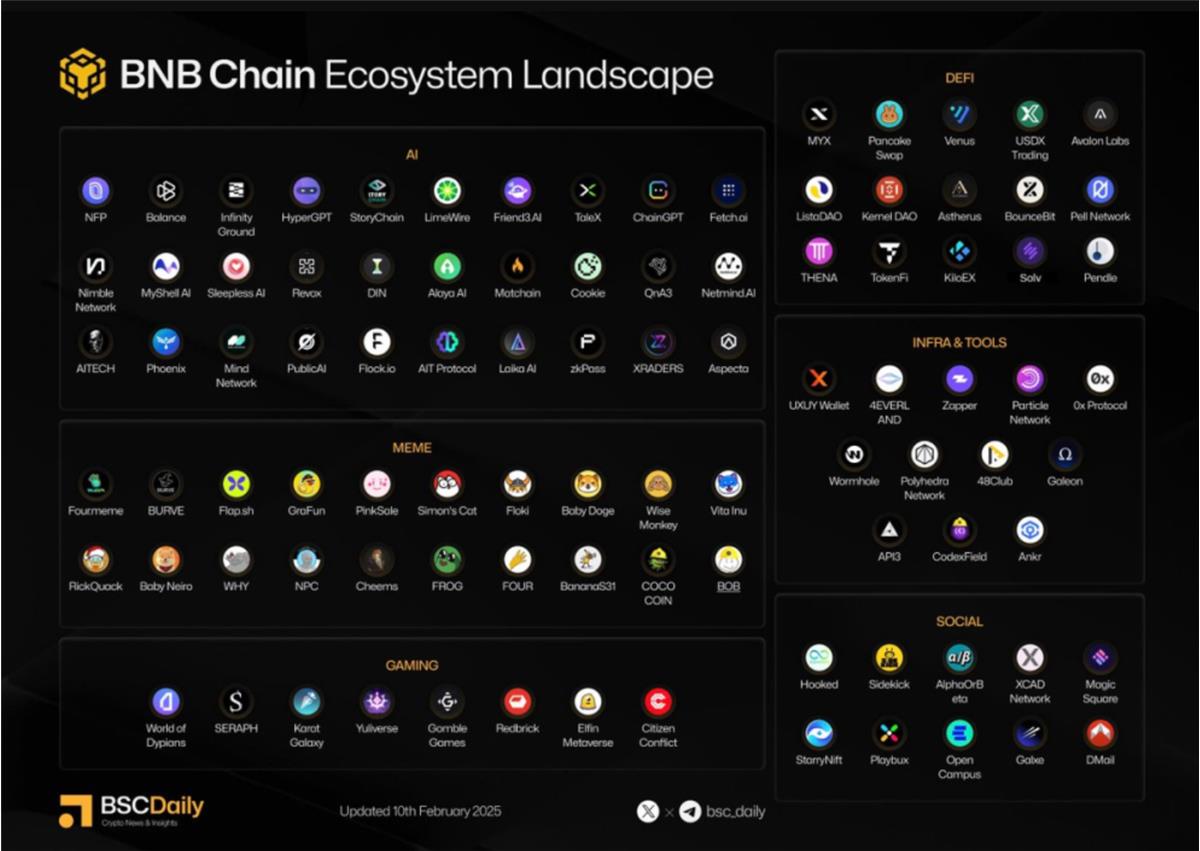

The partnership aims to create a mutually empowering relationship between China Renaissance and YZi Labs, focusing on promoting the adoption of applications within the BNB Chain ecosystem. By leveraging its financial expertise and resources, China Renaissance seeks to enhance the growth and utility of BNB, the native token of Binance's blockchain network. This strategic decision aligns with the growing global trend of institutional adoption of blockchain technologies and digital assets.

BNB has become a pivotal token in the cryptocurrency world, serving as the backbone of Binance's ecosystem. Its applications span decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain-based innovations. The $100 million investment is expected to strengthen the BNB Chain ecosystem, attracting more institutional interest and fostering the development of new applications and services. YZi Labs, a blockchain-focused firm, will collaborate closely with China Renaissance to ensure the effective deployment and utilization of these funds.

This announcement comes at a time when Hong Kong is increasingly positioning itself as a hub for digital asset innovation. With its regulatory framework and financial expertise, the region has attracted significant blockchain initiatives. For instance, DBS Bank recently launched tokenized structured notes on Ethereum, further solidifying Hong Kong's role as a leader in blockchain and digital assets. China Renaissance's move adds another layer to this evolving narrative, showcasing the region's commitment to fostering blockchain growth.

Li Ping, CEO of China Renaissance, emphasized the importance of this partnership in driving long-term value for both the company and the broader blockchain ecosystem. He noted that the investment reflects the firm's confidence in the potential of BNB and its ecosystem as a strategic digital asset. This collaboration also highlights China Renaissance's proactive approach to embracing emerging technologies and diversifying its investment portfolio.

As institutional interest in blockchain and cryptocurrencies continues to rise, partnerships like this are expected to play a crucial role in shaping the future of digital finance. The collaboration between China Renaissance and YZi Labs is not just a financial commitment but a strategic move to integrate blockchain technology into mainstream financial services. With Hong Kong at the forefront of innovation, this partnership could set a precedent for other financial institutions in the region and beyond.

PEPE0.00 -0.36%

PEPE0.00 -0.36%

TON1.41 1.21%

TON1.41 1.21%

BNB643.76 -0.17%

BNB643.76 -0.17%

SOL87.73 1.08%

SOL87.73 1.08%

XRP1.44 1.80%

XRP1.44 1.80%

DOGE0.10 0.43%

DOGE0.10 0.43%

TRX0.28 1.31%

TRX0.28 1.31%

ETH2111.96 1.49%

ETH2111.96 1.49%

BTC71154.71 2.30%

BTC71154.71 2.30%

SUI0.99 -0.86%

SUI0.99 -0.86%